Netflix Earnings Disappointment Was A Long Time Coming

Quarter after quarter Netflix bulls tout how impressive the company’s subscriber growth numbers are. Despite underlying issues, which these investors care little about, as long as subscriber growth remains on the uptick, the stock follows suit. So what happens when that subscriber growth disappoints? NFLX shares face a stark reality in which the business operations aren’t justifying the current share price, far from it actually. We’ll detail some of the issues facing Netflix below.

Content Costs Are Misleading and Undermine Value of Revenue Growth

We first highlighted Netflix’s content cost problem in April 2014 and while the content cost growth rate has slowed lately, it still undermines revenue growth. While Netflix will tout 29% year over year revenue growth, it fails to mention its streaming content costs grew by 17% YoY as well to a total of $10.4 billion in 3Q15. Beware revenue growth that is closely followed or surpassed by expense growth.

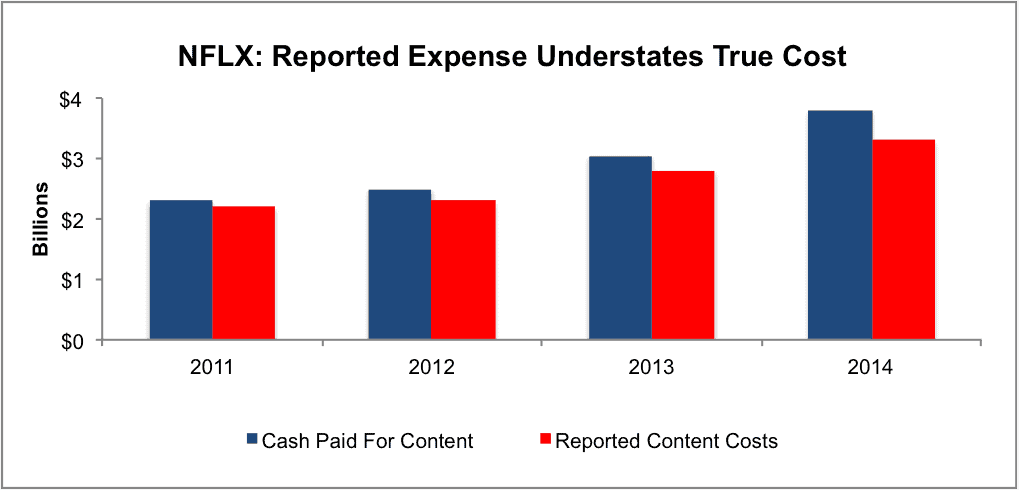

Furthermore, because of the way Netflix accounts for its streaming content, the reported expenses understate the cash costs of that content. From Figure 1, in just four years, the difference between reported content costs and actual cash payments for new content is nearly $1 billion. In 2014 alone, Netflix paid $500 million more to add to its library than it recognized in expenses.

Figure 1: Reported Costs Vs. Actual Cash Paid

Sources: New Constructs, LLC and company filings

Rising Content Costs Will Require Raising Capital

Netflix has been burning cash since 2011 when the company began aggressively expanding its content library. However, the 35 analysts who cover Netflix, as tracked by Factset, have an average overweight rating and price target of $121/share. Additionally, 18 analysts have increased their price target while only two have lowered them. How can so many analysts be bullish on a company that has burned through over $2 billion in cash since 2011? The answer is simple. Netflix has announced the need to raise capital to support its ventures. We’ve previously highlighted how analyst buy ratings are not always trustworthy and by maintaining a high rating on Netflix, an analyst can position their firm to aid in the capital issuance, which could mean big profits for the investment bank.

Subscriber Growth Miss Should Not Be A Surprise

It seems many investors in NFLX care only about subscriber growth and when it disappoints, NFLX crashes. We mentioned Netflix’s slowing subscriber growth in October 2014, and again in February 2015. The 3Q15 subscriber “miss” is just the continuation of that trend. Netflix added only 880,000 subscribers to its U.S. streaming segment in 3Q15, down from 980,000 in 3Q14. Additionally, Netflix has continued to expand internationally, as the company added 2.7 million members over 2 million the year before. However, the international segment’s contribution margin dropped to -13% from -9% in 3Q14. Expanding internationally still remains unprofitable for Netflix and the U.S. market appears to be reaching a saturation point.

