Unflashy, But Reliable And Built To Last

Image Source: Pixabay

In a world of EV disruption and tech-fueled volatility, some companies stick to doing what they do best. This industrial company is one of them.

You won’t find massive hype or headline-grabbing growth here. What you will find is a time-tested business built on replacement parts, industrial resilience, and dependable dividends.

For long-term investors looking for income and stability, this one might not be exciting—but it’s exactly the kind of stock that quietly gets the job done.

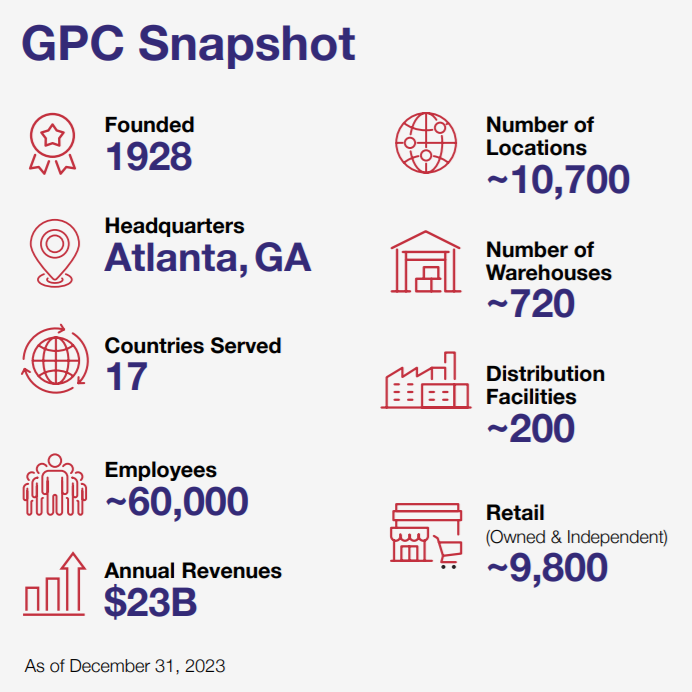

The Nuts and Bolts of GPC: Two Engines Driving Results

Genuine Parts (GPC) operates through two key segments:

-

Automotive Parts Group – This is the company’s bread and butter, including its flagship NAPA Auto Parts brand. It distributes replacement parts (excluding collision parts) for a wide range of vehicles in North America, Europe, and Australasia. Over 75% of sales in this segment come from the commercial market, i.e., repair shops—making demand steady and predictable.

-

Industrial Parts Group – Through its Motion Industries brand, GPC serves OEM and MRO customers with mechanical and fluid power transmission equipment, hydraulics, pneumatics, bearings, and more. This segment supports manufacturing, distribution, and maintenance businesses, adding diversification and industrial exposure.

Together, these segments make GPC a go-to for replacement parts and industrial reliability across mature global markets.

GPC Snapshot from its 2024 Sustainability Report.

Under the Hood: What’s Driving, and Dragging, GPC

Bull Case: Aging Cars, Consistent Orders, and a Steady Hand

Genuine Parts thrives on consistency.

In the automotive segment, the average U.S. vehicle age hit 12.6 years in 2023, and consumers continue to hold on to older cars, especially during economic uncertainty. That spells long-term demand for replacement parts.

GPC’s focus on productivity and margin control, and its history of strategic acquisitions, keep it lean while expanding reach. NAPA Auto Parts has proven to be a recession-resilient performer, and its industrial business adds valuable diversification beyond consumer trends.

Add a stable dividend and conservative financial management, and you’ve got a stock that fits perfectly in an income-focused portfolio.

Bear Case: Growth Limits and EV Threats

Let’s be clear—GPC isn’t a growth machine. It relies heavily on acquisitions in a fragmented market, which works well—until integration gets tricky or deals dry up.

