What The Smartest Canadian Investors Hold In Their Dividend Growth Portfolios

Image Source: Pexels

Every year, Dividend Stocks Rock (DSR) compiles a unique list: the most widely held stocks by its PRO members. With over 2,600 portfolios contributing to this list, it’s more than a popularity contest—it’s a reflection of what experienced, long-term dividend growth investors trust to deliver both income and resilience. This post spotlights three of Canada’s most-owned dividend stocks, offering insight into what seasoned investors value today and what DSR bull and bear cases are.

This post spotlights three of Canada’s most-owned dividend stocks, offering insight into what seasoned investors value today and what DSR bull and bear cases are.

Fortis (FTS.TO / FTS) – The Boring Backbone of Stability Investors Count On

Fortis keeps on getting more love year after year. Fortis is a classic utility offering its customers transmission and distribution of electricity and natural gas. The company likes to remind investors that Fortis is virtually 100% regulated. It’s a symbol of stability and predictable cash flow.

(Click on image to enlarge)

Image of Fortis at a glance. From the Q1 2025 Investor Presentation.

Why it’s in the top 5

Fortis isn’t flashy. It’s reliable. It operates almost entirely regulated utilities across 18 jurisdictions.

What seasoned investors like

-

50 years of uninterrupted dividend growth.

-

Recession-resistant and rate-regulated, it’s the poster child for “sleep-well-at-night” investing.

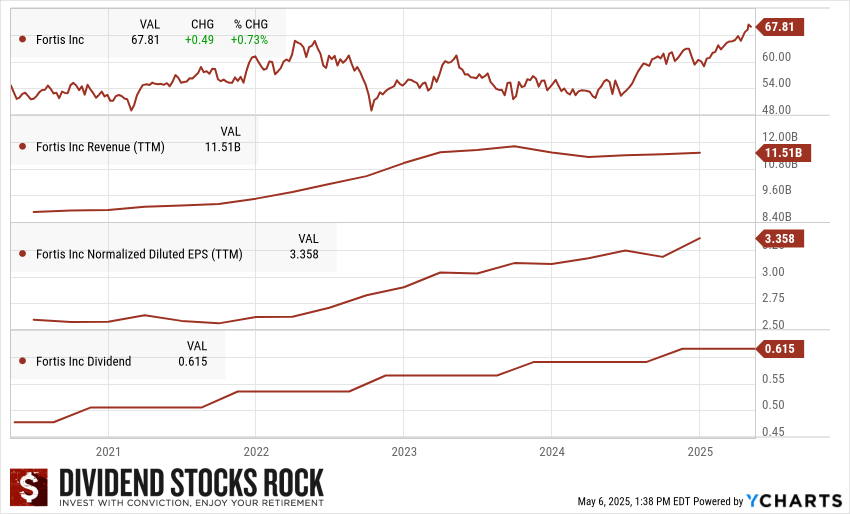

(Click on image to enlarge)

Fortis (FTS.TO) 5-year Dividend Triangle Chart.

DSR Bull Case

Fortis is a top-tier regulated utility with operations across Canada, the U.S., and the Caribbean, generating 99% of its revenue from stable, government-approved sources. Its C$26 billion capital plan aims to grow its rate base by 6.5% annually through 2028, supporting steady earnings and dividend increases. With 50 consecutive years of dividend growth and growing investments in transmission and renewable energy, Fortis offers a rare blend of income reliability and long-term infrastructure-driven growth. It’s a classic “buy and hold” stock for conservative, income-focused investors.

DSR Bear Case

Despite its stability, Fortis faces headwinds from its capital-intensive business model and reliance on regulatory approvals. With one-third of its investment plan funded by debt, rising interest rates could pressure earnings and limit flexibility. Regulatory setbacks or environmental policy shifts may further strain growth. Currency fluctuations also pose a risk, as 60% of revenue is U.S.-based. In a competitive utility landscape, rivals with leaner operations or faster-growing assets could outpace Fortis in total returns.

