Can Bullion Post Further Gains Amid A Rising Dollar?

Gold and silver have had a stellar start to the year so far with prices rising from the last trading day of 2024.

“Gold market bulls have been impressed recently by the yellow metal’s resilience and even good price strength despite a solid rally in the US dollar index and rising US Treasury yields,” Jim Wyckoff, senior market analyst at Kitco, said.

Stringer demand from Asia is currently offsetting the potentially bearish signals from a rising dollar and higher US bond yields, according to Broker SP Angel.

The question is, whether gold and silver can keep up the momentum going forward?

So far this year, the benchmark gold contract on COMEX has risen more than 1.3%, while silver futures have climbed nearly 4% since the start of the year.

Steep gains in 2024

Gold prices finished with a more than 27% rise in 2024, while silver had surged more than 21%.

Bullion prices were supported by increased geopolitical tensions around the globe and interest rate cuts by global central banks.

Moreover, gold prices had hit a series of record highs in the lead up to the 2024 US presidential elections due to uncertainty over the outcome.

In terms of gold, prices were also supported by purchases from the global central banks.

Experts have said that global central banks are expected to keep purchasing gold at a higher rate in 2025 as well.

At one point in 2024, gold prices were higher by more than 30% from the start of the year as geopolitical tensions simmered in the Middle East, spurring safe-haven demand among investors.

Persistent safe-haven inflows

Persistent tensions in the ongoing war between Russia and Ukraine, and conflicts in the Middle East are expected to keep gold bulls on their toes.

According to FXstreet, the rally in prices of gold during the first couple of trading sessions this year is subjected to increasing safe-haven demand from geopolitical tensions.

According to three sources cited by Axios, US President Joe Biden reportedly discussed contingency plans to strike Iran’s nuclear facilities if Tehran made significant progress toward developing a nuclear bomb before Donald Trump’s inauguration on January 20.

“These discussions highlight heightened concerns over Iran’s nuclear ambitions during the transitional period between administrations,” according to a FXstreet report.

Escalation in tensions between the US and Iran could boost safe-haven demand further, benefitting both gold and silver prices in the coming months.

Technical outlook

According to Wyckoff, bulls trading the February gold contract on COMEX have overall near-term technical advantage.

“Bulls’ next upside price objective is to produce a close above solid resistance at $2,700.00. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at the November low of $2,565.00,” Wyckoff said in the report.

The resistance for the gold futures are around $2,681 per ounce, followed by $2,700 an ounce.

After testing the $2,600 per ounce level on December 30, gold had managed to rally nearly $81 per ounce so far. However, prices have fallen from that level earlier on Friday.

As for silver, though prices have climbed in the first two days of 2025, Wyckoff believes that bears have the overall near-term technical advantage.

“Silver bulls’ next upside price objective is closing prices above solid technical resistance at $31.00,” he added.

Resistance for silver prices on COMEX are around $31 per ounce level.

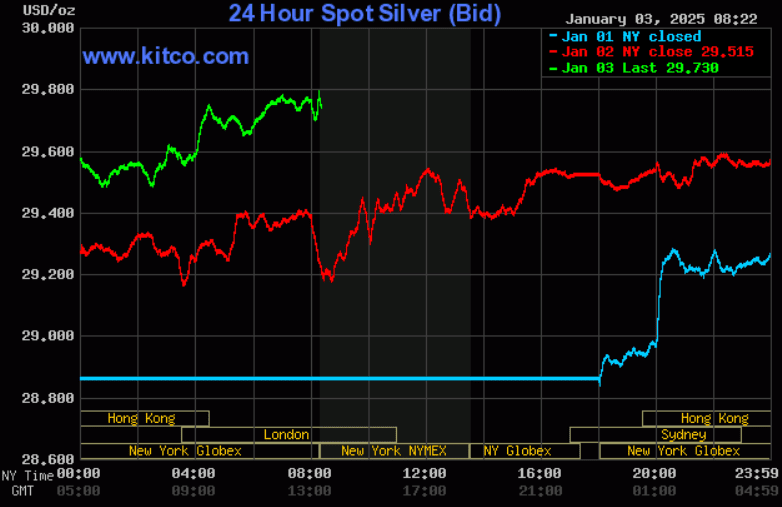

(Click on image to enlarge)

Source: Kitco

“Gold and silver had a positive day (on Thursday), and, while gold is drifting a touch…silver has built on these gains,” David Morrison, senior market analyst at Trade Nation said.

More By This Author:

US Auto Sales Accelerate To Five-Year High As Consumers Embrace IncentivesTesla Tops BYD In Deliveries, But BYD Leads In Growth: What’s Next For 2025?

Oil Price: Will Cold Weather And China Optimism Drive A Boost?

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more