Previewing Big Tech Earnings: What Can Investors Expect?

Image Source: Unsplash

Tech stocks have primarily traded sideways over the last couple of months but have otherwise been standout performers this year. The group’s momentum and outperformance have been driven by a combination of favorable developments on the macro front, primarily growing clarity about an exit from the Fed’s tightening cycle, optimism about the impact of artificial intelligence (AI) that some view warily as reminiscent of the late-1990’s, and an emerging sense that the worst of Tech spending headwinds is either behind us or close to that stage.

With many Tech companies on deck to report September-quarter results this week, the market will be looking for more color on business spending trends, particularly on the cloud side.

A big part of Tech’s improved earnings outlook over the last few months has been a function of more effective cost controls that have helped stabilize margins. Improved clarity on top-line trends will help solidify the nascent favorable revisions trend and undergird the group’s impressive stock market momentum.

On top of it all is the AI debate, where we have already seen direct revenue impact from the likes of Nvidia (NVDA - Free Report) and some ideas from Microsoft (MSFT - Free Report). Still, the innovation’s productivity-enhancing potential appears to be some ways off in the future.

The stock market is essentially a discounting system of the future. To the extent that we see viable business models in the days ahead that make use of AI and the so-called large language models, beyond Nvidia selling more capable chips, and Microsoft starting to charge for new AI-driven bells and whistles in its Office productivity suite, the stock market excitement would be totally justified.

These topics will be front and center in this week’s earnings reports from four of the ‘Big 7 Tech players’ - Alphabet (GOOGL - Free Report) and Microsoft (MSFT) after the market’s close on Tuesday (10/24), Instagram and WhatsApp parent Meta Platforms (META - Free Report) after the close on Wednesday (10/25) and Amazon (AMZN - Free Report) after the market’s close on Thursday (10/27). Of the remaining three members of this ‘club,’ Tesla has reported already, and Apple and Nvidia are expected to report Q3 results on November 2nd and 15th, respectively.

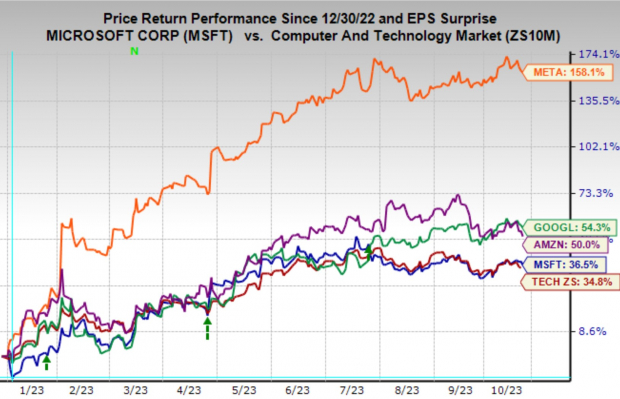

The chart below shows the year-to-date stock market performance of the Zacks Technology sector (red line, first from the bottom; up +34.8%), Microsoft (blue line, second from the bottom, up +36.5%), Amazon (purple line, in the middle, up +50%, Alphabet (green line, second from the top, up +54.3%) and Meta (orange line at the top; up +158.1%). The S&P 500 index has gained +12.8% during this period.

Image Source: Zacks Investment Research

As impressive as this stock market performance has been for these players, we can see that most of them essentially went sideways to down during Q3. Amazon has lost relatively more ground lately, mainly driven by the regulatory overhang in the wake of the Federal Trade Commission (FTC) lawsuit.

Digital advertising has historically been seen as core to Alphabet and Meta, but Amazon has also become a major player in the space. Ad spending stabilized during the last reported period (2023 Q2). Given the macroeconomic uncertainties, it will be interesting to see how these management teams see trends for the current and coming periods. This will also be at play in the Snap report, which reports Q3 results on Tuesday this week.

All of these companies are big players in the artificial intelligence (AI) space, with the Microsoft vs. Alphabet rivalry particularly intense. With the initial excitement around ChatGPT and other AI applications now behind us, the questions now center around how these AI capabilities will be monetized through new and existing business models. It is reasonable to expect each of these management teams to spend considerable time on their Q3 earnings calls discussing their AI plan.

