Pre-Election Special: Market Fragility As Our 'Reality' Connects

A 'broadening top' has been my bigger-picture assessment of market behavior, oh at least, through the summer and by some measures over a two-year 'distribution'. I've made the remark (though it's not essential to play-out that way) that the 'longer a distribution, the deeper the ultimate decline'. For months I've pointed out market disconnects from economic reality. Now, only recently with fragmented confidence in the status quo; do you see a growing recognition (augmented by politics) of our view of historic risk following historic levitation amid a disconnect.

Sure, whether that's how this unwinds over time is theoretically merely a subjective assessment. However, not so for all the minions of analysts or pundits who are thrilled to pronounce corrections as 'limited', or already over, with a minuscule 3% drop in the S&P, while many stocks clearly are (and have been) down a lot more, and well before the chaos surrounding elections. This matters for several reasons.

One is whether a 'perception' insisting any correction is limited tends to lead investors down the primrose path of being handheld and fully long all the way through. Fine 'if' indeed it's only a correction; not so comfy if it turns into something more. And definitely leaving investors hung out to dry if we get the kind of full-blown 'bear market' and/or recession that I've very regularly tied to an assumption that will be tracked back to early-mid July on our part (and in hindsight by others; a bit of which we're hearing; as is good because that will help sustain some selling as they recognize this).

All eyes seem to be on elections; or even blaming that chaos (which for sure is embarrassing to the traditions of this nation, but it is what it is) as a causal factor. It is, near term, one of the catalysts or triggering events of course; but the technical and fundamental set-up (as well as declines in price outside a narrow universe they focused attention to provide their cover for distribution for quite some time) prepared markets for that.

Inherent therein in the risk of pointing all this on the US elections. China is overlooked; Japan is overlooked; Europe is overlooked; the Pope too is overlooked (today he called on EU members NOT to accept any more immigrants unless they commit to assimilate within the host countries; a real acknowledgment of the issue); the street-fighting in Paris between a lot of migrants displaced properly by the clearance of Calais tunnel lanes by French police; the coming OPEC meeting of distrustful cartel nations; and of course the December Fed meeting with a hike rate-hike prospect.

Observation

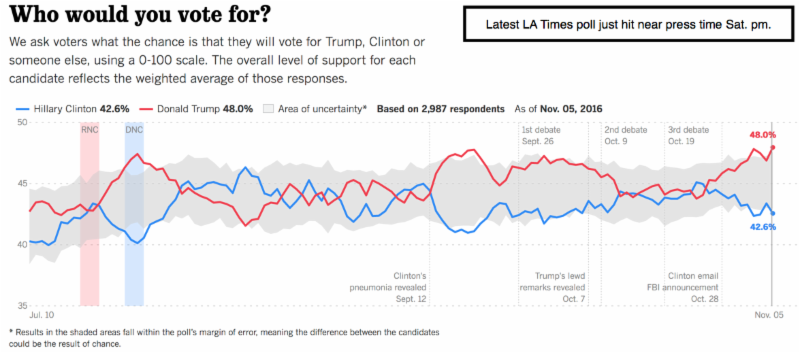

Down to the wire continue further revelations; primarily related to more Wikileaks releases; and a greater realization that Hillary is not only the 'establishment' candidate, but perhaps that she's lost the enthusiasm of some backers, who recognize that external issues coming to fruition can cripple the effectiveness of her (potential) administration (ie: an internal audit of her own foundation was fairly critical and that's a story that's again hitting the wires over the weekend).

So let's worry about the market; but concurrently suspect that the core of the 'worriers' around the Trump circles pertains not to domestic upheaval as much as busting-apart the international entanglements that some saw previously as constructive, before they became failed foreign policy.

