OKE: This Midstream Marvel Just Got Even Stronger

Image Source: Unsplash

In the energy sector, some companies chase price swings. Others quietly build pipelines that keep the whole system flowing—and send cash straight to shareholders.

Today’s stock is in the second camp.

After a bold string of acquisitions, it’s gone from natural gas specialist to full-spectrum midstream operator. We’re talking critical infrastructure, surging volumes, and over 85% of earnings locked in through fee-based contracts. That’s the kind of setup dividend investors dream about—steady payouts with room to grow.

And the latest earnings? Let’s just say the pipes are full and the profits are flowing.

Core Infrastructure, Critical Role: What ONEOK Actually Does

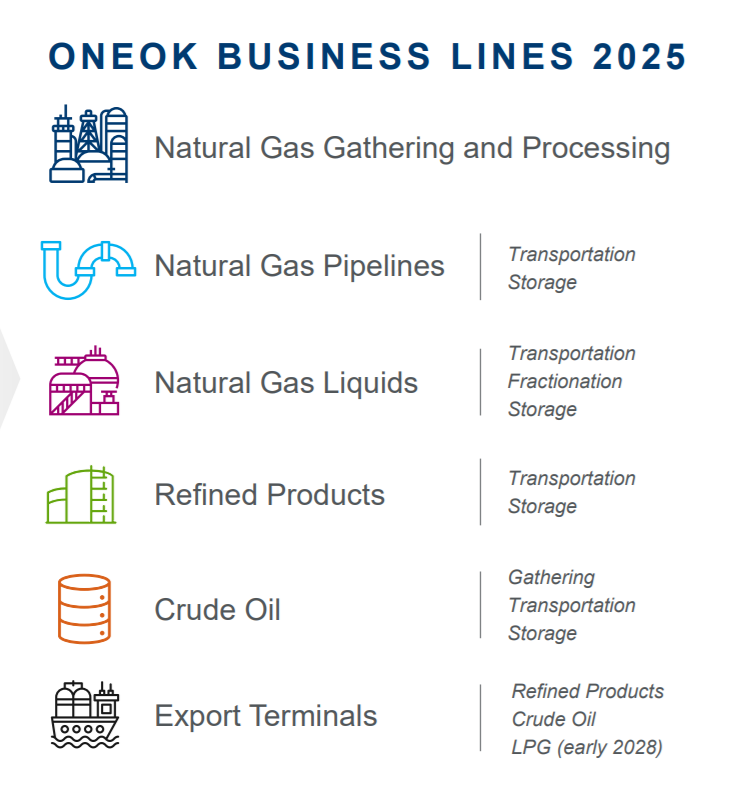

ONEOK (OKE) operates across four key segments—each essential to the flow of energy across the U.S.:

-

Natural Gas Gathering & Processing: Collects and treats gas from producers in energy-rich regions like the Permian and Williston basins.

-

Natural Gas Liquids (NGL): Gathers, fractionates, stores, and ships ethane, propane, butane, and other valuable NGLs. This is ONEOK’s legacy strength and biggest profit center.

-

Natural Gas Pipelines: Transports and stores natural gas across North America.

-

Refined Products & Crude: A new segment added via recent acquisitions—handles crude oil and refined product transport and blending.

With 85% of earnings from fee-based contracts, ONEOK’s revenue is tied more to volume than to commodity prices. That’s a big deal for dividend stability.

ONEOK Business Lines 2025 from the Investor Update Presentation.

Under Pressure or Picking Up Steam?

Bull Case: Bigger, Smarter, and More Diversified

ONEOK has completely reshaped its business through strategic deals—Magellan, EnLink, and Medallion—adding scale and reach across oil, gas, and refined products.

Here’s what’s working in their favor:

-

Massive scale advantage: Now a true one-stop-shop across the midstream value chain.

-

Synergy upside: The $34B in acquisitions are projected to triple economic profit over 5 years.

-

Strong domestic growth: Volume is surging, especially in the Rocky Mountains and Permian Basin.

-

Stability from structure: Long-term contracts + critical infrastructure = resilient cash flow.

