PayPal Stock: The More It Drops The More I Buy

PayPal's (PYPL) stock has been in a downward spiral for months now. Moreover, the company's share price took an additional leg lower after PayPal's "difficult" quarter and lowered guidance last month. Now, the stock is highly oversold, while PayPal's growth story remains robust and attractive going forward. Moreover, PayPal's valuation has been adjusted, and shares trade at only 35 times consensus forward EPS estimates. As PayPal's profitability increases, the company's stock price should move substantially higher in future years. I've been a supporter of PayPal for a long time, and I am buying this drop as I am doubling my position right here.

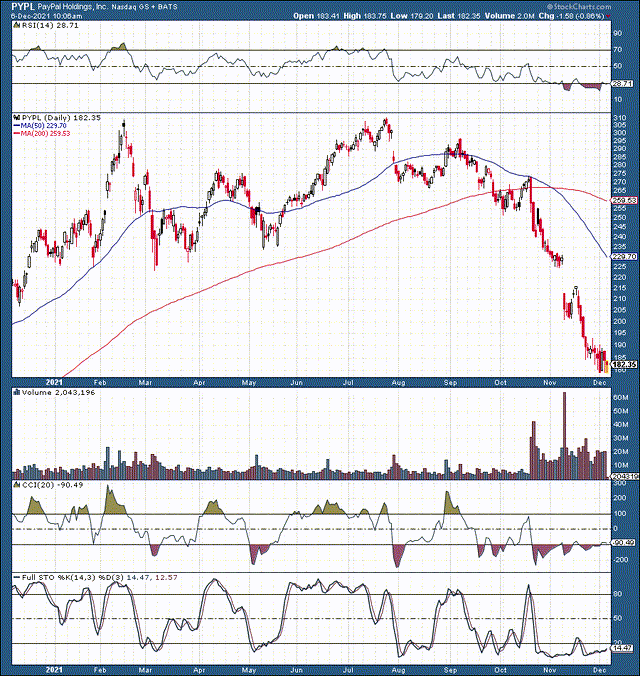

PayPal 1-Year Chart

Source: stockcharts.com

We've seen PayPal's stock get crushed lately. Shares are down by 40% since the stock hit an all-time high ("ATH") around $310 earlier this year. In fact, we see a double top, after which the stock has made a series of lower lows and lower highs. The $64,000 question - is the selloff over?

We see some stabilization around the critical $180 area of support. Moreover, we saw the relative strength index ("RSI") hit a rock-bottom low 20 level, implying highly oversold conditions in the stock. The full stochastic and the CCI are starting to turn upward, suggesting that a shift to a more positive momentum is likely occurring now. If PayPal can remain above $180 support, shares can probably recover, move up towards the unfilled gap at $225-230, and could potentially continue to move higher after that.

Why Is The Stock Down In The First Place?

While PayPal's stock attempted a move towards new ATHs in early September, it failed technically. After this disappointment, we saw shares move lower into November 9th earnings. Now, PayPal's stock took a nosedive post Q3 earnings, as the company guided to lower full-year revenues. PayPal said it expects to see around an 18% YoY rise in revenues, suggesting sales of about $30 billion relative to consensus forecasts of around $31.6 billion for fiscal 2022. A series of lower price target adjustments from analysts covering the stock followed the report, and shares have been under pressure ever since. Yes, the company's growth story is slightly slower than some highly bullish analysts had expected, but is this dynamic worth a 40% drop in the stock?

PayPal: Remains The Gold Standard

Despite having competitors like Skrill, Stripe, Payoneer (PAYO), Google (GOOG) (GOOGL)/Apple (AAPL) Pay, and others, PayPal remains the gold standard amongst payment processing platforms.

