Picking On Netflix Again - Slowing Trends

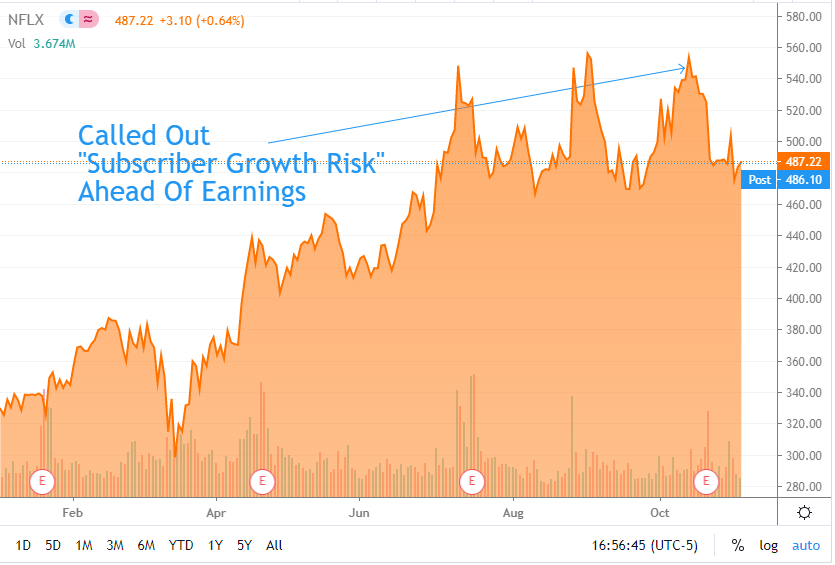

We were bullish on Netflix (Nasdaq: NFLX) earlier in the year. The pandemic pulled forward demand and helped the company beat expectations by a big margin. However, after the Q2 earnings report, we called out possible risk due to lower than expected growth. Last week, the company reported earnings which proved the lower growth forecast correct. Net subscriber additions slowed down and were lower than forecast, which sent the stock lower.

The company is still the king of streaming, but the latest growth trends and new competition lead us to believe there’s some fundamental risk to the stock. For now, we’re on the sidelines.

Subscriber Growth and Earnings Reaction

A couple of weeks ago, we pointed out that there was subscriber growth risk for Netflix.

They recently reported earnings, which showed just 2.2m paid net additions in Q3, vs. a guidance of 2.5M. For comparison, Q2 added 10.1M subs. A slower forecast proved correct..

The company issued guidance forecasting 6M more paid subscribers which assumes a reacceleration.

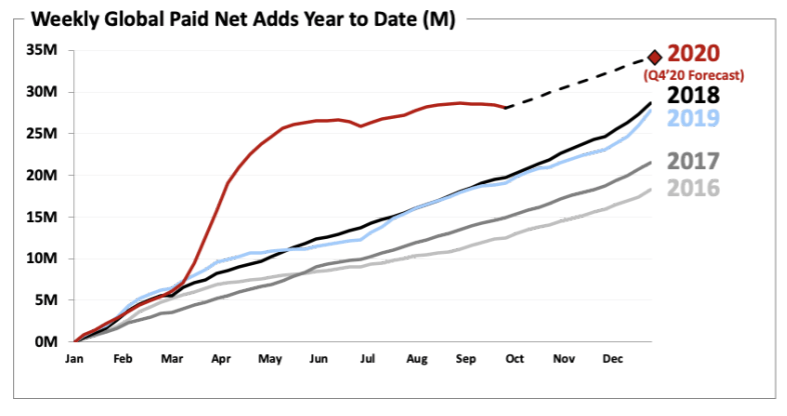

But similar to last quarter, the latest trends suggest growth is slowing down. If you look at the following chart, it's clear that between September and October, growth was flat. Netflix is forecasting this trend to reverse. But based on our experience trends have the habit of continuing. That would imply further downside.

