Not A Figma Of Our Imagination

Image Source: Unsplash

Last week we witnessed one of the most spectacular debuts of a stock in recent memory. Figma (FIG) has been quite the phenomenon since its IPO just over a week ago. Considering how many times I’ve been asked about its activity and what it might mean for the broader market, I thought I would offer those thoughts here.

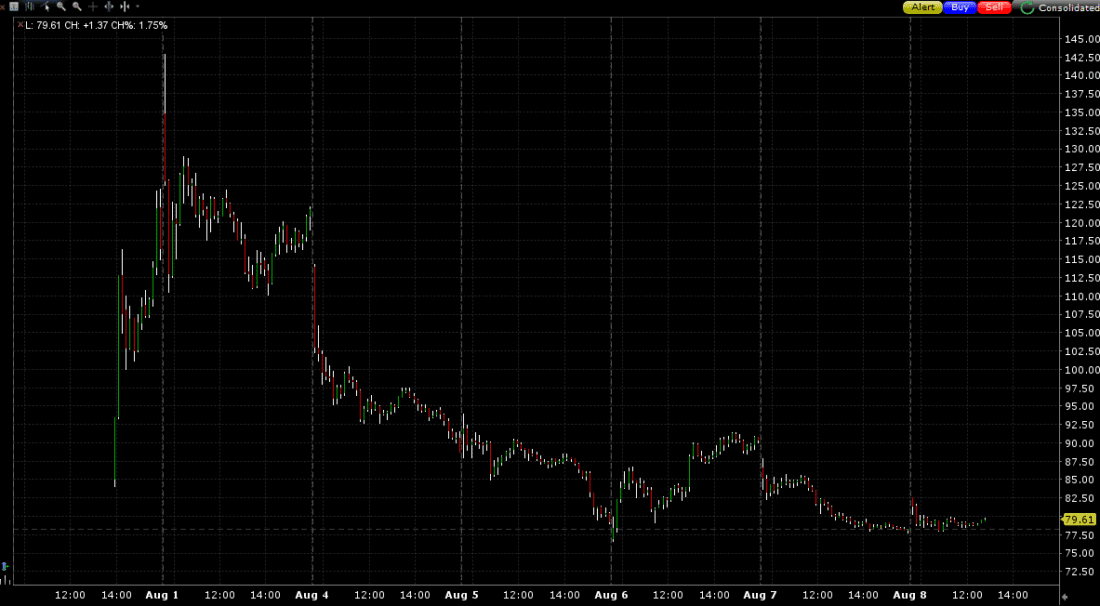

The move was reminiscent of some of those that occurred during the internet bubble.In those days, it was as though there was a contest to see just how far an IPO could run.FIG came public at $33, opened at $85, and closed at $115.50 after trading as high as $124.63 — all within a few hours.The next day we saw it open at $134.82, tick as high as $149.92 shortly thereafter, and within minutes began to meander around the $120 level.The next morning began with a lower open at $113.92, have a brief tick up to $114.285, and then began a decline that saw the stock close at its low of $88.60.Since then, the stock seems to have found a level around $80 – a huge pop from its IPO price, but below its first trade.

It is clear that many IBKR customers were enthralled by the new listing.Bearing in mind that my visibility of customer activity is limited to a top-25 list of a rolling 5-day total of buy and sell orders.That limits both the transparency and the ease of interpretation (deliberately), but it was notable that:

- FIG made it into the top 25 after its first day as a public company

- By Monday, after only ~2.5 days of trading it had made it up to #4!

- It remains in the #5 slot through yesterday.It trails only perennial #1 TSLA and #2 NVDA, while #3 AMD and #4 PLTR are neither strangers to the upper reaches of the list nor did they lack for news this week.

- Its options activity is substantial for a new company, but nowhere close to the aforementioned

FIG was a testimony to the speculative nature of this market, abetted by some of the peculiarities of the IPO process.In the specific case of a large IPO, the bankers are responding primarily to the large institutional customers who make up the bulk of the initial buyers.They will be far less likely to chase a name simply because it’s hot, and frankly, the bankers use allocations in desirable IPOs as a perk – the best customers get access to the biggest pops.Those institutional buyers were undoubtedly aware that a $20 billion acquisition attempt by Adobe (ADBE) recently fell through, and were probably loath to exceed that prior valuation.

But one must question whether the bankers were able to anticipate the mania that can surround a well-hyped, big tech situation. It’s one thing to price in a bump of about 10-20% after an IPO. That’s desirable.Pricing in a more than 2X opening print and a nearly 5X jump on the next day’s open is quite another.A small float and lots of chatter can exacerbate it quite quickly.

How this transpired tells quite a bit about current market psychology.We have been commenting about traders’ willingness to chase rallies, and they certainly did on day one in FIG.But day two is another chapter in that story.The peak occurred in the first few minutes of trading, which was a pattern we saw during the recent meme flurry.The buyers on day one get the stock hyped in social media to a fevered pitch, then sell it into the early mania on day two.Since then, the stock has generally been on a downtrend punctuated by a few modest bumps.Folks will probably lose interest and move onto the next situation if the stock persists below its opening print, even with the stock still > 2X over its IPO price. For reference, Circle (CRCL) made it as high as #5 on our list, but it is #17 today.

FIG, 7-days, 10-minute candles

(Click on image to enlarge)

Source: Interactive Brokers

More By This Author:

Newton’s Third Law Of Markets?Markets And Jobs Hit An Air Pocket

Yes, They Do Care

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more