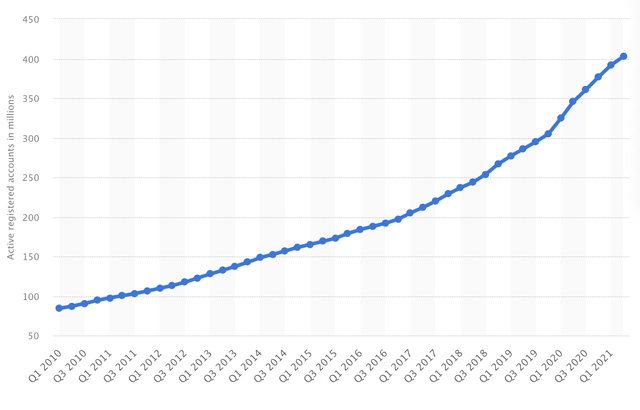

PayPal Active Users

Source: statista.com

Remarkably, the company now has over 400 million active PayPal user accounts. Additionally, we see that growth remains robust. The company reported a gain of more than 15% YoY from 361 million active PayPal users in Q3 2020 to 416 million in Q3 2021.

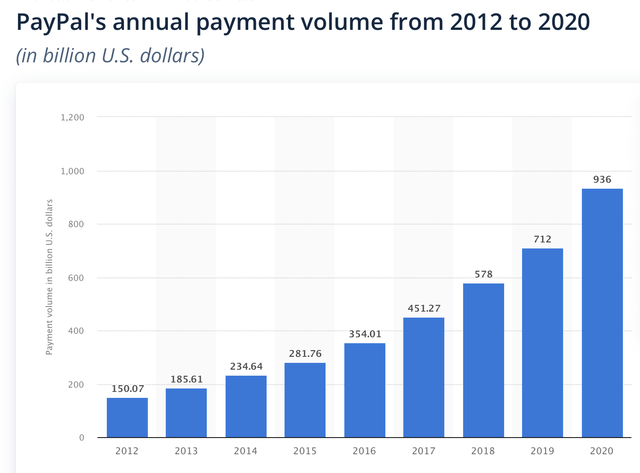

Source: statista.com

PayPal's Total Payment Volume ("TPV") continues to surge. Last year, the company came close to hitting $1 trillion, but the company managed to deliver $906 billion in the first three quarters alone this year. This result represents a massive 37% surge over last year (Q1-Q3). Therefore, PayPal should surpass $1.2 trillion in TPV this year. Likewise, the number of transactions continues to increase notably. Last year, the company processed about 11 billion transactions in the first three quarters, while this year, the company processed over 14 billion, roughly a 27% YoY rise.

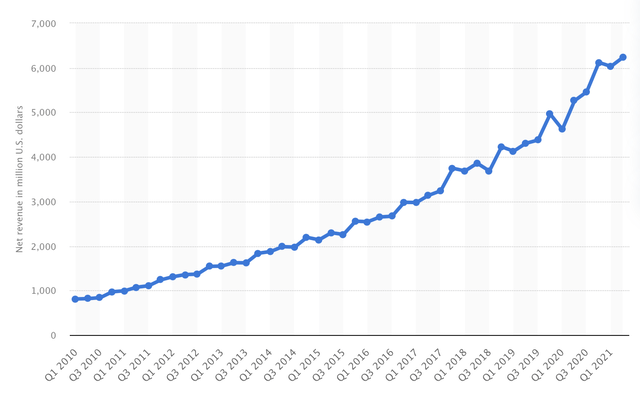

PayPal Revenues

Source: statista.com

For the first nine months, PayPal reported about $18.45 billion in revenues, a more than 20% YoY gain. At the same time, PayPal's operating expenses increased by only 17% in the same time frame. The company specifically illustrated increased efficiency in its general and administrative costs, as these expenses increased by fewer than 3% on a YoY basis. PayPal's technology and development expenses increased by about 17% in the same time frame, and the company's sales and marketing costs jumped by about 42% in the first three quarters. Perhaps most importantly, PayPal put up a solid 27% YoY net income gain through the first three quarters of 2021 (from $2.635B to $3.368B).

The Takeaway

While PayPal's growth may be slowing, the company is still illustrating robust gains in users and transactions. Moreover, PayPal is controlling costs effectively and is increasing net income and EPS for shareholders. While the company's revenues and income rose notably through the first three quarters of this year, PayPal's general and administrative costs came in just marginally higher. Moreover, the company's increased marketing and R&D expenses should pay off in the future. The bottom line is that PayPal should continue to attract new users, expand revenues, improve efficiency, and increase net income as the company advances.

