Q3 Earnings Season Gets Underway

Image: Bigstock

- Estimates for the last two quarters of this year and full-year 2023 are coming down, even though positive revisions to the Energy sector continue to partly offset those estimate cuts elsewhere.

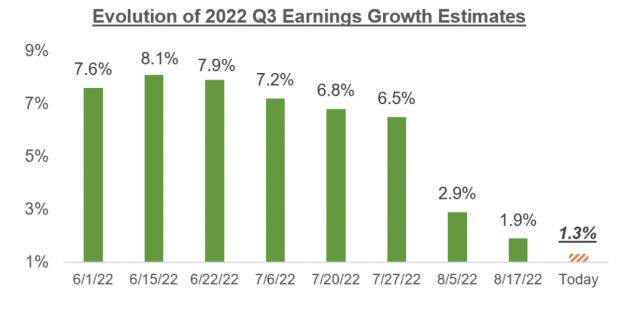

- The +1.3% earnings growth expected for the S&P 500 index in 2022 Q3 is down from +7.2% at the start of the period. Excluding the Energy sector, Q3 earnings are expected to be down -5.4% at present, a significant decline from +2.1% at the beginning of July.

- Q3 estimates have been cut for 14 of the 16 Zacks sectors since the quarter got underway, with the biggest declines at the Consumer Discretionary, Consumer Staples, Technology, Retail, and Conglomerates sectors.

- On the positive side, Q3 estimates have gone up the most for the Energy sector, but the revisions trend has been positive for the Auto sector as well.

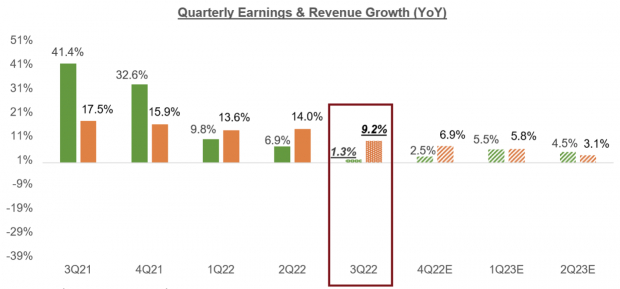

- In terms of year-over-year earnings growth, Q3 earnings are expected to be above the year-earlier level for 8 of the 16 Zacks sectors, with the strongest growth at Energy (+114.9%), Transportation (+53.9%), Autos (+34%), Consumer Discretionary (+32.3%), Construction (+23%) and Industrial Products (+12.1%).

- Q3 earnings growth is expected to be below the year-earlier level for Finance (-9.5% decline) and Technology (-13.8%).

- Q3 earnings growth would be +3.9% (instead of +1.3%) had it not been for the Finance sector drag, but index earnings would actually be down -5.4% had it not been for the strong Energy sector contribution.

- The overall picture emerging from the Q2 earnings season turned out to be good enough: not great, but not bad either. Importantly, the tone and substance of management guidance turned out to be better relative to pre-season fears.

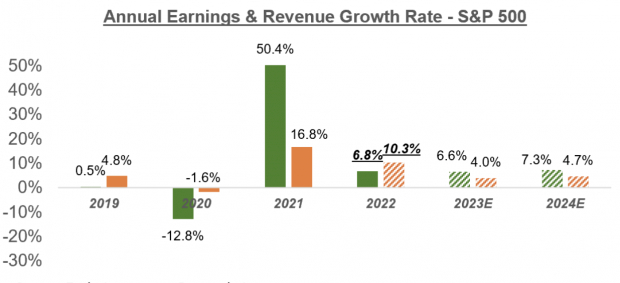

- Looking at the calendar-year picture, total S&P 500 earnings are expected to be up +6.8% in 2022 and +6.6% in 2023. On an ex-Energy basis, total 2022 index earnings would be up +0.2% (instead of +6.8%, with Energy).