Its portfolio role

Defensive core holding—ideal during volatile markets and for steady dividend growth.

Royal Bank (RY.TO / RY) – Canada’s Financial Fortress with Global Reach

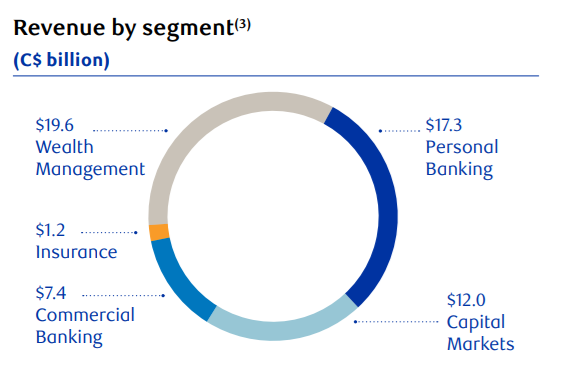

Royal Bank is the largest Canadian Bank by market cap and offers a wide variety of products and services. The business is separated into several segments, including Personal & Commercial (P&C), Capital Markets, Wealth Management, and Insurance.

Pie chart of Royal Bank Revenue by Segment from the 2024 Annual Report.

Why it’s in the top 5

Royal Bank is a bedrock of stability, with diversification across personal banking, capital markets, and wealth management.

What seasoned investors like

- Diversified revenue streams protect against housing market weakness.

- Strong dividend growth track record and capital strength.

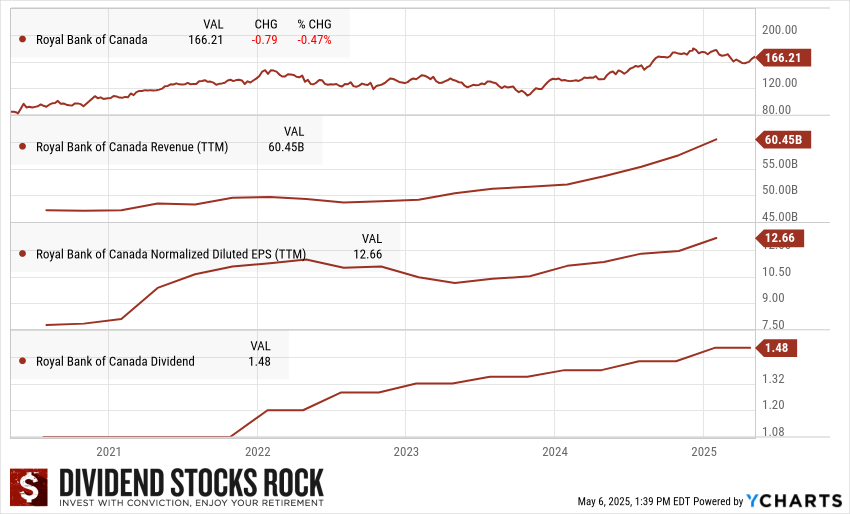

(Click on image to enlarge)

Royal Bank (RY.TO) 5-year Dividend Triangle Chart.

DSR Bull Case

Royal Bank of Canada stands as the country’s largest bank, supported by a well-diversified business model across banking, wealth management, insurance, and capital markets. Over half its revenue now comes from non-traditional banking sectors, offering stability and profitability beyond interest margins. Its international expansion adds resilience against domestic economic slowdowns, while strong brand recognition and regulatory protection create high barriers to entry. With steady earnings, growing fee-based revenue, and a reliable dividend history, RBC is a core holding for investors seeking both income and long-term growth.

DSR Bear Case

Despite its diversification, RBC remains vulnerable to macroeconomic pressures, particularly Canada’s housing market. Rising interest rates and economic uncertainty could lead to higher mortgage defaults and elevated credit losses. The bank has already increased provisions in anticipation of a downturn. Regulatory constraints limit growth flexibility, while a potential recession could dampen lending and capital markets activity. Competition from other major banks and global players also pressures RBC to continuously innovate just to maintain its position. These challenges may weigh on profitability and limit upside in the near term.

