Nihilism Or Meatballs?

Image Source: Pixabay

Yesterday was an odd and exciting day for me. For the first time in my (long; too long?) career, I was on the NYSE floor to participate as an IPO began trading. As a result, and despite my location, I was not as plugged into the intraday market movements as normal. Frankly, I was quite surprised to see the stock market’s reaction – or lack thereof – to the PPI report.

For those of you who have noticed my love of classic comedies, it should be little surprise that two of them came to mind when I was considering how stocks were essentially ignoring the newest inflation data. One was The Big Lebowski and its subplot about nihilists. The other was Meatballs, a far lesser film, but featuring Bill Murray’s rant about “It just doesn’t matter!” Take your pick – they’re both saying essentially the same thing.

First, a digression about the IPO. I have been privileged to be among the groups ringing the opening and closing bell at Nasdaq a few times. One of them was not when IBKR went public – I was helping to keep our then-critical market-making operations functional – but I was there when we re-listed on that exchange and on at least a couple of other recent occasions. I’ve also been part of the bell ringing ceremony at the Montreal Exchange at least twice. All were quite special, but to be fair, a historic building makes an impossible-to-duplicate backdrop. Even the team at the NYSE’s rival exchange group Miami International Holdings (MIAX), a relative newcomer, were impressed.(Full disclosure – IBKR owns a stake in MIAX, and as a result, I represent our firm on the board of its MIAX Pearl options and stock exchange.)

Spending the morning at a celebratory gathering in relatively unfamiliar surroundings meant that I was by no means as plugged into my customary news and market data sources as usual.The irony, of course, was that I was at an exchange amidst a group of other exchange and market professionals, but the location and schmoozing hardly replaced sitting at my desk analyzing data. (That said, it was much more fun, and the food was better.)Thus, I was rather surprised to see that stocks had generally yawned at the stunning +0.9% monthly jump in both the headline and Core Producer Price Index levels.

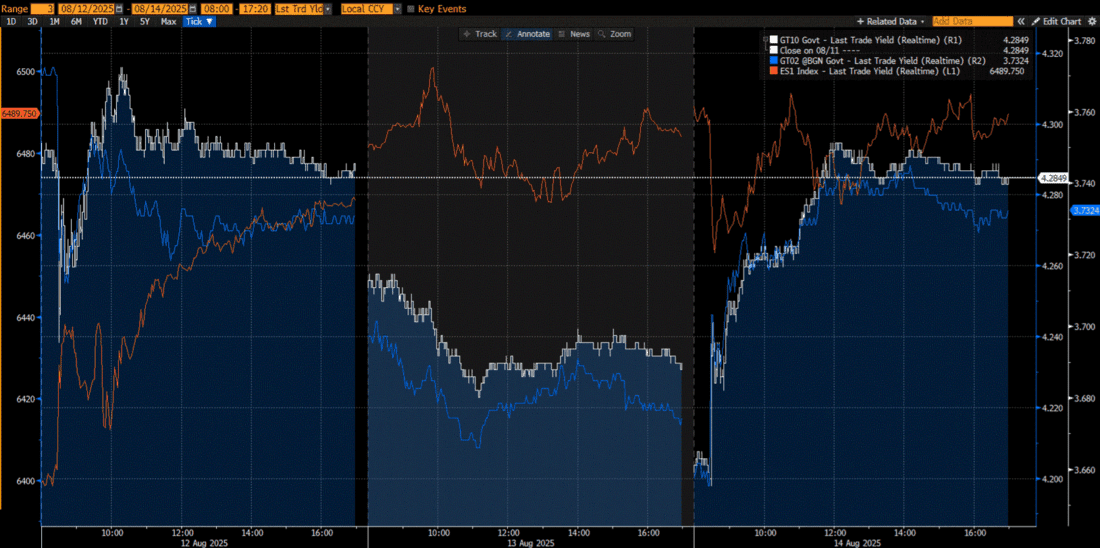

It seemed to me then, and now, that there is no way to sugarcoat an unpleasant surprise of that magnitude. On Tuesday, stocks and bonds both cheered the essentially in-line CPI report.Expectations for a 25-basis point rate cut, which were already robust, increased to a certainty.In fact, by Wednesday, Fed Funds were pricing in a slight chance for a 50bp cut at the September 17th FOMC meeting. After the PPI report, that expectation reverted to reflecting similar expectations to those that prevailed prior to the CPI. The yield curve reacted similarly, with bonds giving back virtually all their prior gains. Yet stocks meandered around unchanged levels throughout yesterday’s session, never giving back more than a small fraction of Tuesday’s rally:

3-Day Chart, from 8:00am – 5:20pm EDT daily, September ES futures (red, left);10-year (white, right) and 2-year (blue, right) US Treasury Yields

(Click on image to enlarge)

Source: Bloomberg

Major stock indices have been exhibiting something of a ratchet effect. They move higher, often sharply higher, on good, or even just OK news, but only falling modestly – if at all – on bad news. That certainly describes the outcome of yesterday’s trading, where two separate groups of rational investors interpreted the same unpleasant data in a completely different manner. We see something similar today, with stocks only declining modestly after receiving the latest set of concerning surveys from the University of Michigan:

- Sentiment fell to 58.6 from 61.7, where the consensus estimate was 62.0

- Current Conditions plunged to 60.9 from 68.0; consensus was 67.5

- 1-Year Inflation Expectations rose to 4.9% from 4.5%; consensus was 4.4%

- 5-10 Year Inflation Expectations rose to 3.9%; consensus was unchanged from the prior 3.4%

There is no way to read that data in a positive manner, except to offer the caveat that “soft data”, like surveys, is less meaningful than “hard data” like government statistics. (Of course, as were all recently reminded, the monthly jobs data from the BLS is also collected from surveys.)

We’ve utilized the term “nihilist market” before when it appeared that stock traders were so focused upon momentum-driven returns that they were ignoring key fundamentals. We unveiled that term on February 14th, 2020, when we expressed surprise at stock traders’ willingness to ignore news about a potential epidemic, writing:

This morning I was greeted with the following alert from Bloomberg news on my iPhone:

“Coronavirus infections still rising, Fed reduces repo operations, and euro-area economy stagnates.Here’s what’s moving markets.”

I should have been surprised that, despite the trifecta of gloomy headlines, US index futures were trading up about 0.2%, but I wasn’t.That sort of thing doesn’t surprise me anymore.Stock markets seem to have taken on a life of their own, beholden only to money flows and positive sentiment.

Our use of the term was similarly well-timed in August 2022, but far less so later in 2020 and in early 2024. Take the current opinion with a large grain of salt.But a market that willfully puts on blinders when confronted with inconvenient news, such as greeting the double whammy of sharply lower sentiment and higher inflationary expectations and readings with a relative yawn, makes me wonder whether “it just doesn’t matter” has become a new market mantra.

More By This Author:

Messages From The Yield Curve

Short-Termism Rules

Not A Figma Of Our Imagination

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the ...

more