Rallies Continue As Volume Buying Starts To Improve

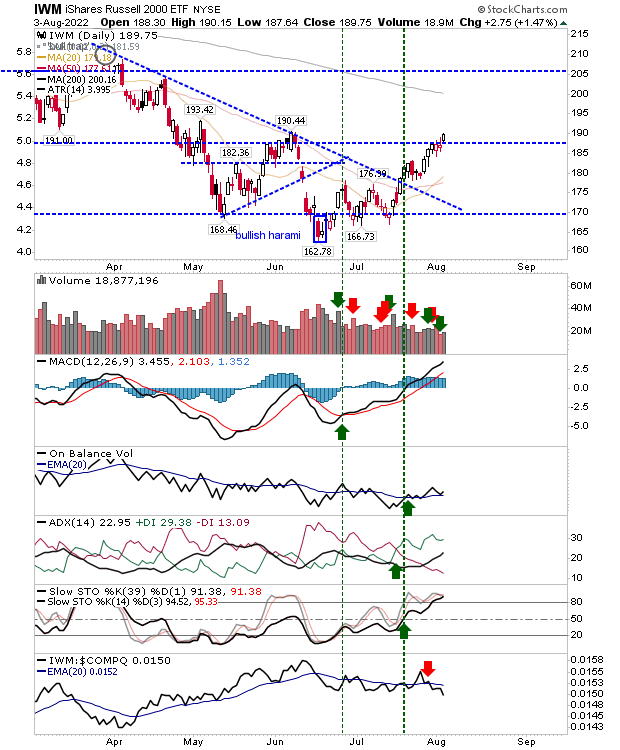

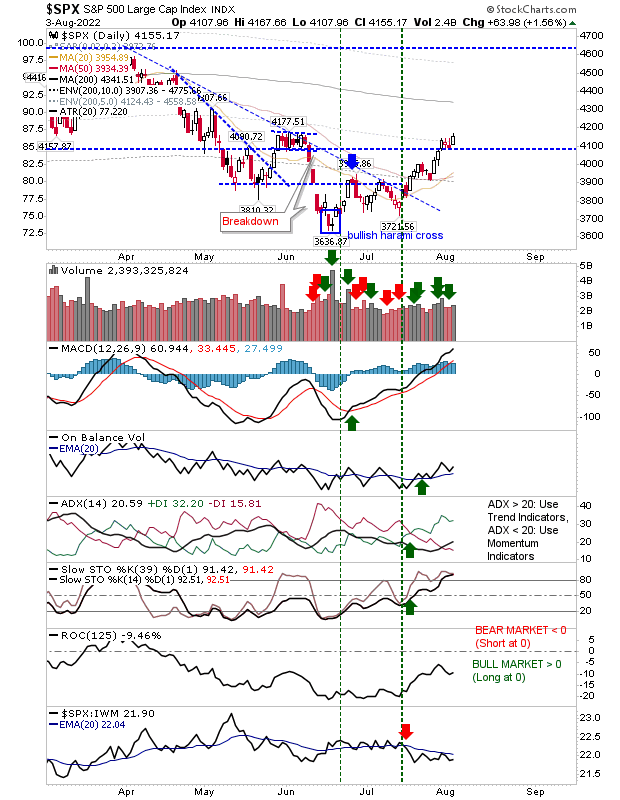

It has been a good summer for indices. We have seen indices rally towards May-June swing highs in challenges which would help mark new higher highs on intermediate time frames. On-Balance-Volume has also turned more bullish through July as technicals for the S&P, Nasdaq and Russell 2000 are net bullish.

The Russell 2000 is also outperforming the S&P as more speculative growth stocks again attract interest over defensive Large Caps.

The Nasdaq is doing a little better than the Russell 2000 in its outperformance to the Small Cap index. On-Balance-Volume has been trending higher throughout July, with the indicator enjoying successful support tests of its 20-day MA. The Nasdaq has already breached the May/June swing high.

The S&P has done its bit, although it hasn't yet gone beyond the May-June high. However, all other technical aspects are positive.

No one can call a market bottom and expect to get it right, but you can look at metrics that reach extremes at previous reversals and use these as a basis for a trade decision. The one which flashed for us was the Percentage of Nasdaq Stocks above the 200-day MA which were heavily oversold. This is not to say markets can't make new lower, lows - but the chances for this happening become smaller each day. As an investor, you make your call, but you have the facility to break an investment into separate pots and use different signals to build a position. I missed the confirmation back test of the new June-July consolidations which occurred in late July (as I was on holiday) - which would be a cue to add, but we can look at how the next signal pans out, which will be the break of the May-June swing high.

More By This Author:

Higher Lows Developing Across Indices

Inching Higher But Only May Consolidations Been Challenged

Buyers make an appearance, but little change

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more