QSR Picks Popeyes And Leaves El Pollo Loco As The Last Chicken Standing

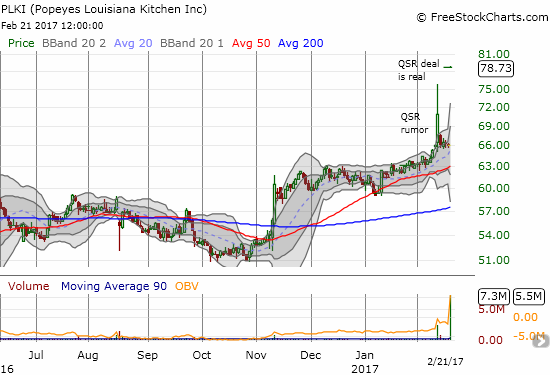

So it was true after all. Restaurant Brands (QSR) was indeed drooling over the secret recipes of Popeyes Louisiana Kitchen (PLKI). Today, PLKI soared 19.1% to $78.73/share and a $1.6B market cap, just short of the $79 ($1.8B market cap) that QSR promised to pay for acquiring PLKI.

(Click on image to enlarge)

When I discussed the merits of a QSR for PLKI deal, I proposed a pairs trade going short both names. After PLKI reversed all of its gains from the first buyout rumor, I also reversed course and bought PLKI shares. It is better to be lucky than good. While I essentially nailed my guesstimate of a $1.7B buyout valuation for PLKI, a different order of events would have left me with a small loss instead of a nice net gain (yes, timing IS everything!). The rumors of QSR souring on a deal gave me the price swings I needed.

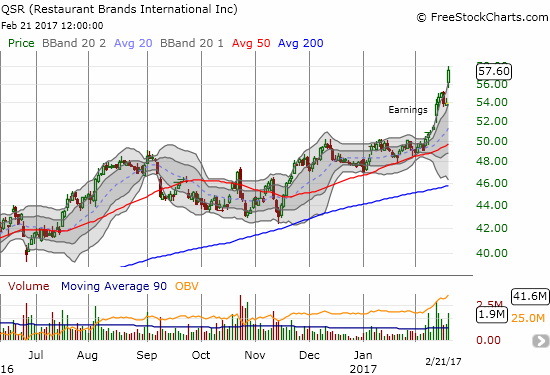

I also thought QSR would pull back on a deal for PLKI. Instead, QSR gained another 6.9% to a new post-earnings and all-time high. Clearly the market thinks of this deal as highly accretive to QSR’s business (the key will be in international expansion).

(Click on image to enlarge)

My QSR puts are of course worthless now. I closed out my PLKI position and took profits – I do not find waiting for the extra $1.27/share to come at the closing of this deal worth the downside risks of this deal somehow going awry.

This rapid turn of events now leaves El Pollo Loco (LOCO) as my “last chicken” standing. I am staying long shares per my discussion in “Another Chicken Run for Restaurant Brands With El Pollo Loco Rumors.” While I doubt QSR will next buy LOCO, I think this deal puts chicken joints in play and cheap, well-established restaurants in play generally. Under these circumstances, LOCO is simply too cheap to ignore as a good risk/reward speculation. While I wait for a fresh catalyst, I will keep a core position and look to play, if possible, the now 18-month long trading range and consolidation period.

(Click on image to enlarge)

Source: FreeStockCharts.com

Full disclosure: no positions

more

Although $LOCO looks stable now, the moving averages look like they will intersect soon, which is a buy/sell signal. I think that the signal is contingent on how $QSR proceeds in the acquisition. Moreover, recent developments suggest that the those who purchased $PLKI at $79/share prior to 21 February may have been taken advantage of. #Investigations are being conducted into the fairness of the aforementioned bid price.

The 50 and 200DMAs are already essentially converged and flatline for $LOCO. About as tame as you can get. I like to see this as a trading range until proven otherwise. And if it is a breakout, I think that point might be too late to get a good risk/reward entry. I am a bit confused how/why someone would have purchased $PLKI for $79 prior to Feb 21. There should have been lower offers available.

Thanks for the article and comment. Glad I bought $PLKI when I did!

I am glad you were able to profit!

You can check this article to get some more background info on this issue.

www.talkmarkets.com/.../done-deal-restaurant-brands-international-inc-acquire-popeyes-louisiana-kitchen-inc