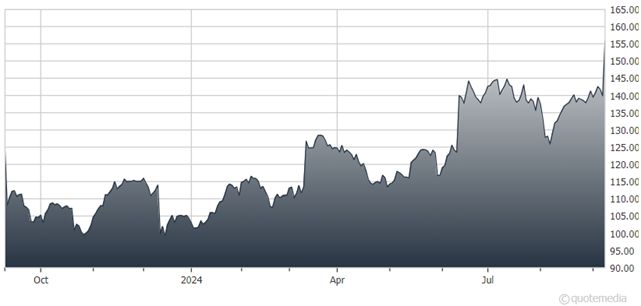

ORCL: Another Great Quarter With Strong Datacenter Business Growth

Image Source: Pixabay

Cloud service revenues rose 21% to $5.6 billion, driven by 45% growth in Cloud Infrastructure (IaaS) revenue to $2.2 billion and 10% growth in Cloud Application (SaaS) revenue of $3.5 billion. Total remaining performance obligations were up 53% to a record $99 billion. The strong contract backlog will increase revenue growth throughout fiscal 2025.

Oracle Corp. (ORCL)

Oracle signed a MultiCloud agreement with Amazon Web Services (AWS), with Oracle’s latest technology embedded in AWS cloud datacenters. AWS customers will get easy and convenient access to the Oracle database.

Oracle has 162 cloud datacenters in operation and under construction around the world. The largest of these datacenters is 800 megawatts and will contain acres of Nvidia Corp. (NVDA) GPU clusters for training large-scale AI models. During the first quarter, 42 additional cloud GPU contracts were signed for $3 billion.

Oracle’s database business growth is increasing as a result of its Multicloud agreements with Microsoft Corp. (MSFT) and Alphabet Inc. (GOOGL). With the addition of the Amazon agreement, customers will be able to use the latest Oracle database technology from within every Hyperscaler’s cloud.

Free cash flow declined 9% during the quarter to $5.1 billion as the company invested $2.3 billion in capital expenditures due to strong demand. Capital expenditures are expected to double this year as the company is rapidly expanding capacity to meet strong public and private cloud demand, which is exceeding supply.

Recommended Action: Buy ORCL.

More By This Author:

International Business Machines: A Less Obvious AI Play That's Powering Ahead

Lamar Advertising: An Outdoor Ad REIT Spinning Off Attractive Income, Returns

IOO: An Attractive ETF For A Lower-Rate, Soft-Landing Market

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more