PayPal: A Valuation Perspective

PayPal said that it expects to increase revenues by around 18% in fiscal 2022. Now, in my view, this projection is far from disappointing. This growth rate is in line with PayPal's revenue growth projections for this year. Moreover, PayPal has a tendency for beating expectations and could deliver 19% revenue growth or higher in 2022. Therefore, the company seems to be in much better shape than the recent price action suggests.

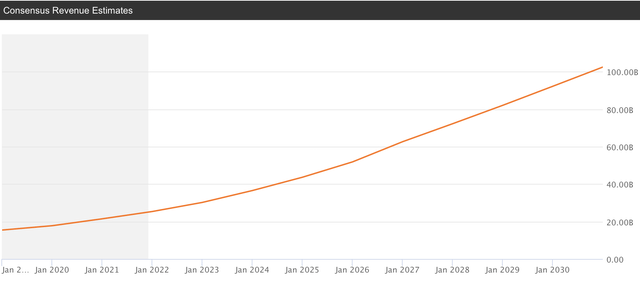

PayPal Revenue Forecasts

Source: seekingalpha.com

More importantly, PayPal should continue to deliver substantial double-digit revenue growth for several years into the future. Analysts predict PayPal will provide over $50 billion in revenues in 2025, which is essentially a 100% increase from this year. Additionally, as PayPal's growth persists, the company could double revenues again to around $100 billion by the end of 2030.

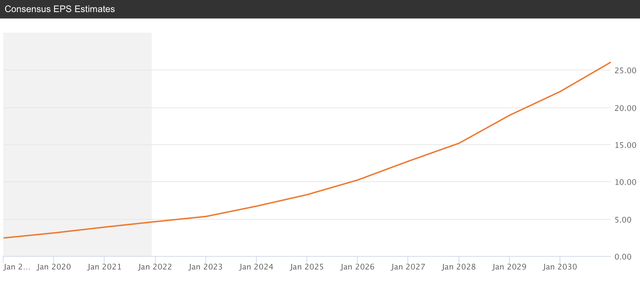

PayPal EPS Projections

Source: seekingalpha.com

As PayPal improves efficiency and profitability, the company should substantially increase EPS in future years. While the company's revenue growth should fluctuate around 15-20%, PayPal's EPS growth will likely swing between 20-25% as we advance. Consensus EPS projections are for $5.31 in fiscal 2022, which illustrates that PayPal trades at only around 35 times forward EPS estimates right now. Additionally, PayPal has beaten consensus analysts' forecasts in all but one of its last 12 quarterly EPS results. Given PayPal's impressive growth and its remarkably long growth runway, the current valuation on the stock appears relatively cheap.

Here is what PayPal's valuation could look like in future years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue $B | 30.2 | 36 | 43.2 | 51.4 | 60.1 | 70.4 | 80.1 | 93 | 105 |

| Revenue growth | 19% | 20% | 19% | 18% | 17% | 16% | 15% | 13% | 11% |

| EPS $ | 5.32 | 6.7 | 8.4 | 10.5 | 13.1 | 15.9 | 19.7 | 24.1 | 30 |

| Forward P/E | 38 | 40 | 38 | 36 | 35 | 33 | 30 | 28 | 25 |

| Price | $255 | $336 | $399 | $472 | $557 | $650 | $715 | $840 | $950 |

Source: Author's Material

The Bottom Line: There's A Lot More Upside Ahead

Right now, PayPal is trading at around $185, or roughly 35 times next year's projected consensus EPS estimates. This valuation appears relatively cheap right now, and PayPal should continue to expand revenues and income over the next several years. We could see modest multiple expansion in the near term, but even as PayPal's earnings multiple contracts in future years, the company's stock price should appreciate considerably due to substantial EPS growth.

Risks to Consider

While I am committed to my bullish thesis, some risks do exist concerning PayPal. The greatest risk is from a macro perspective, in my view. A possible broad economic slowdown could deflate valuations as well as stock prices, affecting PayPal at the same time. Moreover, competition remains a factor of concern, and PayPal could see some of its market share slip to competitors in future years. Additionally, PayPal could experience a bigger revenue growth slowdown than I envision. Therefore, it is possible that my revenue, EPS, and price target projections could be too optimistic for the specified time frame.

Disclosure: I/we have a beneficial long position in the shares of PYPL, GOOG either through stock ownership, options, or other derivatives.

Disclaimer: This article expresses solely my ...

more