One Year’s Loss Is Not The Next Year’s Gain

Image Source: Pexels

Friday was the last trading day of what has been a tough year for most asset classes, especially equities. Yesterday, the S&P 500 appeared on pace to finish the year with a 19.83% loss. Over the course of the index’s history, there have only been nine other years in which the S&P 500 has fallen at least 15% for the full year.

Of course, turning the page of the calendar does not mean all the issues dragging stocks lower magically go away, and a big decline one year does not in and of itself mean we’re due for a big gain the next year.

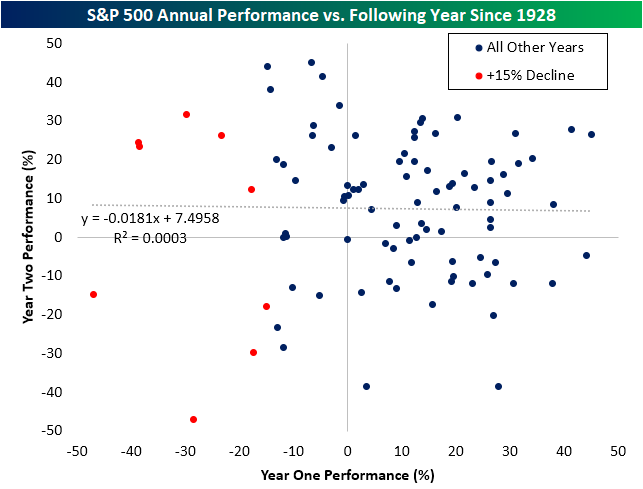

In the chart below, we plot the annual percentage change of the S&P 500 versus its move the following year. Taking a linear regression shows that performance over one year is not a good indication for the next year's performance, with a miniscule R-squared of 0.0003.

Looking just at those years where the S&P fell 15%+, five times the index posted gains the next year, while four times the index posted further declines.

More By This Author:

Bulls Come Home For The Holidays2022 Solidified As The Worst Year For Sentiment

Continuing Claims Top 1.7 Million

Click here to learn more about Bespoke’s premium stock market research service.

See Disclaimer ...

more