Rate Cut Optimism Drives U.S. Indexes To Fresh Record Highs

Image Source: Pixabay

MARKETS

U.S. stocks climbed to new records on Monday as technology company gains drove the market higher. Despite a sluggish start, all major indices closed solidly in the black.

Equity strategists at leading banks have quickly revised their S&P 500 targets upwards (See Goldman Sachs's Latest Calls Below), buoyed by a market that shows no signs of slowing down. The primary catalyst for this optimism remains last week's drop in inflation data, which has bolstered hopes for a rate cut by the Federal Reserve in September.

The S&P 500 climbed 0.8%, surpassing its previous all-time high. The Dow Jones Industrial Average gained 188 points, or 0.5%, while the Nasdaq composite reached new heights, adding 1% to its record close. Gains in the technology sector helped offset the pressure on the stock market from rising Treasury yields. These yields rose, erasing some of the relief from last week when unexpectedly positive inflation reports raised hopes that the Fed would cut interest rates later this year.

This week, the U.S. economic calendar is relatively light, with the most notable reports being Tuesday's update on consumer spending at U.S. retailers and Friday's preliminary look at U.S. business activity. Additionally, markets will be closed on Wednesday during the Juneteenth holiday.

A report released on Monday indicated that manufacturing in New York state continues to contract, albeit not as severely as economists had anticipated. Manufacturing has been particularly hard-hit by the Federal Reserve's efforts to maintain its main interest rate at the highest level in over two decades.

Yields likely overshot to the downside on Friday, driven by the political drama in France, which may have triggered a flight to safety into U.S. bonds. The turmoil surrounding France led investors to seek the relative safety of U.S. Treasuries, pushing yields lower. However, safe-haven trades have been unwinding, with most traders expecting the European Central Bank (ECB) to intervene and cap French bond yields to limit contagion risk to Europe's "Club Med" countries. This unwinding of positions contributed to the EUR/USD climbing above 1.0725 overnight.

The market's reaction highlights the delicate balance between political events and central bank interventions. As traders anticipate ECB action to stabilize the situation in France, they adjust their positions accordingly, impacting both bond yields and currency movements. The broader implications for the euro and U.S. dollar will depend on “Freixt” fear and the ECB's response to ringfence contagion risk.

CHINA

Beijing released its May activity data on Monday, and the story remains familiar: The property market is stuck in a deep malaise, and domestic demand is more sluggish than most when the Monday morning wake-up alarm sounds.

Even though retail sales growth picked up for the first time in six months, at 3.7%, no one is really winning a participation trophy in China. For perspective, from January 2018 through December 2020, monthly retail sales prints averaged an 8.6% year-on-year gain. So, May’s tepid figure is hardly a reason to pop the champagne.

But hey, at least May's retail sales managed to beat economists’ estimates of 3%. However, let's be honest: that extra 0.7% was probably just a Labor Day holiday boost. Strip out that spending and sales likely only rose around 3% compared to last year.

May also marked the fifth straight month where industrial output growth outpaced retail sales. That’s right, even with retail sales slightly overachieving and industrial production underperforming at 5.7% against a 6% expectation.

So, this remains a tale of two economies. This creates tension between Beijing and its trade partners, many of whom aren’t thrilled about absorbing China’s excess capacity to boost Xi’s exports and GDP figures. Western electorates, already fed up with almost everything, are particularly irked with China at all levels. In a US election year where nationalism takes president over “ internationalism,” things could get testier on the trade front.

The real issue is domestic demand in China. Simply put, the Chinese aren’t buying enough. This problem is evident in everything from retail sales to imports to CPI to credit aggregates. New yuan loans were just CNY950 billion last month, missing estimates by a wide margin.

May’s data showed new home prices in China fell more than 4% YoY, the most significant drop in nearly a decade. Existing home prices fell 1% from April, the steepest month-to-month decline since record-keeping began in 2011.

The rest of the housing data wasn’t any better. The cumulative year-to-date decline across various aggregates worsened in May. Property investment was down over 10% from January through May, and property sales plummeted by more than 20%.

Adding to the economic gloom, the PBoC kept the one-year MLF rate unchanged for the tenth straight month on Monday.

So, while Beijing struggles with its economic woes, the rest of the world looks on with a mix of concern and frustration, waiting to see if China can find its footing or if the malaise will continue to drag on.

Editorialized Goldman Sachs Latest Calls

In the ever-evolving world of finance, staying ahead of the curve is crucial. Goldman Sachs' latest projections offer a roadmap, but if you're a trader, you've likely factored these insights into your strategies weeks ago. Here's a reimagined take on David Kostin’s latest calls,