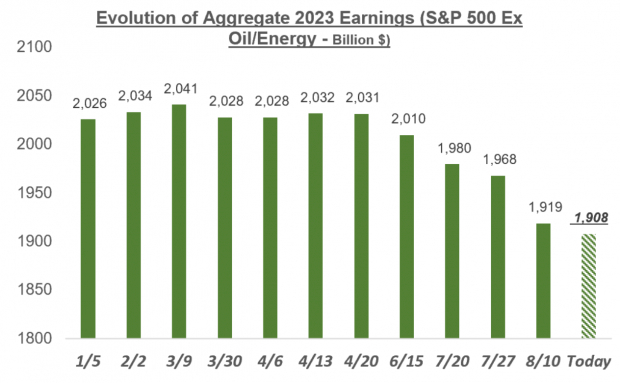

- Full-year 2023 earnings estimates have started coming down since peaking in mid-April, with the aggregate total down -3.64% from the peak for the index as a whole and -6.1% on an ex-Energy basis.

- Since mid-April, aggregate 2023 earnings estimates have declined for 12 of the 16 Zacks sectors, with the biggest declines in the Retail, Construction, Technology, and Consumer Discretionary sectors.

- While 2023 estimates have increased the most since mid-April for the Energy sector, they are also up for the Autos, Basic Materials, and Transportation sectors.

- Since mid-June, aggregate 2023 estimates have come down the most in percentage terms for the Construction, Consumer Staples, Retail, Tech, and Basic Materials sectors.

- The implied ‘EPS’ for the S&P 500 index, calculated using the current 2022 P/E of 17.8X and index close, as of September 13th, is $220.60, up from $206.51 in 2021. Using the forward 12-month P/E of 17.3X and the index close of September 13th, the forward 12-month ‘EPS’ works out to $227.85.

- Using the same methodology, the index ‘EPS’ works out to $235.22 for 2023 (P/E of 16.6X) and $252.40 in 2024 (P/E of 15.5X). The multiples have been calculated using the index’s total market cap and aggregate bottom-up earnings for each year.

We consider Oracle’s (ORCL - Free Report) quarterly report this week as the first among S&P 500 members that will get counted towards the 2023 Q3 earnings season tally. Oracle will be followed by Adobe (ADBE - Free Report) on Thursday of this week and Costco (COST - Free Report), FedEx (FDX - Free Report), and others in the days ahead.

As we have pointed out here before, the Q3 earnings season will really get going in mid-October when the big banks will come out with their results. But the early reports from Oracle and others for their fiscal periods ending in August also get counted as part of the Q3 earnings season tally.

The preceding earnings season turned out to be better than expected: not great, but not bad either. Given the unprecedented Fed tightening and the resulting macro uncertainties, market participants fear the corporate profitability picture will start deteriorating.

We saw some companies miss estimates and guide lower. But for the most part, the market’s earnings fears didn’t bear out. That said, the strong U.S. dollar has joined the pre-existing headwinds of logistical challenges and inflationary pressures in weighing on corporate profitability. We will have to wait and see whether the Q3 reporting cycle will bring in the long-feared earnings downturn.

Estimates have started coming down, with the overall revisions trend turning negative even after accounting for the persistent favorable revisions trend enjoyed by the Energy sector.

You can see this in the revisions trend to Q3 estimates in the chart below:

Image Source: Zacks Investment Research

If we look at the evolution of Q3 earnings growth expectations on an ex-Energy basis, the expected growth rate has dropped from +2.1% on July 6th to -5.4% today.

The chart below shows how the expected aggregate total earnings for full-year 2023 have evolved on an ex-Energy basis:

Image Source: Zacks Investment Research

As you can see above, aggregate S&P 500 earnings outside of the Energy sector have declined -6.1% since mid-April, with double-digit percentage declines in Retail (down -14.8%), Construction (-14%), and Tech (-10.8%). Estimates have been coming down in the Consumer Discretionary, Industrial Products, Medical, and Finance sectors as well.

The Overall Earnings Picture

Beyond Q2, the growth picture is expected to modestly improve, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis:

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue:

Image Source: Zacks Investment Research

Please note that a big part of this year’s growth is thanks to the strong momentum in the Energy sector, whose earnings are on track to grow +138.5% this year. Excluding this extraordinary contribution, earnings growth for the rest of the index would be up only +0.2%.

There is a rising degree of uncertainty about the outlook, reflecting a lack of macroeconomic visibility in a backdrop of Fed monetary policy tightening. The evolving earnings revisions trend will reflect this macro backdrop.

More By This Author:

Exploring The Energy Sector's Ongoing Earnings Boom

Looking Ahead To Q3 Earnings Amid Persistent Inflation And Rising Rates

Exploring Weak Retail Sector Earnings And Guidance

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more