Not-So-Transitory Inflation

A typical couple enjoying their (presumably) debt-financed breakfast in bed (image via Affirm).

Economy-Wide Inflation

As Washington Post economics correspondent Heather Long pointed out on Twitter recently, inflation is now hitting Americans everywhere from rental cars to rent.

Where are Americans seeing inflation?

— Heather Long (@byHeatherLong) October 13, 2021

A lot of places:

Rental cars +43% over last Sept

Gas 42%

Used cars 24%

Bacon 19%

Hotels 18%

Beef 18%

Pork 13%

Eggs 13%

TVs 13%

Kids' shoes 12%

Furniture 11%

New cars 9%

Chicken 8%

Apples 8%

Restaurant prices: 5%

Electricity 5%

Rent 2.9%

And It Might Not All Be Transitory

And Kraft Heinz (KHC) CEO Miguel Patricio suggested earlier this week, that much of the inflation may turn out to be permanent, rather than transitory.

Inflation is across the board, people need to get used to higher prices: Kraft Heinz CEO https://t.co/g0Vk3HOM5u #FoxBusiness

— Portfolio Armor (@PortfolioArmor) October 15, 2021

Profiting From Inflation

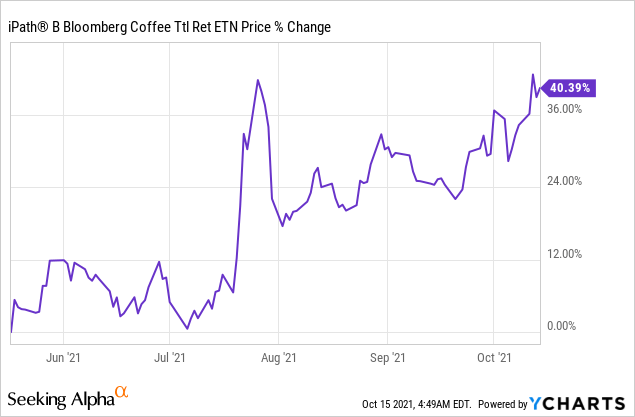

Over the last several months, we've written about ways investors can profit from the inflation trade. In May (Too Much Crypto, Not Enough Stuff), we suggested our top name at the time, the iPath Series B Bloomberg Coffee Subindex Total Return ETN (JO). Since then, it's up about 40%.

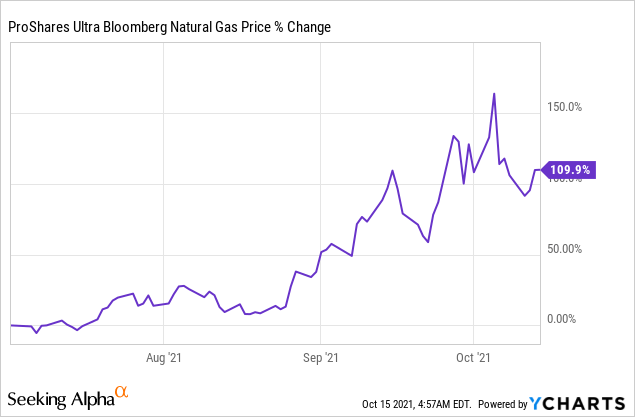

In July (A Structural Inflation Shock), we wrote about our top name the ProShares Ultra Natural Gas ETF (BOIL). It's up about 110% since.

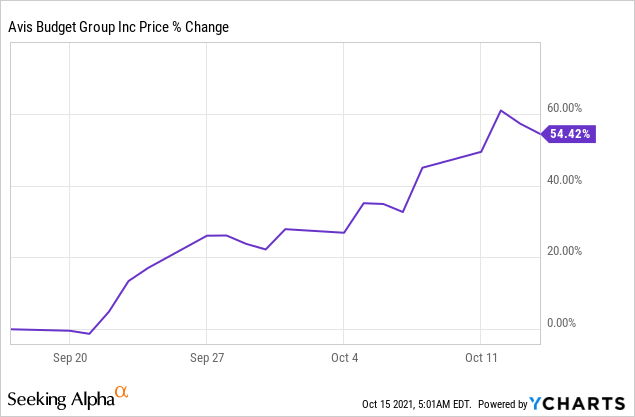

And in September (An Airbag For Avis), we wrote about our rental car top name, Avis Budget Group (CAR). It's up about 54% since.

