One Of These Indices Is Not Like The Others

Looking across the major US index ETFs in our Trend Analyzer, one stands out (in a negative way) from all the others. At the moment, the Dow is the only major US index in the red on a year-to-date basis as we close the books on February. Even more notable, is the fact that it’s also the only one below its 50-DMA. Not only is it below its 50-day, but it is trading firmly in oversold territory sitting over 1.5 standard deviations below its 50-day. Today that dynamic of Dow underperformance continues as the index is falling another 0.3% as of this writing while the S&P 500, Nasdaq, and Russell 2,000 are all higher.

(Click on image to enlarge)

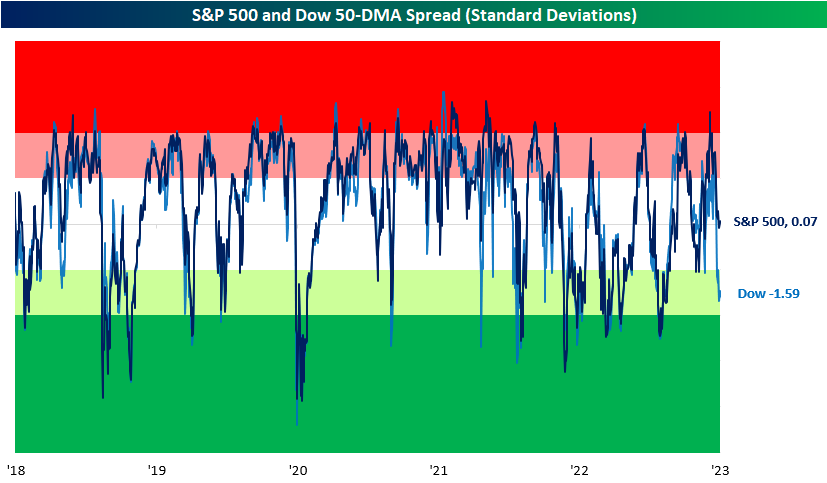

In the chart below, we show how far the S&P 500 and Dow are trading (in standard deviations) from their respective 50-DMAs over the past five years.For the most part, the two large-cap indices have tracked one another relatively well in spite of their differences in composition and price calculations. That makes the current situation in which the Dow is oversold without the same applying to the S&P 500 somewhat unusual, albeit not without precedence. While uncommon, there have been periods in which the indices have similarly distanced themselves from one another like most recently in the spring and fall of 2021.

(Click on image to enlarge)

Although there have been other times in which the Dow and S&P’s overbought/oversold readings have deviated from one another, the current example is abnormally large. With a gap of 1.66 standard deviations between the two indices’ overbought/oversold readings versus their 50-DMA spreads, today’s spread ranks in the bottom 1% of all readings since 1952 when the five-day trading week began. Additionally, such low readings have been exceptionally rare in the past 20 years. Outside of June and September of 2021, August 2015 was the last instance of the spread falling this wide with the Dow underperforming. Looking back even further, 2004 was the only other instance of the past 20 years.

(Click on image to enlarge)

More By This Author:

Tech Relative Strength Still NegativeBuffett Letters And Berkshire Hathaway Performance

Mixed Signals

Click here to learn more about Bespoke’s premium stock market research ...

more