New Stocks On Most Attractive And Most Dangerous Lists: August 2015

Photo Credit: wonderwebby (Flickr)

Recap from July’s Picks

Our Most Attractive Stocks (-1.9%) underperformed the S&P 500 (+0.8%) last month. Most Attractive Large Cap stock Altria Group (MO) gained 12% and Most Attractive Small Cap stock Universal Insurance (UVE) was up 13%. Overall, 14 out of the 40 Most Attractive stocks outperformed the S&P 500 in July.

Our Most Dangerous Stocks (-4.3%) outperformed the S&P 500 (-0.8%) last month. Most Dangerous Large Cap stock SINA Corporation (SINA) fell by 24% and Most Dangerous Small Cap Stock Authentidate Holding (ADAT) fell by 32%. Overall, 28 out of the 40 Most Dangerous stocks outperformed the S&P 500 in July.

The successes of the Most Attractive and Most Dangerous stocks highlight the value of our forensic accounting. Being a true value investor is an increasingly difficult, if not impossible, task considering the amount of data contained in the ever-longer annual reports. By analyzing key details in these SEC filings, our research protects investors’ portfolios and allows our clients to execute value-investing strategies with more confidence and integrity.

21 new stocks make our Most Attractive list this month. 20 new stocks fall onto the Most Dangerous list this month. August’s Most Attractive and Most Dangerous stocks were made available to members on August 5.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stock Feature for August: Intel Corporation (INTC: $29/share)

Intel Corporation (INTC), a global semiconductor and computer processor provider is one of the additions to our Most Attractive stocks list for August and was our Stock Pick of the Week in early May.

Intel’s leading position in the global PC processor market allowed it to build a highly profitable business. Since 1998, Intel has grown after-tax profit (NOPAT) by 5% compounded annually. This long history of profit growth points to Intel’s strength and ability to adapt in the constantly changing technology market. Intel currently generates a top quintile return on invested capital (ROIC) of 21%.

In our previous report on Intel, we noted that the company has strategically positioned its Data Center Group to lead its future profit growth. This segment has continued to perform well and through the first six months of 2015, Data Center Group operating income has grown by 12% year-over-year, and now makes up 64% of Intel’s operating income. The strength of this segment has allowed Intel to weather the declining PC market, and we expect it to continue to be a strong profit generator. We believe Windows 10 could provide Intel with a much-needed boost in PC sales and profits.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Intel’s 2014 10-K:

Income Statement: we made $1.6 billon of adjustments with a net effect of removing $197 million of unusual expenses (<1% of revenue). One of the largest adjustments was the removal of $422 million related to gains on sales of equity investments.

Balance Sheet: we made $47 billion of adjustments to calculate invested capital with a net decrease of $15.3 billion. The largest adjustment was $7.3 billion added back to invested capital (10% of reported net assets) due to asset write-downs.

Valuation: we made $46 billion of adjustments with a net increase of $2.1 billion to shareholder value. One of the most notable adjustments was a $1.8 billion (1% of market cap) decrease to shareholder value for underfunded pensions.

Intel Shares are Attractively Undervalued

Despite the positives noted above, the stock is down 16% on the year. This price decline has left Intel undervalued and reflects unduly low expectations. At its current price of $29/share, Intel has a price to economic book value (PEBV) ratio of 0.8. This ratio implies the market expects Intel’s NOPAT to permanently decline by 20%. Such low expectations discount any potential boost from Windows 10, Intel’s recent acquisition of Altera, and the long-term strength of Intel’s business.

If Intel can grow NOPAT by just 2% compounded annually for the next five years, the stock is worth $38/share today – a 31% upside.

Most Dangerous Stock Feature: athenahealth (ATHN: $139/share)

athenahealth (ATHN), provider of electronic health record management services, is one of the additions to our Most Dangerous stocks for August. We placed it in the Danger Zone in mid-April.

