New Highs For S&P 500 But Not A Lot Of Sectors

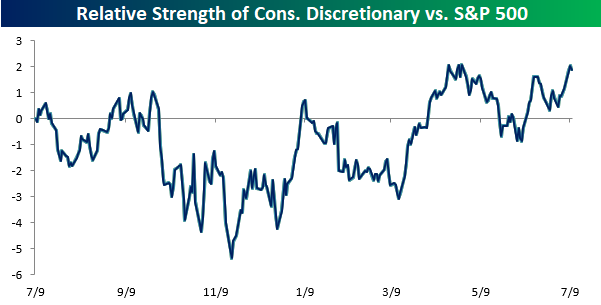

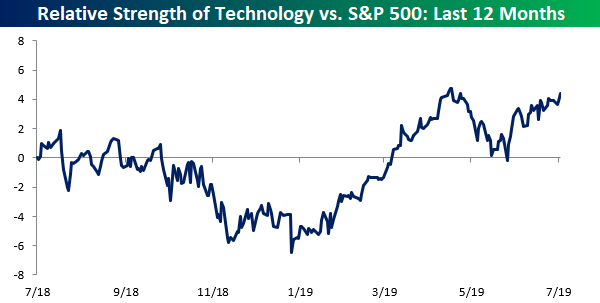

It was a monumental milestone for the S&P 500 earlier today as the index briefly crossed 3,000 for the first time in its history. While the S&P 500 traded up to a new all-time high, it was interesting to see that not a single sector made a new high in terms of their relative strength versus the index. The only two sectors where relative strength is even close to a 52-week high versus the S&P 500 are Consumer Discretionary and Technology. Just two sectors hitting new highs on a relative basis may not sound too impressive, but when those two sectors account for nearly one-third of the entire index, it’s not as bad.

(Click on image to enlarge)

(Click on image to enlarge)

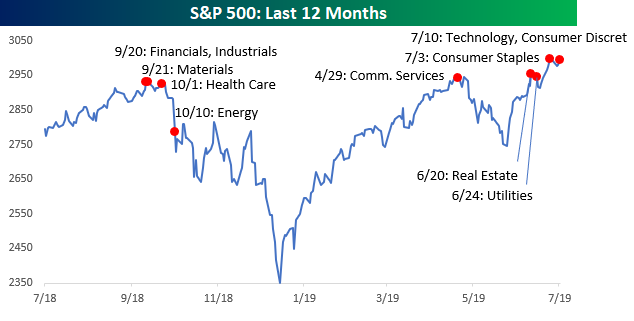

While no sectors are hitting new highs today on a relative basis, a number of sectors have recently hit new highs on an absolute basis. The chart below shows the S&P 500 over the last year, and on it we have notated the date of each sector’s 52-week high. When the S&P 500 recently first made a new high, the rally was being led by defensives like Real Estate and Utilities which made their highs on 6/20 and 6/24, respectively. On 7/3, another defensive sector joined the fray as Consumer Staples rallied to a new high. Today, we are finally beginning to see some non-defensive sectors get in on the act as both Consumer Discretionary and Technology made new highs. Trailing way back in the dust of these sectors are Financials, Industrials, Materials, and Health Care, which haven’t made new highs in over eight months. If these sectors can make it over the hump, the S&P will likely be in the midst of a big leg higher.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our full research suite.

Disclaimer: To begin ...

more