New Year’s Resolution For Rotation

While the broad S&P 500 (SPY) is trading slightly higher to start the new year, individual sectors are mixed and experiencing some pretty extreme moves. Energy (XLE) and Consumer Discretionary (XLY) are surging out of the gate with both sectors gaining over 2% today. For Consumer Discretionary, the bulk of its 2% gain today is thanks to Tesla (TSLA). While TSLA is up more than 10% on the day, the majority of stocks in the Consumer Discretionary sector are down on the day. The Financials sector (XLF) is also up over 1%, while Technology (XLK) and Communication Services (XLC) are both up ~0.6%. Conversely, Industrials (XLI), Utilities (XLU), Materials (XLB), Health Care (XLV), and Real Estate (XLRE) are all down well over 1%.

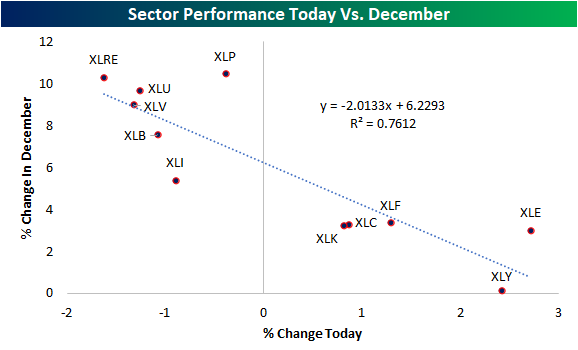

Rotation out of last month’s winners appears to be the big driver of today’s move. In the chart below, we show each sector ETF’s performance today plotted against performance in the month of December. As shown, last month’s biggest winners are all in the red in today’s session. Defensive sectors, in particular, are down the most today whereas last month they rallied high single to double digits. Meanwhile, cyclicals were up more modestly last month and are today’s biggest winners.