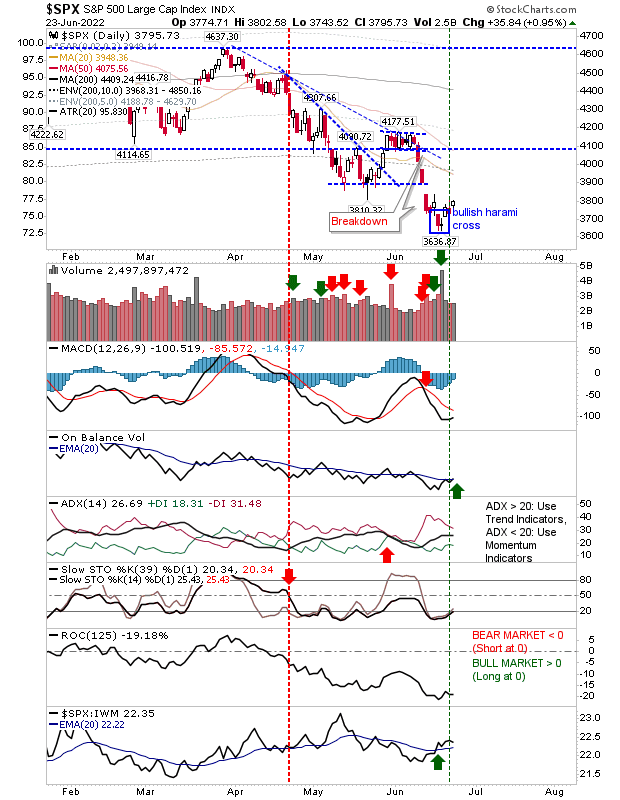

Inching Higher But Only May Consolidations Been Challenged

Despite putting in the groundwork for a swing low we are still not seeing a whole lot of demand for building a rally off the lows. There should be no upside in the tank, but once it reaches congestion from May I wouldn't be surprised if the rally stalls out - which would probably be enough to push the indices well out of an oversold condition.

With respect to the S&P, we had a new 'buy' trigger in On-Balance-Volume to go with the relative outperformance of the index against the Russell 2000.

The Nasdaq is in the process of challenging the May swing lows without any real injection of volume. Like the S&P, the Nasdaq is enjoying a new 'buy' trigger for On-Balance-Volume to go with the relative performance gains against the S&P.

Finally, the Russell 2000 also comes up against the resistance of its May swing low, to bring up its first challenge. Technicals for this index are firmly net negative.

The rallies off the bottom are off to a slow start and it would only take one bad sell-off day to undo the work of the past week. I would have liked to have seen more conviction in the buying given the heavily oversold state of the market, but I suspect market participants are expecting more downside.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more

Jun23b.png)