Not All Price Drops Are The Same

Image Source: Pexels

In this video, Chuck Carnevale — co-founder of FAST Graphs and known as “Mr. Valuation” — explains why investors must look beyond short-term market reactions and focus instead on the intrinsic value of the businesses they own. Using two recent case studies, FMC Corporation (FMC) and Fiserv (FI) , he illustrates how price and fundamentals interact — and why “not all price drops are the same”.

Video Length: 00:32:04

The Psychology of Price Drops

Chuck begins by reminding viewers that investors tend to be about two-and-a-half times more sensitive to fear than to greed. When stocks are expensive, investors often ignore the overvaluation. But when prices fall, panic sets in and emotion takes over. His goal is to re-center investors on fundamentals — earnings, cash flow, and valuation — rather than short-term price swings.

FAST Graphs, he notes, visually connects price to a company’s operating results over time. The orange “earnings justified” line represents the business’s intrinsic value, while the black price line shows how the market values it. When those diverge, opportunity or risk emerges.

Case Study 1: FMC Corporation — A True Fundamental Collapse

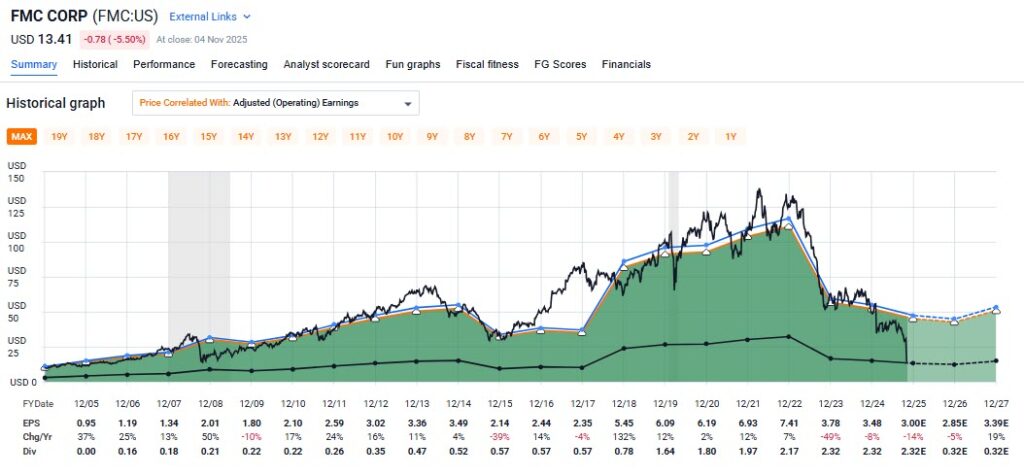

The first example, FMC Corporation, illustrates a fundamentally driven price decline.

(Click on image to enlarge)

FMC, a cyclical fertilizer and agricultural chemical company, had enjoyed years of solid earnings growth until recent troubles hit. Its adjusted operating earnings fell steadily over the past four to five years, including a 50% earnings collapse in 2023, followed by additional declines expected in 2024–2026. Free cash flow turned sharply negative, and the company was forced to slash its dividend from $2.32 to $0.32 per share to preserve cash.

Behind these numbers was a series of operational and leadership setbacks. The CEO, Mark Douglas, departed after the board lost confidence in his direction. FMC also recorded a $500 million write-down on its India business, part of a wider restructuring that included job cuts, asset sales, and factory closures. Analysts badly missed their earnings estimates for two consecutive years, showing just how quickly the company’s fundamentals deteriorated.

Despite this, the stock’s decline far exceeded the earnings collapse. From its peak, FMC lost nearly 90% of its market value, even though earnings fell roughly 70%. Chuck points out that while fundamentals clearly justified much of the drop, fear and sentiment drove it to extreme lows.

Today, with the stock around $14 per share, he believes most of the downside may already be priced in — but recovery will take time. Management is targeting $125–150 million in annual cost savings, reducing debt, and emphasizing innovation and sustainability. Analysts’ price targets range from the mid-teens to the high-30s, implying meaningful upside if restructuring succeeds. However, leverage, execution risk, and continued industry headwinds keep it a high-risk, high-uncertainty situation.

Case Study 2: Fiserv — A Valuation-Driven Decline

Fiserv, by contrast, shows how a great company can still suffer a big price drop due to valuation excess and shifting expectations rather than collapsing fundamentals.

(Click on image to enlarge)

Historically, Fiserv delivered exceptional revenue and earnings growth. But leading up to 2019 and 2020, its stock became extremely overvalued, with a P/E multiple near 30. Even as earnings continued to rise, the inflated price left no margin for error. When growth slowed modestly and management revised its guidance, the stock plunged more than 70% from its peak — even though earnings only flattened, not collapsed.

Chuck emphasizes that the majority of this decline was a correction from overvaluation, not a breakdown in business quality. Recent results included modest revenue misses and lower growth guidance, particularly in its Financial Solutions segment. Organic revenue projections were trimmed from 10–12% to roughly 4%, and earnings guidance was cut by 20%. Yet, by most measures, Fiserv still ranks among the most profitable years in its history.

A major focus for the company is Clover, its flagship point-of-sale and business management platform for small and medium-sized businesses. Clover offers both hardware and cloud-based tools for payments, inventory, analytics, and employee management — a direct competitor to Square. Short-term challenges, such as competition, merchant turnover, and fee pushback, have hurt sentiment. But management’s renewed focus on technology upgrades, customer support, and ecosystem expansion aims to stabilize the platform and set the stage for renewed growth by 2027.

Carnevale believes that, as with FMC, the market has overreacted — but in Fiserv’s case, fundamentals remain intact. This is a “valuation reset,” not a structural collapse.

Key Takeaways

- Earnings drive price over time, but short-term emotion can drive big disconnects.

- FMC’s decline stemmed from a real collapse in fundamentals, compounded by investor panic.

- Fiserv’s decline came mainly from overvaluation and sentiment shifts, not business failure.

- Investors must separate temporary market reactions from lasting business changes.

- Continuous due diligence is critical — when the facts change, change your mind.

Conclusion

Chuck closes by stressing that “there’s never a substitute for ongoing research.” FAST Graphs provides investors with the evidence they need to distinguish between fair value and fear-driven mispricing. The lesson is timeless: valuation matters, and it matters a lot — because not all price drops are the same.

More By This Author:

Fundamental Analysis: Principles, Types, And How To Use ItWhat Is Stock Valuation?

How The Stock Market Works: A Guide For Long-Term Investors

Disclosure: Long FI.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks ...

more