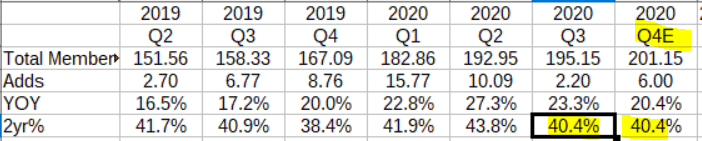

In Q3 2020, total membership two-year growth slowed down slightly from 43.8% to 40.4%. The slowdown is not huge, but this is our most important datapoint for Netflix. A slowdown is meaningful.

Source: Elazar Advisors Models

It’s also interesting that management’s guidance implies a two-year growth rate of 40.4% for next quarter. Exactly the same two-year as this quarter. If you follow my work, you know I always use the two-year growth rate, and Netflix’s management seems to use it too. Companies like this metric because it smoothes out one timers, and it's a good indicator of trends.

On a bigger picture level, Netflix implied two-year guide confirms our general use of two-year growth trends as a key measure.

Price Hike in US Standard and Premium Plans

After earnings, we also told subscribers that, to hit on their revenue target, the company would have to reduce expenses significantly or miss their EPS. The numbers didn't match up for us.

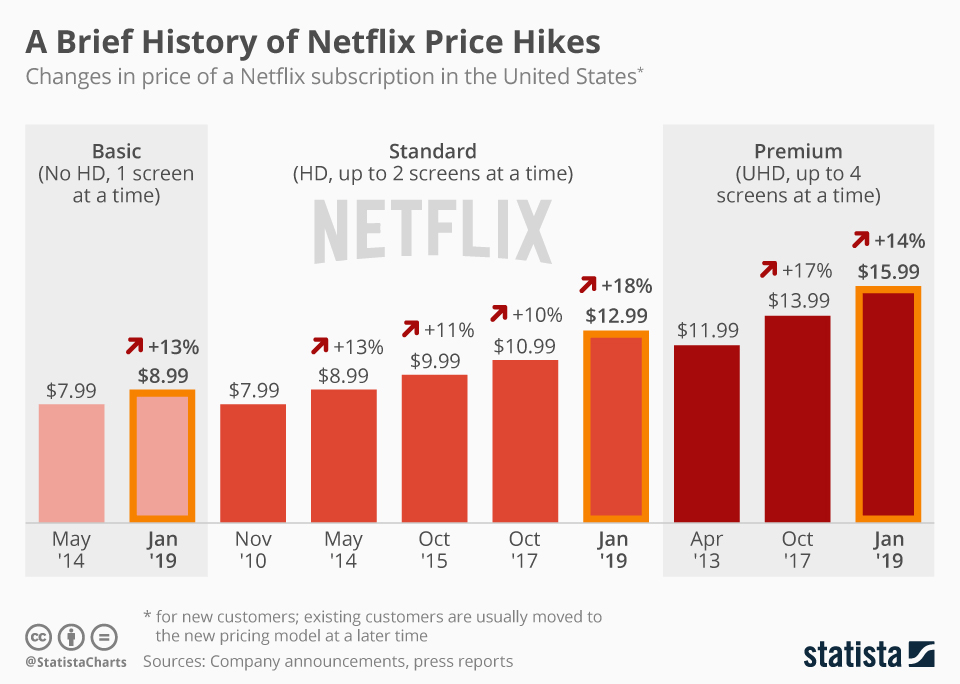

Potentially as a reaction to squeezed margins Netflix decided to raise prices. Netflix announced a price hike for US consumers soon after.

According to the report, Netflix’s most popular plan will increase from $13 to $14, while the premium package will rise from $16 to $18 a month. The entry level plan will stay at $9.

The chart shows the history of the other Netflix price hikes. With the most recent increase, the price of the standard plan will have increased from $8 to $14 in 10 years, jumping 75%.