Its portfolio role

Anchor stock for both income and growth investors.

Enbridge (ENB.TO / ENB) – Reliable Income from a Pipeline Powerhouse

Enbridge lost some love this year and was beaten out by Royal Bank. Some investors would be right to highlight the amazing year ENB had on the market. A part of that “bull run” is explained by its poor performance last year. Unfortunately, this is often the case for such a company: ENB stock price is known to go up and down through cycles. I bought it during one of those down cycles and was happy to sell it at a high price before the 2023 drop.

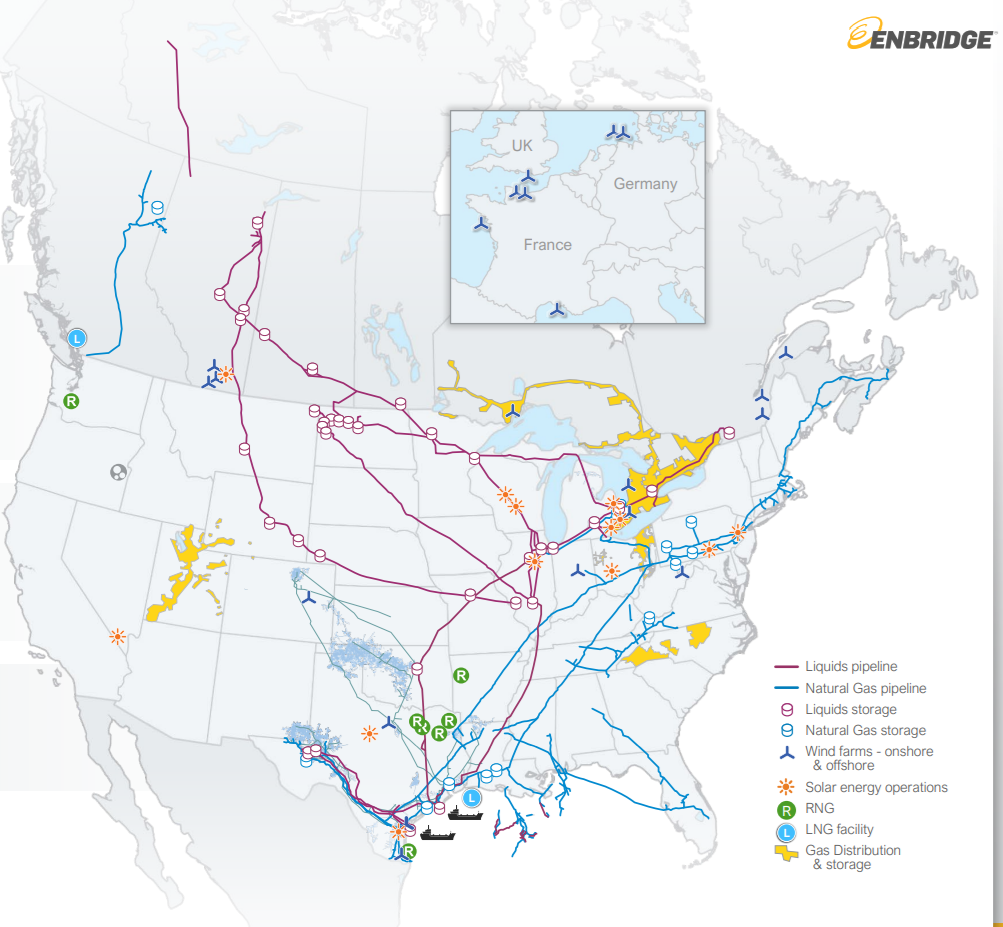

(Click on image to enlarge)

Map of Enbridge Energy locations and pipelines from the 2025 Investors Day presentation.

