Bull Of The Day: UBS Group Ag

UBS Group AG (UBS) , a Zacks Rank #1 (Strong Buy), has surged off the bear market bottom from last year, widely outperforming its industry in the process. The stock has been hitting a series of 52-week highs this year on increasing volume. Shares continue to display relative strength as buying pressure accumulates in this market leader.

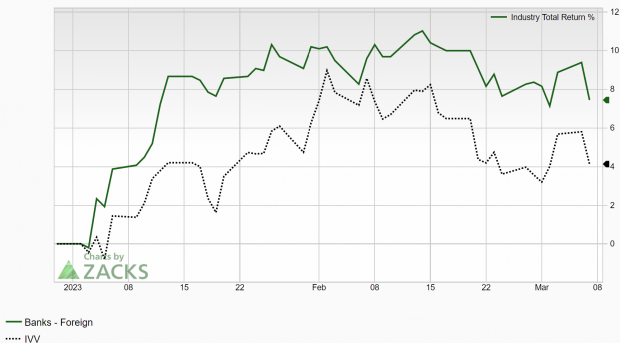

UBS is ranked favorably by our Zacks Style Scores, with a ‘B’ for Value and overall ‘B’ VGM score, indicating further upside is likely. The company is part of the Zacks Banks-Foreign industry group, which ranks in the top 7% out of more than 250 Zacks Ranked Industries. This group has widely outperformed the market to kick off the new year:

(Click on image to enlarge)

Image Source: Zacks Investment Research

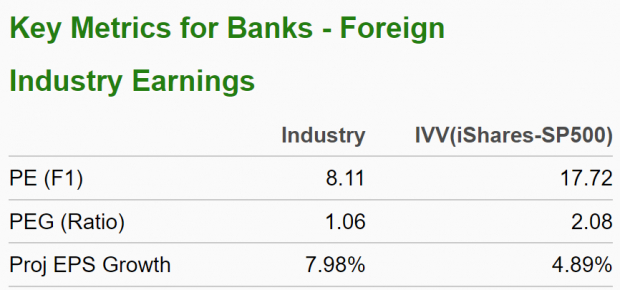

Despite the impressive performance, this industry group remains relatively undervalued:

(Click on image to enlarge)

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

UBS Group AG provides financial advice and solutions to institutional, corporate, and private clients globally. The company offers a host of financial-related services such as personal banking, investment advice and solutions, lending, wealth planning, asset allocation, and investment banking. UBS was founded in 1862 and is headquartered in Zurich, Switzerland.

UBS remains focused on opportunistic expansion strategies in various areas by entering into partnerships with a host of other firms. These inorganic growth moves are expected to benefit the company’s long-term trajectory. UBS maintains a strong capital position and its efficiency initiatives will likely continue to aid profitability.

Earnings Trends and Future Estimates

UBS has surpassed earnings estimates in three of the past four quarters, with an average earnings surprise of 16.6%. The financial firm most recently reported fourth-quarter earnings back in January of $0.50/share, beating the Zacks Consensus Estimate of $0.37 by 35.14%.

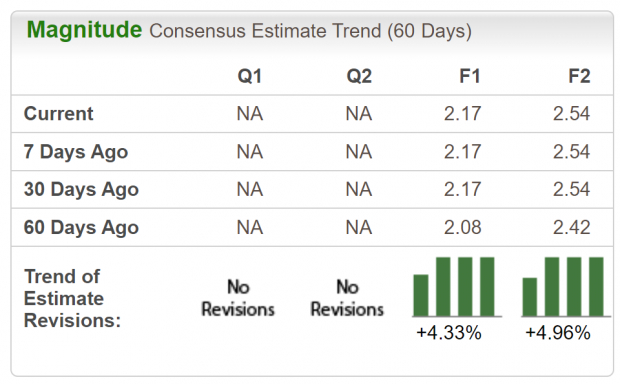

UBS Group AG has witnessed improving earnings estimate revisions. Looking into the current year, analysts have raised their 2023 EPS estimates by 4.33% in the past 60 days. The Zacks Consensus Estimate now stands at $2.17/share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Let’s Get Technical

UBS shares have advanced more than 50% off the bottom from last year. Only stocks that are in extremely powerful uptrends are able to make this type of price move while the general market remains volatile. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

(Click on image to enlarge)

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been making a series of higher highs. With both strong fundamentals and technicals, UBS is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, UBS Group AG has recently witnessed positive revisions. As long as this trend remains intact (and UBS continues to deliver earnings beats), the stock will likely continue its bullish run this year.

Bottom Line

Solid institutional buying should continue to provide a tailwind for the stock price. UBS has vastly outperformed its financial peers, and increasing volume at recent breakout levels adds to the bullish sentiment.

Robust fundamentals combined with a strong technical trend certainly justify adding shares to the mix. Backed by a leading industry group and robust history of earnings beats, it’s not difficult to see why this company is a compelling investment. Investors would be wise to consider UBS as a portfolio candidate if they haven’t already done so.

More By This Author:

Bear Of The Day: Alico, Inc.Etsy Is An Incredible Growth Stock: 3 Reasons Why

Campbell Soup Q2 Earnings And Revenues Top Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more