Throw in growing access to Mexico and LNG export routes, and you have a company that’s not just bigger—but smarter, too.

Bear Case: Leverage, Limits, and Integration Jitters

But not all pipelines run smooth.

ONEOK is carrying a net debt-to-EBITDA ratio above 3.5x, and management has flagged 2025 as a key year to bring that down. Slower-than-expected cash flow could put pressure on that plan—and on dividend flexibility.

The company is also juggling the integration of three major acquisitions in short succession. Execution risk is real. Missed synergies or delays in operational alignment could eat into margins.

And finally, ONEOK is still domestically anchored. It lacks its own international export terminals, meaning it must rely on third parties to access global pricing.

ONEOK’s recent update showed the real impact of its expanded network:

-

NGL volumes in the Rocky Mountains rose 15%, driving strong EBITDA gains in that segment.

-

The Natural Gas Gathering & Processing unit also saw a significant profit lift, thanks to new Permian assets from EnLink.

-

And the Refined Products and Crude segment reported a big jump in crude volumes shipped—up to 1.846 million barrels/day, from 839K in Q4 2024.

It’s clear: the acquisitions are not just on paper—they’re pushing revenue and capacity higher in real time.

Dividend Triangle in Action: Stability, Growth, and a Slight Kick Higher

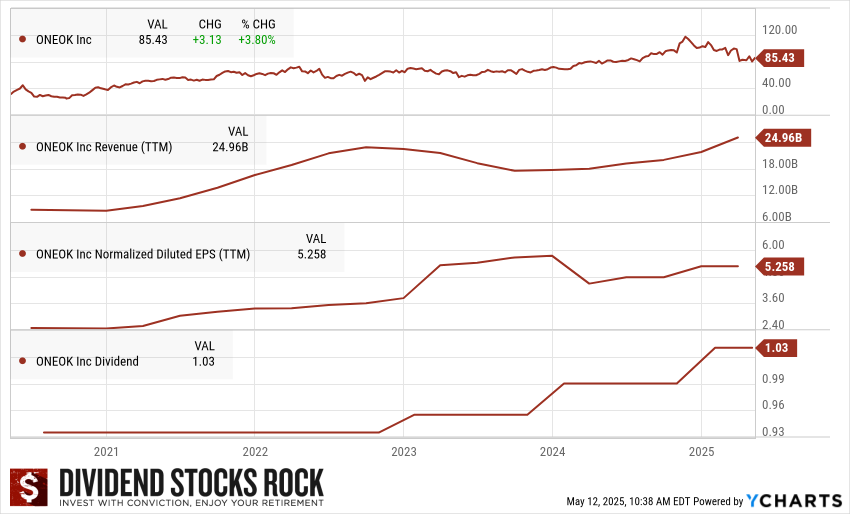

(Click on image to enlarge)

OKE 5-year Dividend Triangle.

Here’s how ONEOK stacks up across the Dividend Triangle:

- Revenue: Up to $24.96B (TTM) and climbing again after a 2023 dip. Acquisition-driven growth is now translating into top-line strength.

- Earnings (EPS): Normalized EPS stands at $5.26 (TTM)—solid, steady, and showing strong year-over-year progress as volume and margins recover.

- Dividend: The dividend has ticked up to $1.03/share, continuing a disciplined pattern of steady increases. With 85% fee-based revenue and growing free cash flow, the payout remains well-supported.

Final Verdict: Pipes That Pay, and a Pipeline to More

ONEOK has transformed itself from a natural gas transporter into a diversified midstream leader—touching nearly every aspect of U.S. energy infrastructure.

Yes, there’s leverage risk. And yes, integration will take time. But the scale, stability, and strategic positioning ONEOK now commands make it one of the most compelling dividend plays in the energy sector.

If you want a company that’s built to move energy—and cash flow—in all directions, ONEOK delivers.

More By This Author:

The Top 3 Most Popular U.S. Stocks Among Experienced Dividend Investors

What The Smartest Canadian Investors Hold In Their Dividend Growth Portfolios

Silicon, Software, And Shareholder Rewards