Quitters Never Win

On this day, 51 years ago, President Nixon became the first U.S. president to resign from office. While there are plenty of others that Americans likely wish had also resigned from office since then, Nixon remains the only President to leave office before his term ended, despite saying in his resignation speech that “I have never been a quitter.” As crazy as the political, social, economic, and geopolitical climate feels today, it has nothing on the backdrop from 51 years ago. If you weren’t around then, just ask someone who was.

There’s no shortage of uncertainty or unease in the backdrop today, but equities are within percentage points of record highs, and interest rates are relatively low versus history. This morning specifically, futures are firmly in positive territory on generally positive earnings news overnight. There’s no economic data on the calendar today, and all the earnings for the week are behind us, so unless the President fires up the Truth Social app, we can expect a relatively quiet summer Friday.

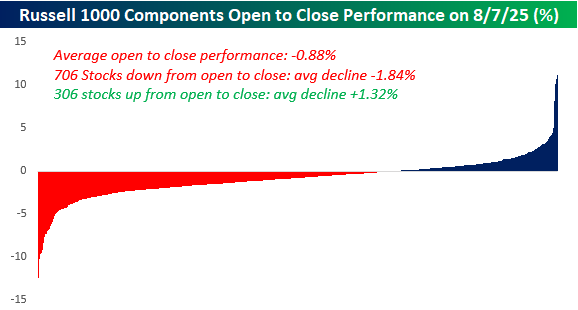

In yesterday’s trading, there were many quitters. Stocks opened the day higher and gave up their gains throughout the trading day. On an average basis, stocks in the Russell 1000 declined 0.88% from the open to close. Of the index’s components, 706 closed lower than they opened, and their average decline from the open to closing bell was 1.84%. On the upside, only 306 stocks (there are more than 1,000 stocks in the index) closed higher than they opened, and their average gain was just 1.32%.

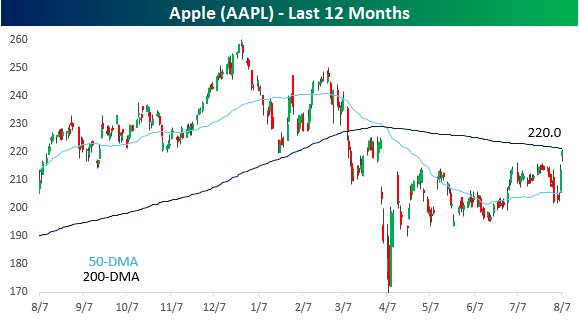

One stock that didn’t quit yesterday was Apple (AAPL). It gapped up around 2% and then added on another 1% from the open to close to finish just below its 200-day moving average (DMA), a level it hasn’t traded above since early March. While the stock didn’t quit Thursday, downward-sloping moving averages have a way of acting as resistance, so whether AAPL can close above its 200-DMA to close out the week will say a lot about how strong this latest two-day rally is. Will today be the day that Cook & Co can say to the bears that they won’t have Apple to kick around anymore?

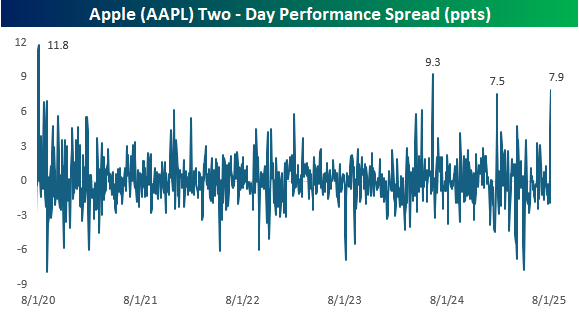

Besides rallying over 8% in the last two days, AAPL also outperformed the S&P 500 by just under 8% since Tuesday’s close, which ranks as one of the strongest two-day rallies relative to the S&P 500 in the last five years. The only two that were stronger were an 11.8 ppt performance spread in early August 2020 after the company reported earnings, and then a 9.3 ppt margin of outperformance after the company’s WWDC conference last summer. Besides those two periods, the only other two-day period of outperformance that was close to the last two days was a 7.5 ppt performance spread following its January report.

More By This Author:

Bull-Bear Spread Tips NegativeEnergy Sector Breaks; Gold Goes Sideways

Best And Worst Historical S&P 500 August Performers

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more