The Q3 Earnings Season Kicks Off Very Positively

Image Source: Unsplash

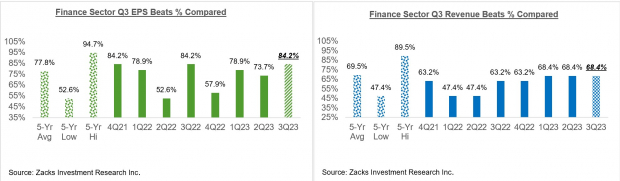

We are off to a good start in the Q3 earnings season, though the focus at this early stage has been largely on the Finance sector. Most of the big banks came out with better-than-expected Q3 results and described ongoing business trends in relatively reassuring and favorable terms.

This has to count as a big positive for the group, given the all-around negative views on the sector.

The chart below shows the Q3 EPS and revenue beats percentages in a historical context for the 38.1% of the sector’s market capitalization in the S&P 500 index that have already reported results.

Image Source: Zacks Investment Research

Beyond the Finance sector, looking at Q3 expectations as a whole, total S&P 500 earnings are expected to be down -1.1% from the same period last year on +0.8% higher revenues.

The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

As you can see from these quarterly earnings-growth expectations, the long-feared recession doesn’t show up in this near-term earnings outlook.

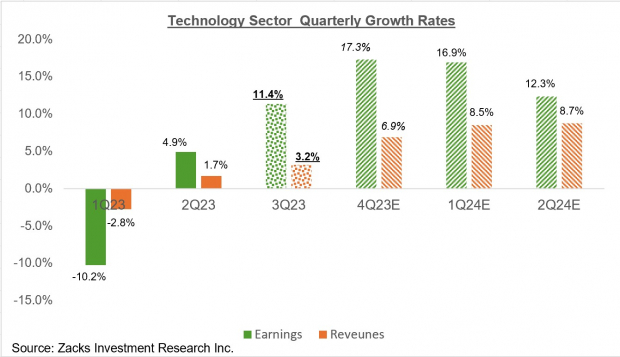

One key sector whose earnings outlook has been steadily improving lately is the Technology sector, whose members will be coming out with Q3 results in the next few days. The sector has been operating in a constrained growth environment since 2021 Q4, but this is on track to change starting with the group’s Q3 results, as you can see in the chart below.

Image Source: Zacks Investment Research

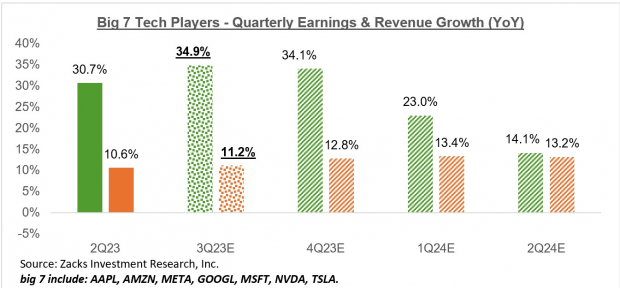

A significant source of growth for the group is the 7 mega-cap stocks, most of which are from the Tech sector. We call this group the ‘Big 7 Tech Players’, which includes Apple (AAPL - Free Report), Microsoft (MSFT - Free Report), Alphabet (GOOGL - Free Report), Nvidia (NVDA - Free Report), Tesla (TSLA - Free Report), Meta (META - Free Report), and Amazon (AMZN - Free Report).

Q3 earnings for this group of companies are expected to grow by +34.9% from the same period last year on +11.2% higher revenues.

Image Source: Zacks Investment Research

The ‘Big 7 Tech Players’ are a big contributor to overall index earnings now and going forward. Excluding the earnings contribution from the ‘Big 7’, S&P 500 earnings for the rest of the index would be down -6.4% (down -1.1% otherwise).

We show below the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

This big-picture view of corporate profitability doesn’t leave much room for that development either, as shown in the chart above.

Given the emerging consensus on the ‘soft-landing’ outlook for the economy, one can expect this favorable turn in the overall earnings picture to strengthen further as companies report Q3 results and share trends in underlying business.

More By This Author:

Q3 Earnings Scorecard And Analyst Reports For Walmart, Nike & TJX

Analyzing Positive Bank Earnings: An Uncertain Outlook

Analyzing Q3 Earnings And Higher Interest Rates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more