Oracle Pain Continues

Investor sentiment towards Oracle (ORCL) is taking another hit today on reports from the FT and Reuters that Blue Owl Capital, which typically funds and leases data centers back to Oracle, pulled out of a project in Michigan designed to serve OpenAI. With over $100 billion in outstanding debt, investors continue to grow more concerned about the company’s borrowing to fund its AI ambitions.

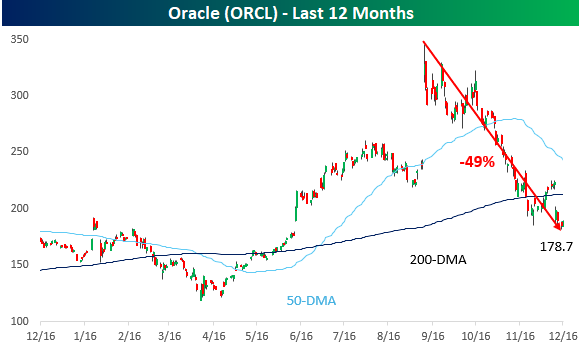

Those concerns have obviously manifested themselves in ORCL’s stock price. With this morning’s 5%+ decline, the stock has basically been cut in half from its intraday high in September. Shockingly, even with that decline, the stock is still hanging on to a single-digit percentage gain YTD. It’s not often that stocks fall 50% and remain up on the year.

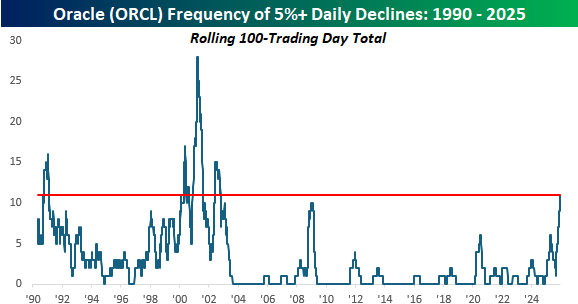

If today's declines hold, it will also mark the 11th time in the last 100 trading days that ORCL declined at least 5% in a single session. Even during the Financial Crisis, when it seemed as though stocks were crashing every day, the highest this reading ever got for ORCL was ten. That said, it’s nowhere near the levels (at least not yet) that it got during the bursting of the dot-com bubble in early 2000 through 2002. Hopefully for bulls, Oracle's recent weakness isn't living up to its namesake and offering a warning for the rest of the market.

More By This Author:

Regional Strength

Early Christmas Gift: Gas Prices Below $3

Historic Health Care Relative Strength

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more