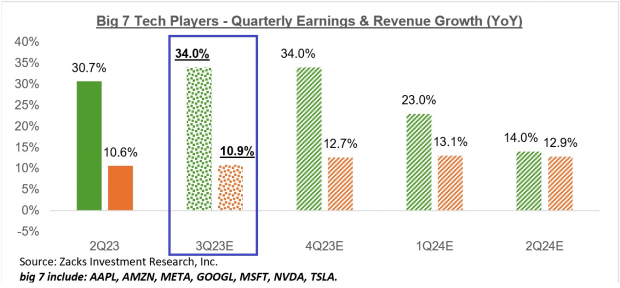

Take a look at the chart below that shows current consensus expectations for the ‘Big 7 Tech Players’ as a whole for the current and coming periods in the context of what they achieved in the preceding period.

Image Source: Zacks Investment Research

As you can see, the group is expected to bring in +34% more earnings relative to the same period last year on +10.9% higher revenues. Please note that these expectations have steadily increased as Q3 unfolded, with the current +34% earnings growth expectation up from +21.5% three months ago. As with Q3 estimates, earnings estimates for the last quarter of the year have also increased.

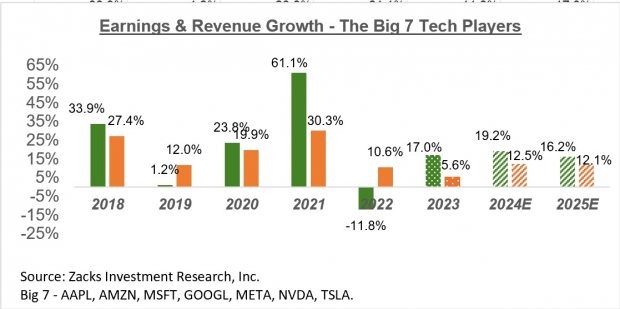

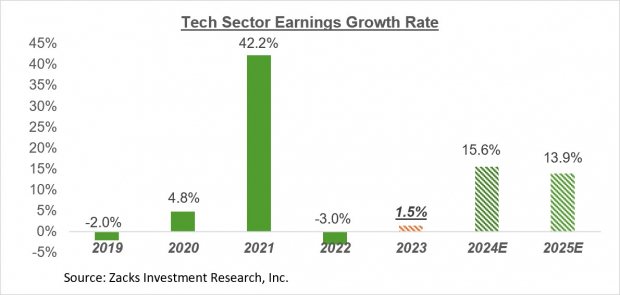

The chart below shows the group’s earnings and revenue growth on an annual basis.

Image Source: Zacks Investment Research

As we all know by now, the group’s phenomenal boost in 2021 partly reflected pulled forward demand from future periods that was in the process of getting adjusted last year and this year. As you can see above, the expectation is for the group to resume ‘regular/normal’ growth next year, but a lot of that is contingent on how the macroeconomic picture unfolds.

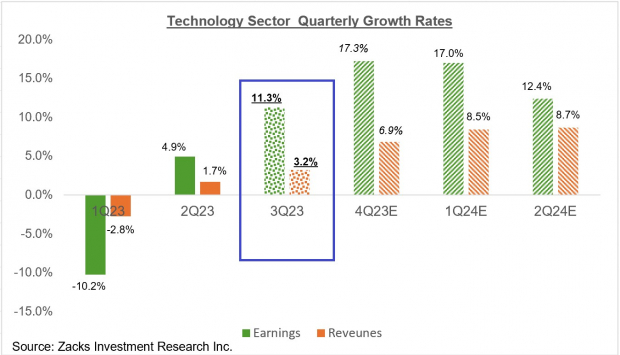

Beyond these mega-cap players, total Q3 earnings for the Technology sector as a whole are expected to be up +11.3% from the same period last year on +3.2% higher revenues.

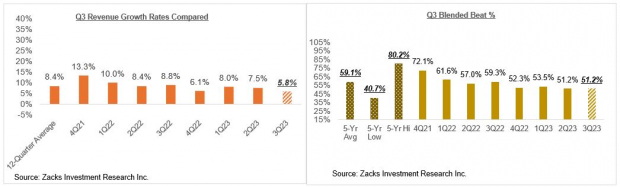

The chart below shows the sector’s Q3 earnings and revenue growth expectations in the context of where growth has been in recent quarters and what is expected in the coming four periods.

Image Source: Zacks Investment Research

As was the case with the ‘Big 7 Tech Players’, the overall Tech sector has been dealing with pulled forward revenues and earnings during Covid over the last many quarters. In fact, earnings growth for the Zacks Tech sector turned positive only in the preceding quarter (2023 Q2) after remaining in negative territory during the four quarters prior.

This big-picture view of the ‘Big 7 players’ and the sector as a whole shows that the worst of the growth challenge is shifting into the rearview mirror.