The market perceived the price hike as a good move, with the stock jumping right after the announcement. When asked in chat we told subscribers not to chase the stock. The price hike could signal the company is expecting a slowdown in subscriber growth.

|

Q4 2018 |

Q1 2019 |

Q2 2019 |

Q3 2019 |

Q4 2019 |

|

|

Netflix Subscribers |

139.26 |

148.86 |

151.56 |

158.33 |

167.09 |

|

QoQ |

6.78% |

6.89% |

1.81% |

4.47% |

5.53% |

|

YoY |

25.87% |

25.20% |

21.88% |

21.40% |

19.98% |

|

2Yr Change |

56.31% |

57.76% |

52.95% |

52.21% |

51.02% |

Last time Netflix increased its pricing, growth slowed down the following quarters. In Q1 2019, the company raised prices on all their plans, and the subsequent three quarters the two-year growth rate slowed down from 56-57% range to the 53-51% range.

If the company expected higher user growth, they might have waited on the price hike. But this move could signal they’re expecting a slowdown, so they are increasing prices for their current customers as an offset to meet their revenue growth targets.

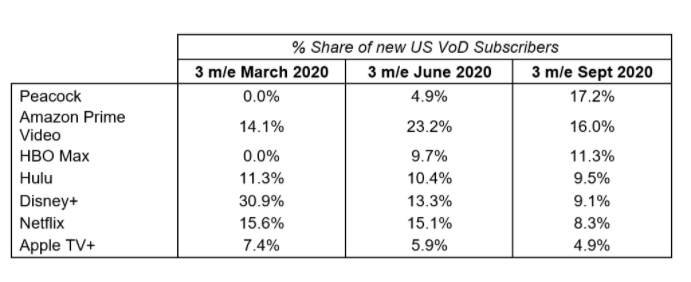

Peacock and Amazon Prime Video Gaining Share, Netflix Seventh in New Adds

The first half of 2020 pulled forward demand, so growth could be harder to achieve in the 2H of 2020. On top of that, there's a lot more competition right now. In the previous article, we highlighted all of the new video streaming services that have been recently launched, like Disney+, HBO Max, and Peacock.

These services, with fresh content, are sure to attract a lot of new subscribers. Clearly these services are not exclusive, but it’s unrealistic to expect a large proportion of consumers to pay for multiple streaming services.

One report estimated that in Q3 2020, Peacock and Amazon Prime captured 17.2% and 16% of new video on demand subscribers growth in the US. Netflix was just seventh on the list.

The report also states that 10% of new subscribers were switchers. That means they cancelled one service to join another.

The report also mentioned: “Looking ahead to the fourth quarter, a further 15% of households say they are considering signing up to Peacock.”

So 15% of 82.8% of those surveyed (the other 17.2% already signed up), indicated they are considering signing up for Peacock.

General growth numbers can be harder to come by with multiple strong competitors attacking the pie.

Disney+ also could hit some of Netflix’s international growth, since they are launching the service in Latin America in November 2020.

On top of that, sports are back. In Q2 2020, almost every single sport event in the world was halted. But with the NBA Finals and the MLB postseason, sports surely attracted a lot of viewers. NFL and soccer leagues across Europe are also in full swing, which will surely attract viewers.

With competition heating up, Netflix will be pressured to spend big on new content next year to attract new subs and offset their pricing headwind.

Conclusion

We called out risk on Netflix a couple of weeks ago ahead of earnings. Netflix did ended up missing their growth targets. New information gives us more conviction that there could be more risk ahead for Netflix. Subscriber growth slowed down, sports are back, and competition is heating up. Netflix is still the king of streaming, but right now, given the risks we’ve outlined in their key metric (subscribers) we are on the sidelines.

Disclaimer: All investments have many risks and can lose principal in the short and long term. The information provided is for information purposes only and can be wrong. By reading this you ...

more

Since the pandemic started, I literally don't know a single person that doesn't have Netflix.