A Bullish Base Case for US Equities

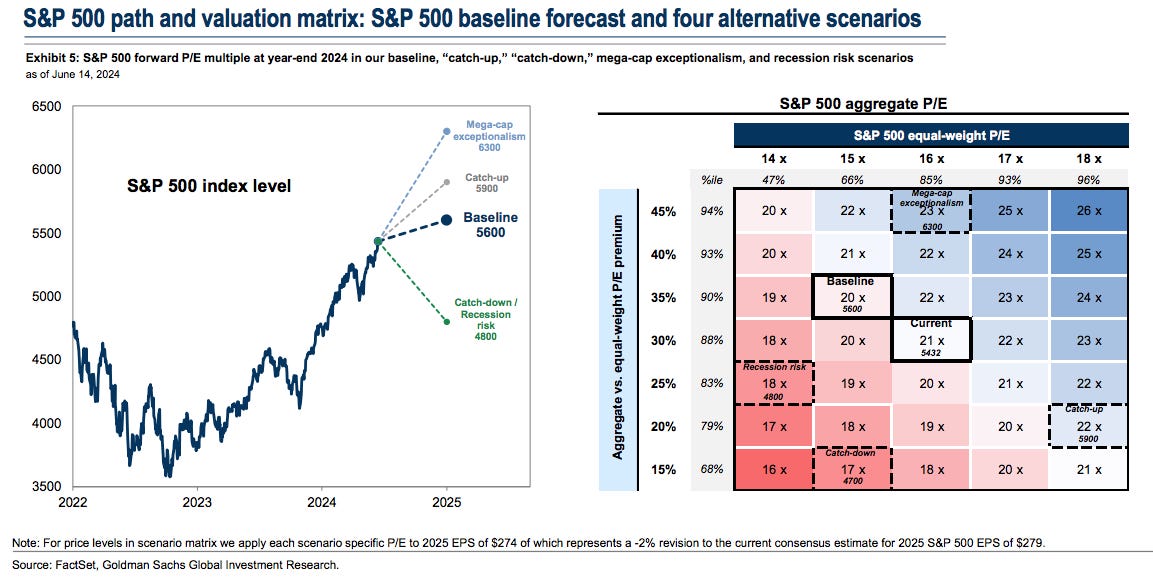

Goldman Sachs' Chief Equity Strategist David Kostin has upped his S&P 500 target, now predicting a potential rise of 16% by year-end. Why the optimism? It boils to "milder than average negative EPS revisions" and a favourable forward multiple. The revised target sees the S&P 500 hitting around 5600, compared to the previous target of 5200.

Kostin’s new base case assumes a forward multiple of 19.5x on a lower bottom-up consensus 2025 EPS estimate. He forecasts the index will still trade above 20x at year-end despite some expected multiple compression. Goldman anticipates only a minor 2% revision to the 2025 EPS estimate of $279, bringing the S&P to 5578.

Historical Context and Mega-Cap Influence

Historically, consensus estimates have been slashed by about 7% starting in June of the previous year. However, Kostin expects milder revisions this year, largely thanks to upward revisions in mega-cap tech earnings.

Scenarios to Watch

Goldman’s 2024 and 2025 aggregate EPS estimates remain at $241 and $256, respectively, though Kostin warns that consensus might be overly optimistic on margins. Here are the four scenarios Kostin outlines:

-

Continued Mega-Cap Exceptionalism: In this most bullish scenario, the S&P could skyrocket to 6300, trading at 23x, a 45% premium to the equal-weighted index.

-

Catch-Up Scenario: If the equal-weighted gauge sees multiple expansions to pre-pandemic highs (18x), the S&P might rise to 5900 by year-end, a 9% increase.

-

Catch-Down Scenario: If growth estimates for market leaders prove too optimistic, the S&P could drop to 4700. "Strong upward revisions to earnings create a higher bar for [mega-caps]," Kostin notes, especially as investor focus shifts to AI-driven revenue.

-

Recession Fears: Should recession worries resurface, the S&P could correct to 4800. Despite Goldman’s above-consensus economic growth forecast, weak growth data could reignite slowdown fears and push the P/E multiple down to 18x. However, Kostin adds, "downside would be limited as the Fed would have ample room to cut interest rates if economic data deteriorate meaningfully."

(Click on image to enlarge)

Key Takeaways for Traders

While Goldman’s projections provide a structured outlook, the savvy trader knows that the market often moves ahead of analyst calls. Here’s what you should keep in mind:

-

Mega-Cap Tech: Keep a close eye on mega-cap tech stocks. Their performance and earnings revisions could be a significant driver of market direction.

-

Earnings Revisions: Monitor consensus EPS estimates. Even minor revisions can impact market sentiment and valuations.

-

Economic Indicators: Stay vigilant on economic data releases, especially inflation and job reports. These could sway the Fed’s decisions and market expectations.

-

Market Sentiment: Be prepared for volatility around major announcements. Understanding market psychology can help you navigate through potential whipsaws.

Take this editorialized plonk for what it is: reading analysts' reports isn’t going to make you a better investor or trader. Many celebrated Wall Street analysts are more often wrong than right, just like those who've been betting on Michael Willson or Marko Kovolenko's calls. But the secret sauce isn’t mindlessly following the newsletters; it’s in understanding the market dynamics and developing your own informed strategies.

Here’s a reality check: relying solely on analysts' predictions is like betting on a sports team based on a pundit's forecast. They can guide you, sure, but they won't win the game for you. The best investors and traders synthesize the information, challenge their assumptions, and make decisions based on a mix of research and experience.

Wall Street analysts have their place but remember; they’re playing the same game you are – just with fancier tools and a bigger platform to spread the news. To succeed, you need to dig deeper and think critically. So, use those analyst reports as a puzzle piece, not the entire picture.

More By This Author:

Rates Traders Are Now Fully Expecting Two Cuts This Year

As France Teeters On The Political Cliff Edge , U.S. Stocks Rally

The Inflation Dragon Might Be Losing A Bit Of Its Fire