Reap Monthly Income With This Combination Of 3 Stocks

Photo by Jason Briscoe on Unsplash

While the majority of stocks pay quarterly dividends, investors can still construct a portfolio that allows them to get paid monthly.

How? Let me explain,

The first stock pays its dividend in January, April, July, and October. The second stock pays out in February, May, August, and November. And finally, the third stock will pay its dividend in March, June, September, and December.

So, with just a little positioning, investors can reap steady monthly paydays.

Together, three stocks – Coca-Cola Company (KO - Free Report), AbbVie (ABBV - Free Report), and Exxon Mobil (XOM - Free Report) – would allow payouts to roll in each month.

For income-focused investors, let’s take a closer look at each one.

Coca-Cola

Coca-Cola is an American multinational corporation best known for its flagship Coca-Cola beverage. The stock presently sports a Zacks Rank #2 (Buy), with earnings estimates drifting higher.

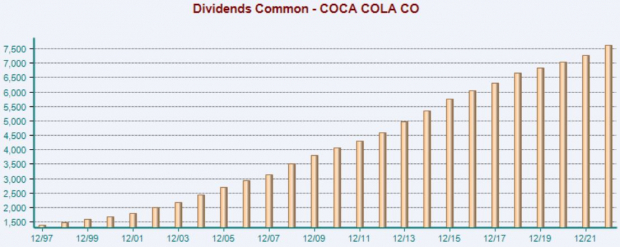

Image Source: Zacks Investment Research

Impressively, KO is a Dividend King, showing an unparalleled commitment to shareholders through 50+ years of increased payouts. The company’s annual yield sits at 2.9%, a tick ahead of the Zacks Consumer Staples sector average.

Image Source: Zacks Investment Research

KO pays dividends in January, April, July, and October.

AbbVie

AbbVie enjoys leadership positions in key therapeutic areas, including immunology, hematologic oncology, neuroscience, aesthetics, eye care, and women’s health.

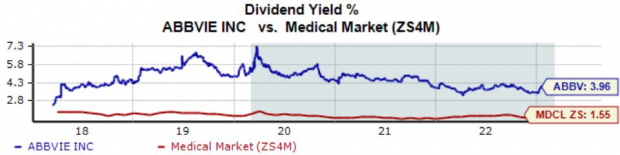

Like KO, AbbVie is a Dividend King, reflecting the company’s shareholder-friendly nature in a big way. Currently, ABBV’s annual dividend yields a sizable 3.9%, more than double the Zacks Medical sector average.

Image Source: Zacks Investment Research

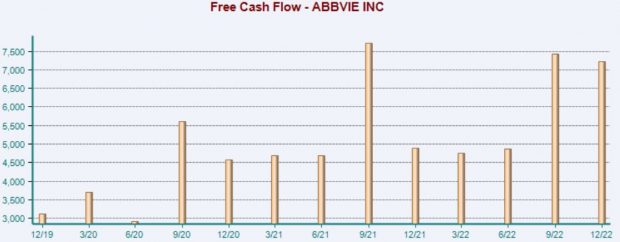

In addition, AbbVie’s cash-generating abilities have been amplified thanks to successful new drugs; ABBV generated $7.2 billion of free cash flow in its latest quarter, growing nearly 50% year-over-year.

Image Source: Zacks Investment Research

ABBV pays dividends in February, May, August, and November.

Exxon Mobil

Exxon Mobil is a U.S.-based oil and gas entity, one of the world's largest publicly traded energy companies.

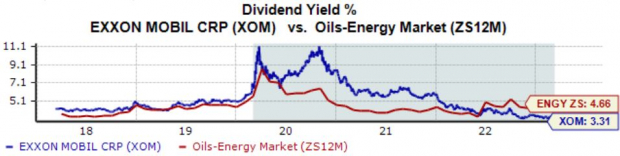

Exxon’s annual dividend yield currently stands at a solid 3.3%, with a sustainable payout ratio of 26% of its earnings. The surge in energy prices undoubtedly benefitted the company, with its payout growing 3.4% just over the last year.

Image Source: Zacks Investment Research

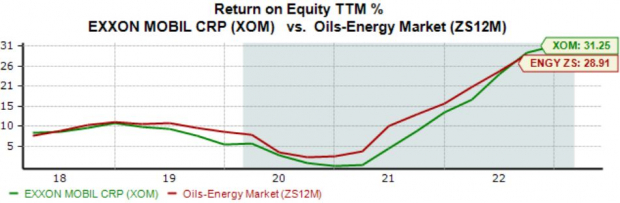

Further, the company’s 31.2% TTM return on equity is certainly worth highlighting, with the surge in energy prices again providing a nice boost.

Image Source: Zacks Investment Research

XOM pays dividends in March, June, September, and December.

Bottom Line

Dividends amplify any portfolio, cushioning the impact of drawdowns in other positions and providing the ability to reap passive income.

Interestingly enough, if investors select their dividend-paying stocks in a structured manner, they can create a portfolio that provides monthly paydays.

When combined, all three stocks above – Coca-Cola Company (KO - Free Report), AbbVie (ABBV - Free Report), and Exxon Mobil (XOM - Free Report) – construct a portfolio that allows monthly income.

More By This Author:

Bull Of The Day: UBS Group Ag

Bear Of The Day: Alico, Inc.

Etsy Is An Incredible Growth Stock: 3 Reasons Why

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more