And then there’s the EV shift. While the transition will take years, electric vehicles typically require fewer replacement parts than internal combustion engine (ICE) vehicles. That’s a long-term headwind for a company rooted in ICE-based servicing.

In the short term, margin pressure and rising expenses have weighed on profitability. If inflation persists and pricing power erodes, EPS growth could continue to slip.

What’s New? Margin Pressure Squeezes an Otherwise Stable Quarter

Genuine Parts recently reported a mixed quarter, reflecting both its defensive strengths and cost pressures.

Revenue rose by 1%, supported by a 3.0% increase in comparable sales, though foreign currency impacts partially offset this. However, EPS dropped by 21% due to higher operating costs and inflation. Gross margin slid slightly to 35.0%, down from 35.2%, reflecting product mix and pricing challenges.

Still, the business remains healthy. GPC reaffirmed its full-year guidance for 3% to 5% revenue growth and adjusted EPS of $9.80 to $9.95 for 2024. That suggests confidence in its ability to weather short-term headwinds.

Dividend Triangle in Action: Still Strong, Even with an EPS Dip

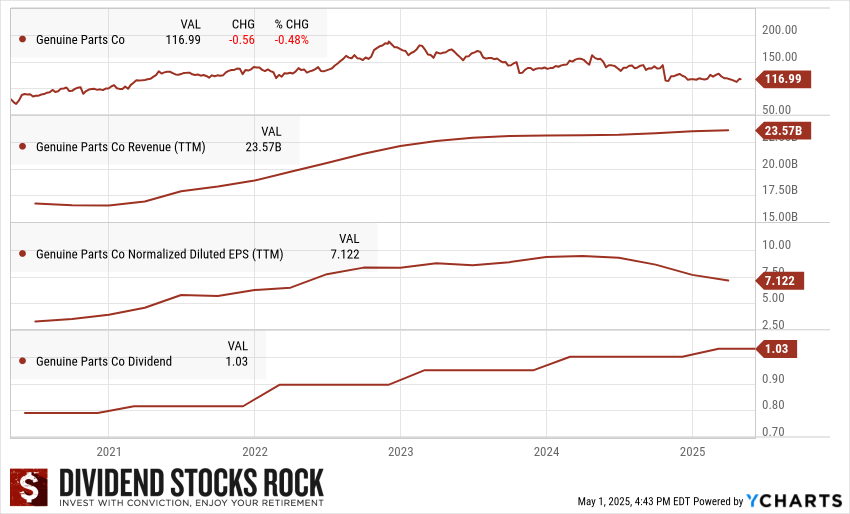

GPC 5-year Dividend Triangle.

Let’s see how Genuine Parts performs across the Dividend Triangle—our framework for tracking long-term shareholder return potential.

- Revenue: TTM revenue now sits at $23.57B, showing steady top-line growth over several years. GPC’s combination of organic sales and acquisitions continues to push the business forward, albeit modestly.

- Earnings (EPS): EPS dipped recently to $7.12 (TTM) due to margin pressures, but the longer-term trajectory remains positive. Management’s full-year guidance implies a recovery in the coming quarters.

- Dividend: At $1.03/share, the dividend continues its upward trend. GPC is a Dividend King, with over 65 consecutive years of increases—an elite record that signals strength and discipline.

Final Turn of the Wrench: Not Fast, Not Flashy, Just Built to Work

Genuine Parts won’t deliver overnight gains or tech-style growth spurts. But that’s not the point.

This is a durable, cash-generating company anchored in aging vehicles, industrial demand, and recession-friendly services. Despite near-term earnings pressure and long-term EV headwinds, the core business is resilient—and it rewards shareholders with consistent dividends and operational steadiness.

If your portfolio needs a dependable workhorse, GPC deserves a parking spot.

More By This Author:

Brewed For Loyalty, Facing The Heat: This One Is Under PressureThe Elephant in the Room – March Dividend Income Report

This Isn’t Exciting - It’s Exactly The Point