Why it’s one of the most held stocks

Enbridge combines reliable income with defensive characteristics, making it ideal for retirees and income investors.

What seasoned investors like

- Enbridge operates one of North America’s largest pipeline systems, generating toll-like income from oil and gas transportation.

- The company has increased its dividend for 29 consecutive years—a rare feat in the energy space.

- Investors appreciate its strategic pivot toward natural gas and renewables, improving its long-term sustainability.

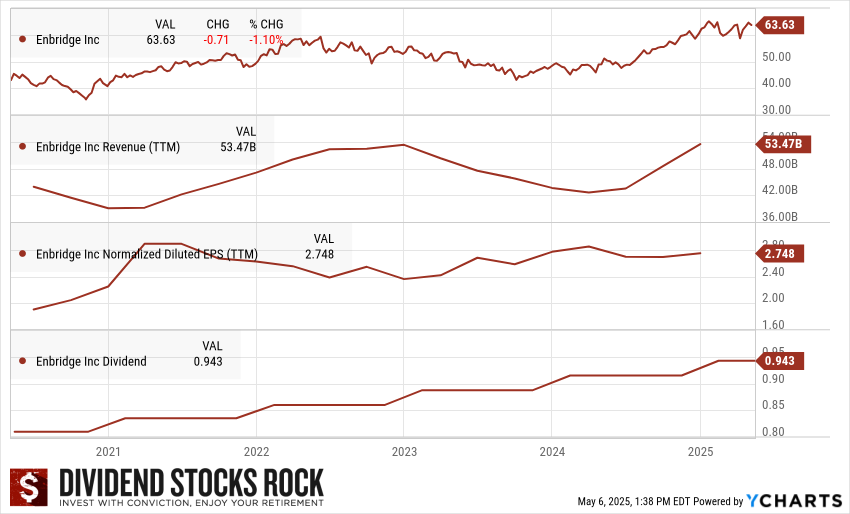

(Click on image to enlarge)

Enbridge (ENB.TO) 5-year Dividend Triangle Chart.

DSR Bull Case

Enbridge is a North American energy infrastructure giant, offering stable, inflation-resistant cash flow through long-term, take-or-pay contracts. Its Mainline system handles 70% of Canada’s crude exports, while recent acquisitions have expanded its footprint in natural gas transmission—now half its business. The company is targeting 7–9% annual EBITDA growth through 2026 and is investing in energy transition projects like renewable natural gas and offshore wind. With hard-to-replicate assets and a growing utility base, Enbridge remains a reliable income-generating powerhouse for long-term dividend investors.

DSR Bear Case

Enbridge’s aggressive growth strategy has led to a soaring debt load—reaching nearly $100 billion in 2024—which could strain future investments and dividend growth, especially amid rising interest rates and inflation. Regulatory and environmental hurdles remain a persistent threat, with pipeline projects often delayed or derailed. Increasing carbon taxes and operating costs in Canada may further erode margins. While Enbridge’s asset base is robust, its debt-heavy model puts it at a disadvantage compared to leaner midstream competitors with stronger balance sheets.

Its role in a portfolio

Enbridge is your premium income generator. It likely won’t deliver much capital growth, but it offers a steady, well-covered yield and solid inflation-beating income.

Final Thoughts: Seasoned Investors Choose Balance

DSR PRO members aren’t just picking high yielders or tech flyers. They’re selecting companies that combine resilience, income, and future potential. That’s a powerful takeaway for anyone building or reviewing a dividend portfolio.

Portfolio Role Recap Table

| Stock | Role in Portfolio | Ideal For |

|---|---|---|

| Fortis | Defensive Core | Stability, retirement income |

| Royal Bank | Balanced Anchor | Growth + income blend |

| Enbridge | Yield Generator | Income-focused investors |

More By This Author:

Silicon, Software, And Shareholder Rewards

Unflashy, But Reliable And Built To Last

Brewed For Loyalty, Facing The Heat: This One Is Under Pressure