Oklo Stock Is Soaring Amid The Modular Nuclear Boom: Is It A Buy?

Oklo’s (OKLO) stock price has gone vertical and moved to a record high as investors bet on the Sam Altman-backed company. On Friday, it soared by over 24%, reaching a high of $27.35, a few points below its all-time high. This surge pushed its market cap to over $3 billion.

Why the Oklo stock price is surging

Oklo is a fairly new company established by Sam Altman, the head of OpenAI, the parent company of ChatGPT.

The company is working on nuclear energy, a sector that has boomed in the past few months as investors linked it to the artificial intelligence industry.

Most of these gains happened after Microsoft inked a deal with Constellation Energy to restart the Three Mile Nuclear plant. Amazon, the biggest data center operator globally, also signed a deal worth $334 million for modular nuclear plants. Alphabet has also invested in this technology.

Analysts believe that modular nuclear plants could be the next big sector in the energy sector, especially in the data center sector. That’s because these plants will be small, effective, clean, and cost effective in the long run.

Therefore, the Oklo stock price has jumped because it is in that nuclear industry. Other players in the sector like NuScale, Nano Nuclear Energy, Constellation, and Rolls-Royce have all surged in the past few months.

The ongoing surge is what happens when investors are excited about a sector. Just recently, many companies in the quantum computing industry like IONQ and Quantum Scientific have soared. The Defiance Quantum ETF (QTUM) has jumped by 60% in the last 12 months, making it one of the best-performing funds in the industry.

The same situation is happening in other industries like electric vertical takeoff and landing (eVTOL) like Joby Aviation and Archer Aviation. These firms have soared by double digits after an analyst predicted a boom in the sector.

The challenge, however, is that these thematic trends don’t last long since retail investors usually drive them. Some of the top sectors that experienced a boom and bust cycle are cannabis, clean energy, and electric vehicles.

Oklo is a risky company

Oklo stock price has also jumped because it was started by Altman, who is widely seen as one of the top innovators of our time.

Still, it is a high-risk investment because it is a cash incinerator for now since it is in the development phase. Historically, many companies in such a phase like Quantumscape and Virgin Galactic don’t do well in the long term.

Also, the company’s Aurora reactor’s application was rejected by the Nuclear Regulatory Commission (NRC) for lack of information in 2022. It is now working on a plan to submit its license application this year, and it is still unclear whether it will be approved.

Oklo hopes that its reactor will be approved and that full capacity will commence in 2027. Before then, it will be a cash incinerator. It ended the last quarter with over $230 million in cash and short-term investments.

At the same time, it had a net loss of almost $10 million in the quarter and $63 million in the first nine months of the year. These numbers mean that the company will likely need to raise more cash in the next few years.

Oklo stock price forecast

(Click on image to enlarge)

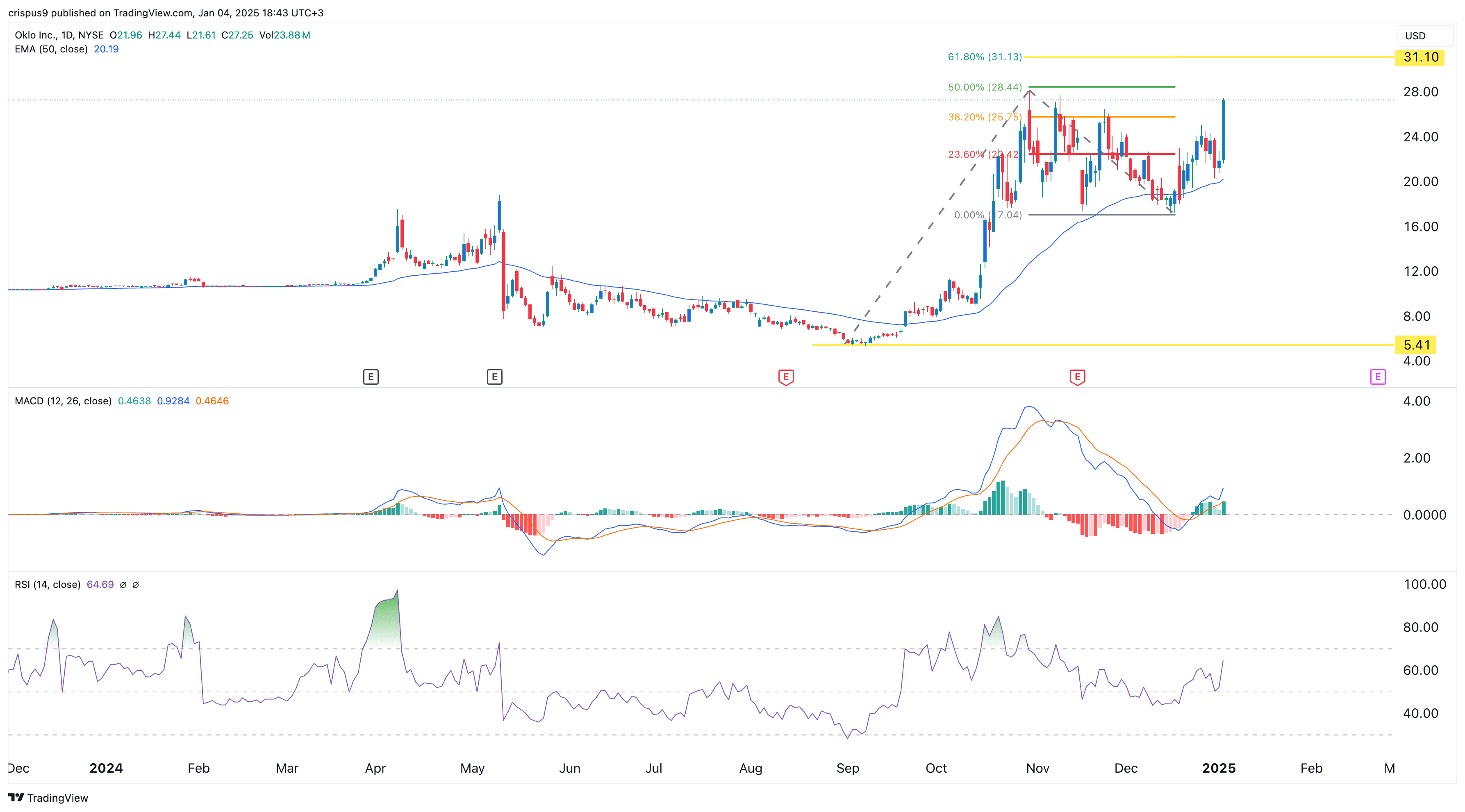

The daily chart shows that the Oklo share price has been in a strong bull run in the past few months, moving from $5.4 in August to almost $30 today. The stock is now attempting to move above the all-time high of $28.45, a move that will invalidate the double-top chart pattern.

It has also formed a small inverse head-and-shoulders pattern, while the RSI has pointed upwards. Therefore, the stock’s short-term outlook is bullish. The next point to watch is $31.13, the 61.8% Fibonacci Retracement point.

The long-term outlook for the Oklo stock price is shakier because of the risks involved in the nuclear energy industry.

More By This Author:

Can Bullion Post Further Gains Amid A Rising Dollar?

US Auto Sales Accelerate To Five-Year High As Consumers Embrace Incentives

Tesla Tops BYD In Deliveries, But BYD Leads In Growth: What’s Next For 2025?

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more