Competition Is Only Increasing and Getting Stronger

At its core, Netflix is merely a content delivery platform — and one of many. Netflix may blame poor subscriber additions on the transition of credit/debit cards to new chip cards, which made it harder to collect membership fees, but we believe the poor additions were probably from the litany of competition Netflix faces. Some competitors include:

- Amazon Video – $8.25/month

- Hulu Plus – $7.99/month

- CBS All Access – $6/month

- HBO Now – $14.99/month

- Showtime –$ 11/month

- Dish Network’s Sling TV – $20/month

- Verizon’s Go90 – Free

There is no shortage of competition in this space, and none of them stand out as offering anything that is really unique. Netflix’s attempts to differentiate through original content are extremely costly and the company is not the only player in that game. Amazon creates excellent original content, Hulu has its own original series, and there is even numerous reports of Apple taking steps to create its own original programming, further adding to the competition pool.

Valuation Implies Half The World Uses Netflix

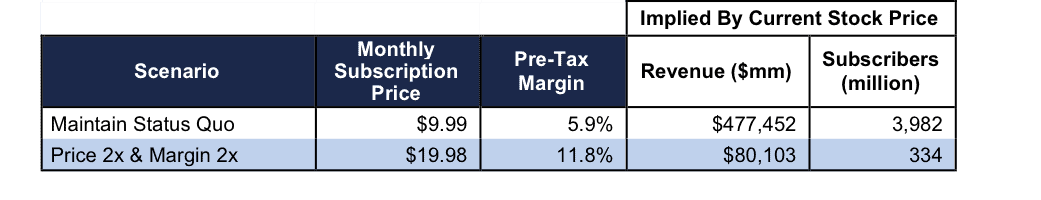

Netflix may be one of the most overvalued stocks in the market today. To justify the current price of $100/share, Netflix must grow revenue by 25% compounded annually for the next 20 years. Netflix currently maintains a TTM pre-tax margin around 5.9% and has 69 million subscribers, 43 million of which are in the U.S. United States penetration is around 13% of the 320 million people in the U.S. and global penetration is much lower. We think most investors have failed to realize that the valuation of the stock price already implies staggering levels of global penetration. Figure 2 has the details.

Figure 2: Implied Stock Price Scenarios

Sources: New Constructs, LLC and company filings

Scenario 1 above assumes Netflix prices and margins remain the same. Netflix recently upped the price of the 2-screen account to $9.99 so we use that new price. Pre-tax margins are currently 5.9% on a TTM basis. The DCF model shows that at the current profit margin, the company must grow revenues by 25% compounded annually for the next 20 years to justify the current price. That performance means the company would reach over $477 billion in revenue in 20 years. At $9.99 per month, Netflix would need over 3.9 billion subscribers to generate $477 billion in revenue. The world population is about seven billion. Any questions?

Scenario 2 assumes Netflix can double its price and profit margins. We realize that doubling price and doubling margins at the same time is a stretch. Nevertheless the DCF model shows after doubling prices and margins, the company would have to reach over 334 million subscribers, or nearly five times their current subscriber base of 69 million. We wouldn’t bet on that happening.

Don’t Get Caught Up In The Hype Again

We’ve seen this movie before: After a huge run up in 2013, Netflix stock dropped over 28% in early 2014. Then again, after a large run, the stock dropped 24% in October 2014. This year has been no different, as Netflix fell 20% in August. NFLX remains up over 106% YTD despite the drop in August. Don’t get caught as this earnings miss leads to the next as margins continue deteriorating and subscriber growth continues its descent.

Click here to download a PDF of this report.

Photo Credit: Televisione Streaming (Flickr)

Disclosure: more

Current analyst opinion seems to be still holding belief in Netflix as a good buy. Since this article the stock has been on the rise, reaching a high of $109 in trading yesterday 11/2/15.

This month, the analyst breakdown is as follows: Strong Buy: 9, Buy: 16, Hold: 15, Underperform: 2, Sell: 2

Agreed, the earnings miss was concerning, and the number of competitors is increasing and the pressure is on, but I still believe the stock has room to run. Buy and hold!