You can see this clearly in the chart below.

Image Source: Zacks Investment Research

This Week’s Notable Earnings Releases

Including all the earnings reports through Friday, October 20th, we now have Q3 results from 86 S&P 500 members. Total Q3 earnings for these 86 index members are up +1.9% from the same period last year on +5.8% higher revenues, with 79.1% beating EPS estimates and 61.6% beating revenues estimates.

The reporting cycle really ramps up this week, with more than 650 companies reporting Q3 results, including 160 S&P 500 members. In addition to the aforementioned Big Tech players, we have a representative cross-section of companies from all sectors coming out with results this week.

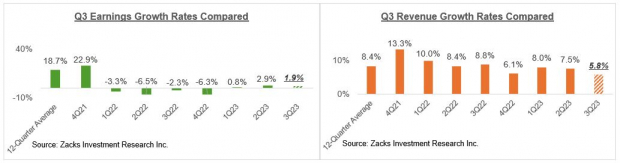

The comparison charts below put the Q3 earnings and revenue growth rates at this stage in a historical context.

Image Source: Zacks Investment Research

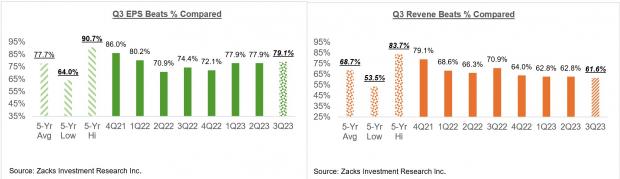

The comparison charts below put the Q3 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

As you can see here, companies are comfortably beating consensus EPS estimates but coming up a bit short on the revenue beats percentages. This becomes clearer when we look at the ‘blended’ beats percentage for Q3, which shows the proportion of these 86 index members that have beaten both EPS and revenue estimates.

Image Source: Zacks Investment Research

The Earnings Big Picture

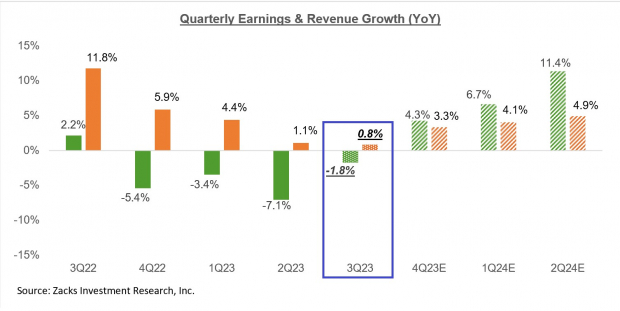

Looking at 2023 Q3 as a whole, the expectation currently is of S&P 500 earnings declining by -1.8% from the same period last year on +0.8% higher revenues. This would follow the -7.1% decline on +1.1% higher revenues in 2023 Q2.

The chart below highlights the year-over-year Q3 earnings and revenue growth in the context of where growth has been in recent quarters and what is expected in the next few periods.

Image Source: Zacks Investment Research

As you can see here, 2023 Q3 is expected to be the last period of declining earnings for the index, with positive growth resuming from 2023 Q4 onwards. In fact, had it not been for the Energy sector drag, earnings growth in 2023 Q3 would already be positive.

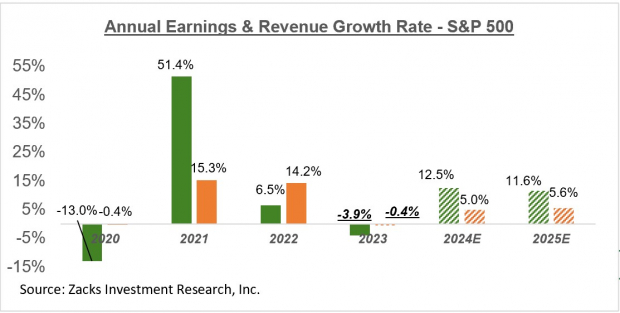

The chart below shows the earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

Look at current expectations for next year and the year after to understand the disconnect between the reality of current bottom-up aggregate earnings estimates and the seemingly never-ending worries about an impending economic downturn. That said, most economic analysts have been steadily lowering their recessionary odds in recent months.

More By This Author:

The Q3 Earnings Season Kicks Off Positively

Q3 Earnings Scorecard And Analyst Reports For Walmart, Nike & TJX

Analyzing Positive Bank Earnings: An Uncertain Outlook

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more

I don't love Big Tech's politics, but I do love their earnings.