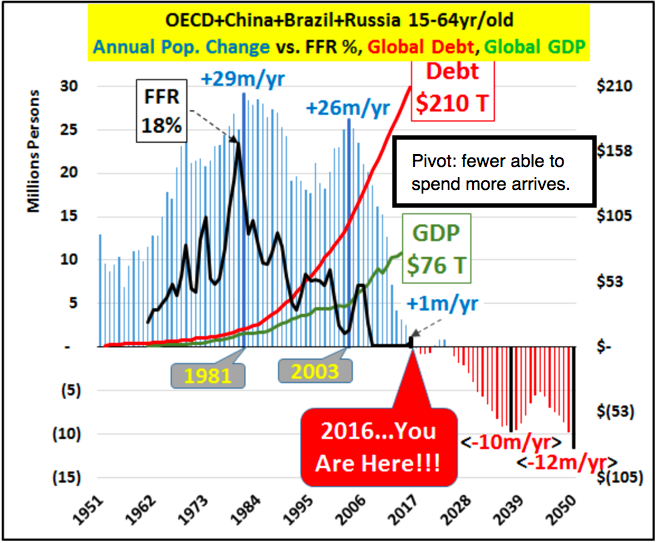

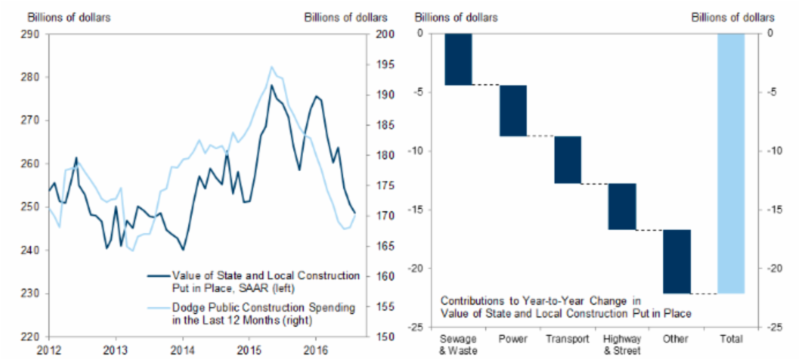

The stock market has been leery for months about the economy; falsified (I mean massaged) GDP, and estimates for growth in many ways; half-truths data releases; and extended levitation by virtue of monetary policy which was reluctantly trying to back down a bit from excess stimulus, which never did lift much of the nation (deficit rates did decline, but insufficiently to really make an appreciable dent; of course about to go the other way as any upcoming rate increase sobers meaning of all this associated debt bloating.

So now the market is entering a potential panic phase, regardless of any post-vote relief rally everyone is counting on, that we're prepared to play for traders, albeit not for investors; because we suspect it goes lower for longer and deeper, later. In fact, if there are any more revelations, there's risk of an unbelievable absence-of-bids going into Election Day; which is itself a reason to retain bearish skin in the game, even if preparing for a potential subsequent rebound (within the grander downtrend).

And remember, Wall Street is not positioned for surprises (as should be surprising given all the warnings such as we've trotted out as well as basic chart patterns) hence a vacuum is rippling the waves. This was a market 'accident' waiting to happen; with sort of an irony; as we haven't really had a significant decline yet; and they are freaked about this nominal drop in the indexes. Mostly because now the technicians recognize long distribution as the broadening top I've alluded to for awhile; and also because they know the underpinnings for a big new advance are simply not there. Not fundamentally; not monetarily; as well as totally not technically given the initial entry into what I've termed a vacuum that awaited under the September and October S&P lows.

We've now entered the upper reaches of that vacuum in the process as outlined in recent weeks; and the extent of potential decline remains high regardless of intervening rebounds. And that includes any post-election sort of panic followed by rebound, as we saw in the UK's Brexit wake (as well as rightly forecast incidentally; believing Soros' panic call was mostly playing his book perhaps. Thanks to those of you who noticed we got it).

One difference; because we were so overextended, with monetary policy begging to move off excess stimulus and corporate profits stagnant or at least not robust, as prior extended S&P price levels would have required; because of this (unlike London's FTSI at the time) I don't see new highs.

Bottom line

Should we see a pre-or-post vote washout; we may well hit it for a rebound (for traders that means covering some shorts or puts for terrific profits, and perhaps even going long for a trade, depending how it evolves...and that is how we handled it on Brexit day and the following).

A trading play for a rebound does not suggest markets out of the woods, nor diminish prospects for considerably lower prices. It merely allows for a requisite relief rally, before 'the crowd' is compelled to face the reality it is not merely about elections but the broader backdrop, including Oil.

Conclusion

While there is growing consensus about a view I've taken in that a Trump victory would be short-term negative for markets but longer term bullish; the reality is that either way we have contraction and a shift in monetary policy to deal with in the weeks and months ahead. A Hillary win would be only superficially calming and still precede more problems.

|

For now, we continue short December S&P (for weeks) from 2167. |

Disclosure: None.

Thanks for sharing