Exploring The Energy Sector's Ongoing Earnings Boom

Image Source: Unsplash

High oil prices are problematic for the broader economy, but they are a boon for oil patch operators.

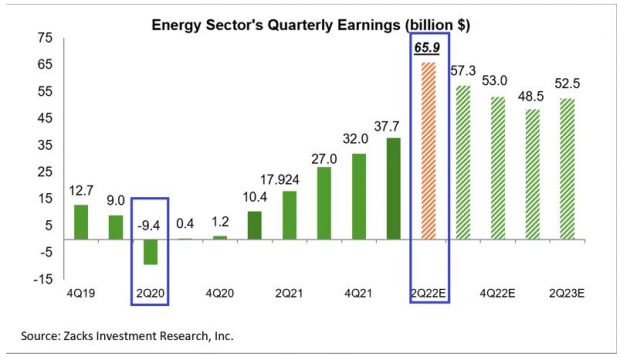

The pandemic was tough on the oil patch, with the immediate aftermath of Covid lockdowns pushing oil futures into negative territory. But the rebound was equally impressive. You can see this in the chart below that shows the Zacks Energy sector’s quarterly earnings in billion dollars.

Image Source: Zacks Investment Research

As you can see above, the group lost money in the second quarter of 2020, when transportation activities came to a halt as a result of Covid lockdowns.

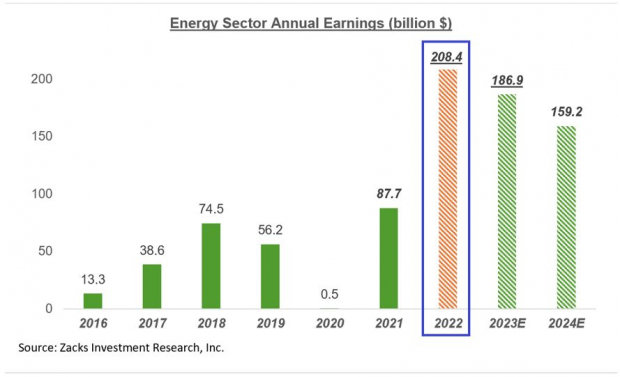

The sector’s profitability picture is even more impressive on an annual basis, as the chart below shows.

Image Source: Zacks Investment Research

What this chart and the earlier quarterly version are telling us is that the Zacks Energy sector is currently expected to bring in $208.4 billion in fiscal 2022 and $65.9 billion in the second quarter of FY22.

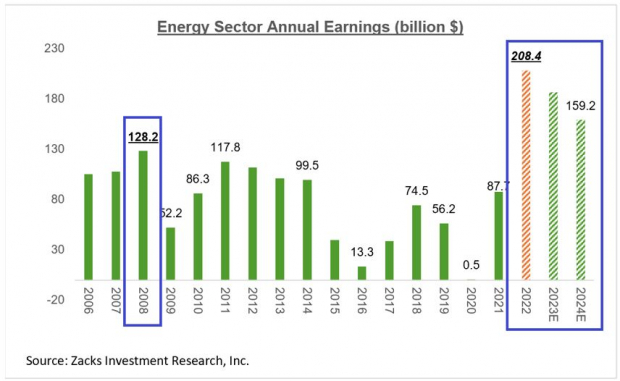

Interestingly, the sector’s expected earnings haul in 2022, as well as current estimates for the next two years, represent all-time records for the space, easily surpassing the previous record set in 2008 when oil prices had gone above $140 per barrel.

You can clearly see this in the chart below that shows a much longer historical span.

