One Of These Sectors Is Not Like The Others

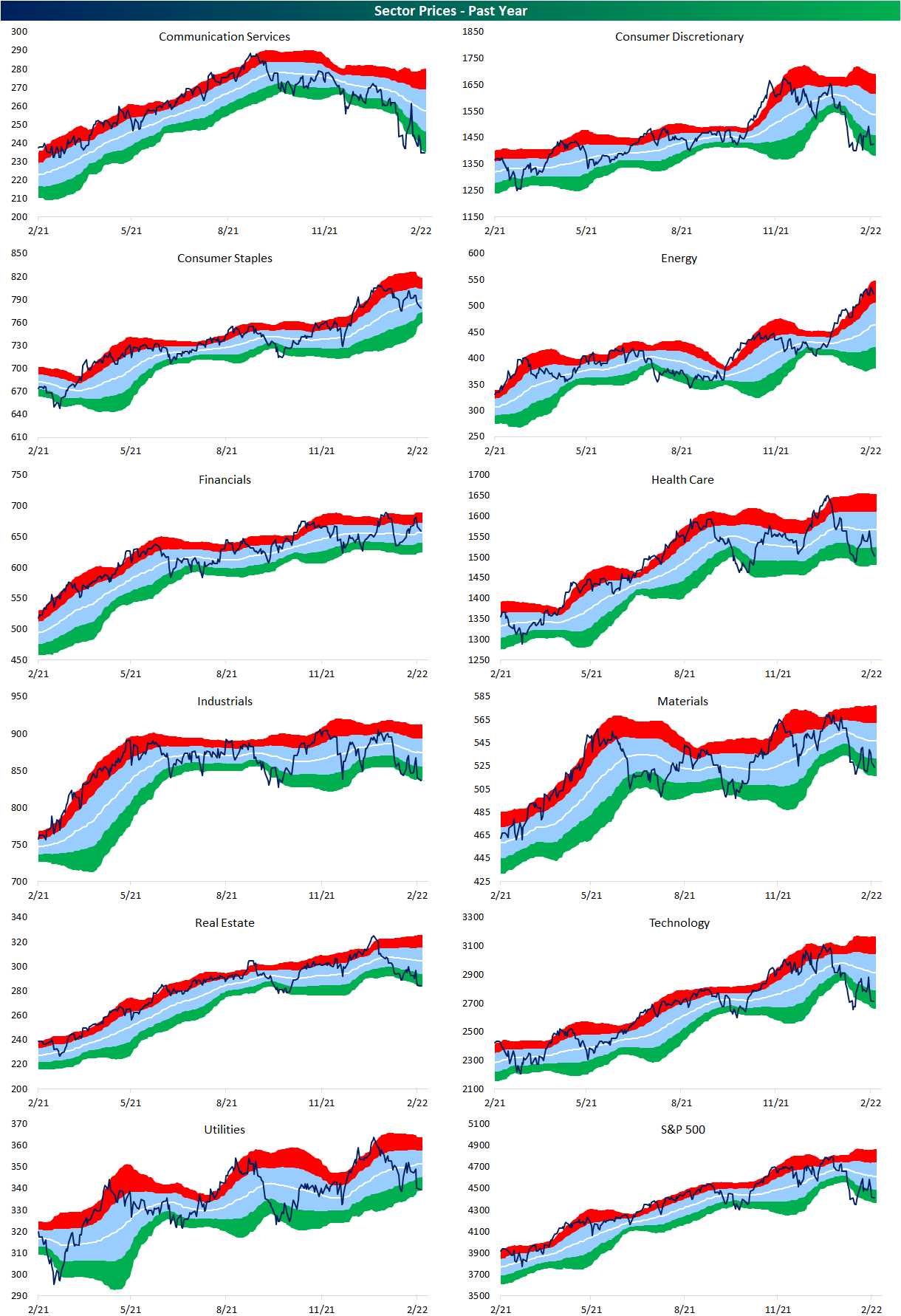

Looking across the charts of each sector from our Daily Sector Snapshot, things range from well-defined and longer-term downtrends as is the case for Communication Services to more sideways price action like what we’ve seen in the Financials and Industrials sectors. Then there’s Energy. In spite of the broader market weakness, the Energy sector has continued to roar higher having closed at overbought levels (at least one standard deviation above its 50-DMA) every day since the start of the year. In fact, while most sectors are firmly in the red on a year-to-date basis, Energy has rallied over 25%, and it’s only mid-February!

(Click on image to enlarge)

As a result of Energy stocks’ continued outperformance, the ratio of the sector versus the S&P 500 has made a sharp and significant move higher. Ever since the financial crisis, the ratio has consistently been grinding lower meaning Energy has underperformed the broader market. Over the past two months though, the ratio has seen a record-sized move having risen nearly 35% surpassing the previous record set almost a year ago in March 2021 when the ratio rose 33% in a two-month span.

Disclaimer: For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our ...

more