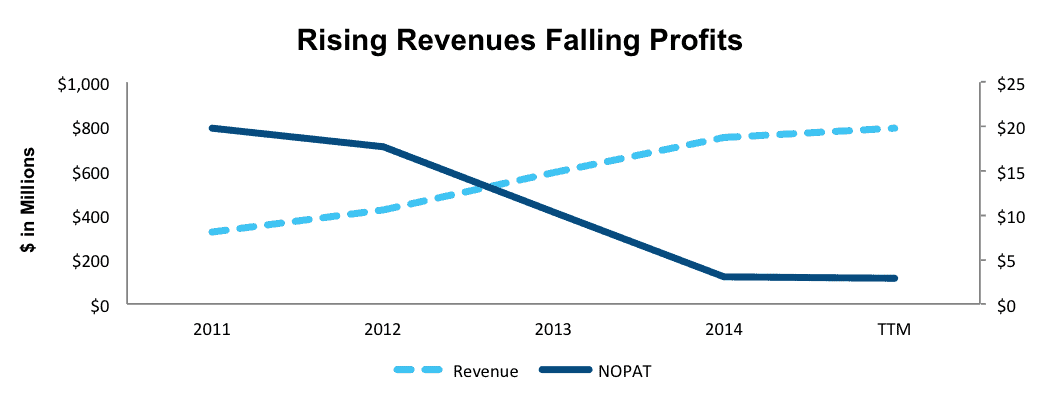

Like many cloud companies, athenahealth is great at growing revenues at breakneck speeds. Unlike other cloud providers, the company was also able to grow NOPAT, albeit at a lower pace, from 2007-2011. However, since 2011 the company has seen its NOPAT decline by 46% compounded annually.

Figure 1: athenahealth NOPAT Headed in the Wrong Direction

Sources: New Constructs, LLC and company filings

The main culprit of athenahealth’s struggles has been the costs of growing revenues. Total expenses have increased 36% compounded annually since 2011. At the same time, athenahealth’s NOPAT margin has fallen to 0.4% on a trailing-twelve-month (TTM) basis from 6% in 2011.

athenahealth currently earns a bottom quintile ROIC of 0%, which equals the ROIC of competitor Allscripts (MDRX) but is well below larger competitor Cerner (CERN) at 16% ROIC.

Impact of Footnotes Adjustments and Forensic Accounting

athenahealth reported GAAP net income of -$3 million in 2014. However, after removing a net $6 million in non-operating expenses we see that NOPAT was actually $3 million. Suppressing 2014 GAAP net income through the use of non-operating expenses could setup a misleading comp when 2015 results are reported.

In regards to the balance sheet, we made $313 million of adjustments to calculate invested capital with a net increase of $37 million. One of the larger adjustments was the removal of $77 million in excess cash, which represents 11% of reported net assets.

Additionally, we made $551 million of adjustments with a net decrease of $397 million when calculating shareholder value. The largest adjustment made to athenahealth’s shareholder value was the removal of $130 million (2% of market cap) related to outstanding employee stock options.

Athenahealth Remains Overvalued

Despite the struggling business, ATHN is up 9% since our Danger Zone report with much of the gain coming in the last month. athenahealth reported 2Q15 earnings and showed continued revenue growth, which was enough to satisfy the market, but at the same time, further margin contraction. With the stock price increase, ATHN has only gotten more overvalued.

To justify its current price of $139/share, athenahealth must grow NOPAT by 39% compounded annually for the next 24 years. Fulfilling those expectations means that athenahealth would be generating revenue of $357 billion per year in 2039, or nearly 10 times the revenue of hospital provider HCA Holdings (HCA) 2014 revenue.

Even if we assume a best case scenario, one in which athenahealth achieves pretax margins of 11% (achieved in 2011 and fallen every year since) and continues growing revenues by 20% compounded annually for the next decade, ATHN is only worth $56/share today – a 60% downside.

With such high expectations and deteriorating business operations, it’s easy to see why athenahealth landed on this month’s Most Dangerous stocks list.

Disclosure: New Constructs staff receive no compensation to write about any specific stock, sector, or theme.

Athena Health has jumped nicely since you wrote your stock warning in August. It recently reached as high as $167 on Nov 23. and has proven itself as a company that has outperformed on earnings. Curious to know if you still think it should be avoided?