Nvidia Q3 Preview: Can Shares Stay Blazing-Hot?

Image: Bigstock

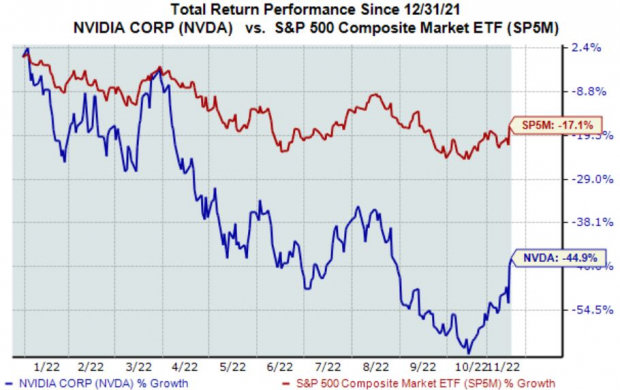

The Zacks Computer and Technology sector has primarily struggled in 2022 amid a hawkish pivot from the Fed, down more than 30% and lagging behind the S&P 500 by a fair margin.

A name that many are familiar with, Nvidia (NVDA - Free Report), is on deck to unveil quarterly earnings on Nov. 16, after the market close. Nvidia is the worldwide leader in visual computing technologies and the inventor of the highly-successful graphic processing unit, or GPU.

Currently, the semiconductor titan carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a D. How does everything stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, it’s been a challenging road for NVDA shares, down roughly 45% and widely underperforming the general market.

Image Source: Zacks Investment Research

However, over the last month, NVDA shares have melted up, tacking on more than 40% in value and widely outperforming the S&P 500.

Image Source: Zacks Investment Research

Clearly, buyers have returned in a big way.

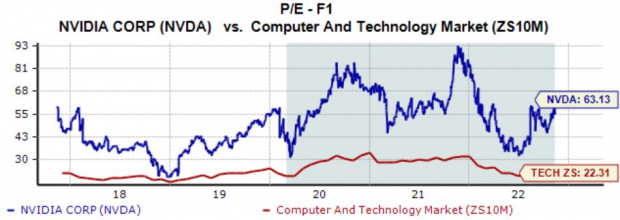

The company’s shares have recently been seen trading at a 63.1X forward earnings multiple, which is above the 49.2X five-year median and reflects a 183% premium relative to its Zacks Computer and Technology sector. NVDA carries a Value Style Score of an F.

Image Source: Zacks Investment Research

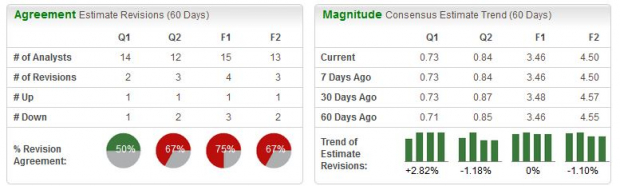

Quarterly Estimates

Analysts have had mixed reactions for the quarter to be reported over the last several months, with a singular downward and upward earnings estimate revision. The Zacks Consensus EPS Estimate of $0.73 indicates a year-over-year decline in earnings of more than 35%.

Image Source: Zacks Investment Research

The company’s top-line is also undergoing some turbulence; the Zacks Consensus Sales Estimate of $6 billion suggests a year-over-year decline of more than 15%.

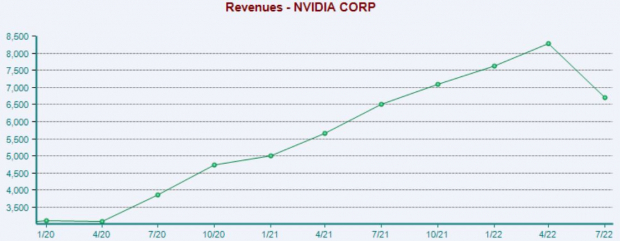

Quarterly Performance

NVDA has primarily exceeded bottom-line estimates, penciling in nine EPS beats across its last ten quarters. Still, it’s worth noting that the one miss during the timeframe occurred in its latest release when the company fell short of earnings expectations by roughly 9%.

Top-line results have also been consistently strong; NVDA has chained together 14 consecutive revenue beats. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

NVDA shares reside deep in the red year-to-date, but they have soared over the last month, indicating that the bulls have finally returned. The company’s forward earnings multiple resides on the higher end of the spectrum, above its five-year median and Zacks sector average. Analysts have had mixed reactions regarding the quarter to be reported, with estimates indicating year-over-year decreases in both revenue and earnings.

The company has consistently exceeded quarterly estimates, but it fell short of EPS expectations in its latest report, snapping a long streak of positive surprises. Heading into the release, Nvidia (NVDA - Free Report) carries a Zacks Rank #3 (Hold) paired with an Earnings ESP Score of -9.7%.

More By This Author:

Target Q3 Preview: Rebound Quarter Inbound?

3 Top-Ranked Stocks Up More Than 25% The Past Month

Lowe's Lined Up For Q3 Earnings: What's In The Cards?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more