Another Way To Play Inflation

Last month, another kind of inflation trade started to hit our top names: companies that help consumers buy things they can't currently afford with debt financing. The first example of this was Lending Club (LC). It appeared in our top ten on September 2nd.

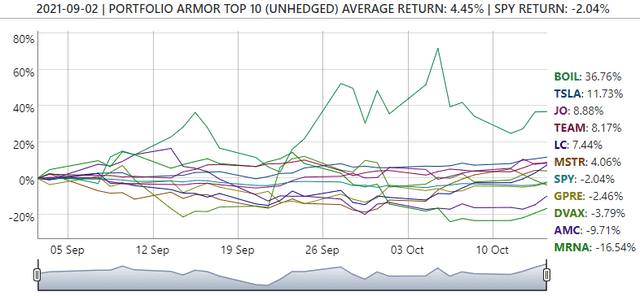

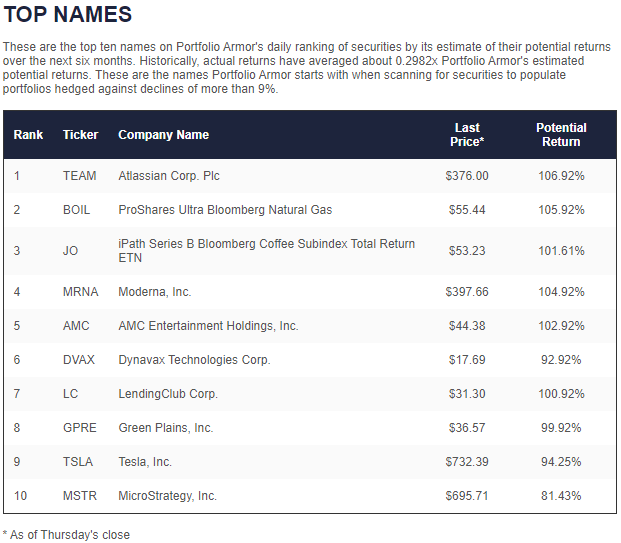

Screen capture via Portfolio Armor on 9/2/2021.

Since then, Lending Club is up about 7% versus SPY, which was down about 2% over the same time frame.

Last week, another consumer finance company hit our top ten, Affirm Holdings, Inc. (AFRM).

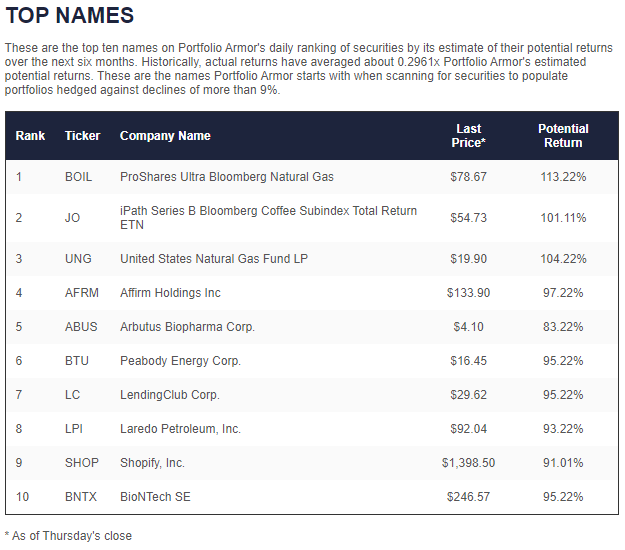

Screen capture via Portfolio Armor on 10/7/2021.

Either stock might be worth considering for investors looking for another angle besides energy and other commodities to profit from current inflation.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more