Image Source: Zacks Investment Research

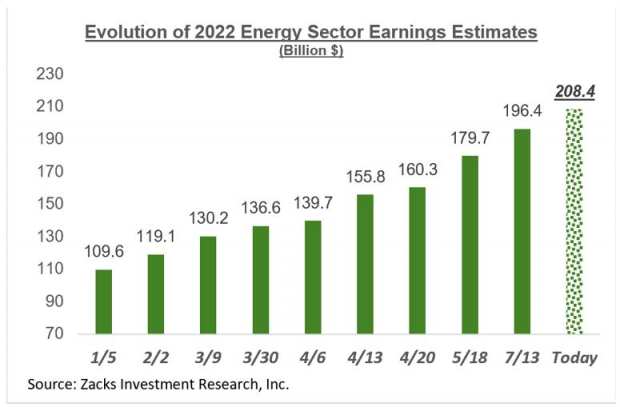

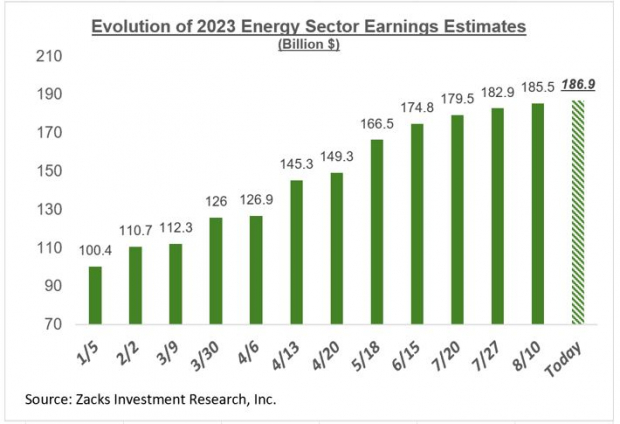

Energy is one of just a few sectors enjoying positive estimate revisions. In fact, the current aggregate 2022 estimate for total sector earnings has almost doubled in the last four months, as the chart below shows.

Image Source: Zacks Investment Research

The revisions trend for next year is no less impressive, as you can see below.

Image Source: Zacks Investment Research

As would be expected, all players in the space are benefiting from this favorable trend. Chevron (CVX - Free Report) is representative of its super major peers, with its full-year 2022 and 2023 estimates going up roughly +8% and +15.3% in the last three months, respectively. We see comparable revision trends with Exxon (XOM - Free Report), BP (BP - Free Report), and others.

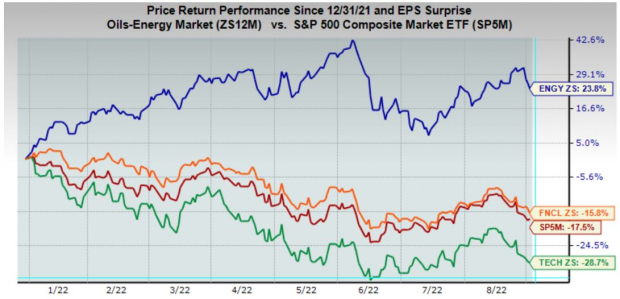

Given this impressive revisions trend, it is no surprise that the sector has been the leader in stock market performance lately. You can see this in the one-year performance chart below that plots the Zacks Energy sector (blue line, up +23.8%) vs. the S&P 500 index (red line, down -17.5%), the Zacks Finance sector (orange line, down -17.5%) and the Zacks Technology sector (green line, down -28.7%).

Image Source: Zacks Investment Research

How sustainable or otherwise these gains are will be determined by how enduring the current commodity-price gains turn out to be. These stocks don’t need spiking oil prices, what they do need instead are stable prices. Greater confidence in the forward price curve will keep the revisions trend in the positive territory, which should help these stocks not only sustain their recent gains, but actually build on them.

The Overall Earnings Picture Beyond the Energy Sector

The Q2 earnings season turned out to be fairly good; not great, but not bad either. The market was anxious ahead of the start of the Q2 earnings season that we may see all-around downbeat guidance from management teams. A number of companies did guide lower, but the trend was hardly widespread, with far more companies reiterating or raising guidance.

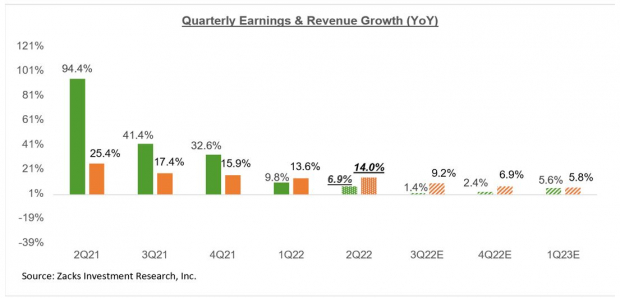

For 2022 Q3, total S&P 500 earnings are currently expected to be up +1.4% on +9.4% higher revenues.

Estimates have come down since the quarter got underway, even with estimates for the Energy sector offsetting the negative revisions trend.

The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the comparable picture on an annual basis.

Image Source: Zacks Investment Research

More By This Author:

Looking Ahead To Q3 Earnings Amid Persistent Inflation And Rising Rates

Exploring Weak Retail Sector Earnings And Guidance

Making Sense Of Fading Earnings Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more