Netflix Craters On Disappointing Guidance, Stock Buyback Pause

Image Source: Unsplash

It was already an ugly quarter for NFLX shareholders who have been caught in a painful takeover battle for Warner Bros Discovery which has hammered the stock. And it only got uglier moments ago when Netflix reported Q4 earnings which came in solid, along with record subscribers for 2025, but it was the company's disappointing guidance due to higher program spending, together with the halt of stock buybacks (to fund the pending WBD deal) that slammed the stock to levels last seen during the Liberation day panic.

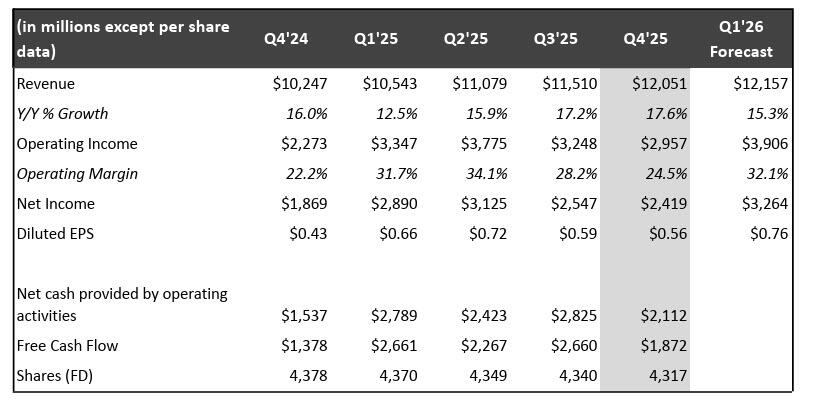

Here is what NFLX reported for Q4 results:

- EPS 56c vs. 43c y/y, beating estimates of 55c

- Revenue $12.05 billion, +18% y/y, beating estimates $11.97 billion

- US & Canada revenue $5.34 billion, +18% y/y, beating estimates $5.26 billion

- EMEA revenue $3.87 billion, +18% y/y, beating estimate $3.84 billion

- Latin America revenue $1.42 billion, +15% y/y, matching estimate $1.42 billion

- APAC revenue $1.42 billion, +17% y/y, missing estimate $1.44 billion

- Operating income $2.96 billion, +30% y/y, beating estimate of $2.89 billion

- Operating margin 24.5% vs. 22.2% y/y, beating estimate of 24.2%

- Cash flow from operations $2.11 billion, +37% y/y, beating estimate of $1.68 billion

- Free cash flow $1.87 billion, +36% y/y, beating estimates $1.46 billion

So far so good, because absent a small miss on APAC revenue, the quarter was generally in line (as a reminder, Netflix stopped providing regular updates on its subscriber total, directing investors to focus on more traditional financial metrics).

Some more details on Q4 results:

Q4 revenue grew 18% year over year (+17% on a foreign exchange (F/X) neutral basis), driven primarily by membership growth, higher pricing, and increased ad revenue. Despite unfavorable F/X movements during the quarter, revenue was 1% above our guidance due to stronger-than-forecasted membership growth and ad sales.

Operating income in Q4 was $3.0B, up 30% year over year, and operating margin expanded two percentage points year over year to 25% - both slightly ahead of our forecast due primarily to the revenue upside.

Diluted EPS amounted to $0.56 vs $0.43 in Q4’24 (+31% year over year), slightly above our forecast (adjusted for our 10-for-1 stock split). Net income included ~$60M of costs (booked in interest expense) related to our recent Warner Bros.-related bridge loan and associated bridge reduction financings (which was not included in our guidance).

With our strong Q4 results, we met or exceeded all of our full year 2025 financial objectives. We grew revenue 16% to $45B (+17% on a F/X neutral basis) and we increased our operating margin to 29.5% for the year, up from 26.7% in 2024. We also made great progress growing advertising revenue. In 2025, which was only our third year selling advertising, ad revenue grew by more than 2.5x vs. 2024 to over $1.5 billion.

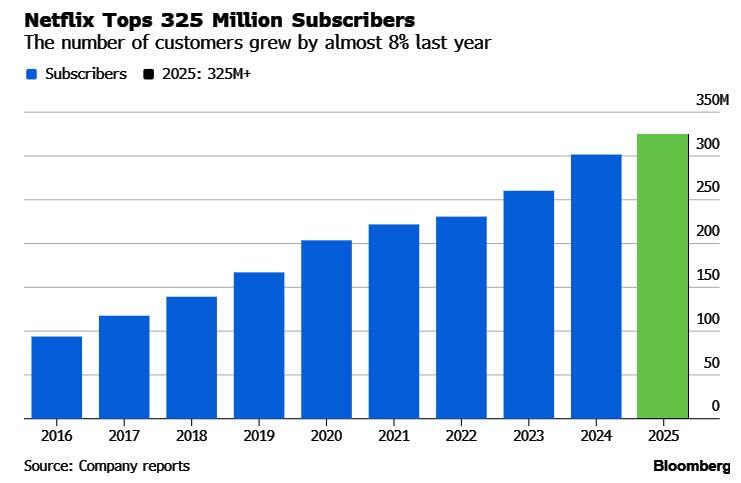

The streaming leader said it plans to increase spending on films and TV shows by 10% in 2026 while forging ahead with plans to buy the studio and streaming business of Warner Bros., a deal that would unite two of the world’s largest entertainment companies. Netflix spent about $18 billion on programming last year, with subscribers growing almost 8% to top 325 million.

The strong subscriber metrics and results were to be expected in a quarter that had a particularly strong programming lineup to close the year, including the final episodes of Stranger Things, a documentary series about hip-hop mogul Sean Combs and a new Frankenstein film.

But while Q4 was solid, it was the company's forecast that was the first alert, with the company reporting revenue, operating income and margins all of which came below estimates.

- Sees EPS 76c, missing estimates of 82c.

- Sees revenue $12.16 billion, missing estimates of $12.17 billion

- Sees operating income $3.91 billion, missing estimates of $4.18 billion

- Sees operating margin 32.1%, missing estimates of 34.4%

Extending the forecast to the full year, there was more disappointment, because while revenue came in just barely higher than expected, both margin and free cash flow came in well below the median consensus.

- Sees revenue $50.7 billion to $51.7 billion, estimate $50.96 billion

- Sees operating margin 31.5%, estimate 32.4%

- Sees free cash flow about $11 billion, estimate $11.93 billion

Some more details on the forecast from the investor letter, which suggests that the takeover of WB Discovery will weigh on the bottom line for some time, including an additional$275 millionin acquisition-related expenses, on top of the $60 million already spent.

For 2026, based on F/X rates as of 1/1/2026, we forecast revenue of $50.7B-$51.7B. This represents 12%-14% year over year growth (or 11%-13% F/X neutral growth), driven by increases in membership and pricing plus a projected rough doubling of ad revenue in 2026 vs. 2025.

We’re targeting a 2026 operating margin of 31.5% (based on 1/1/26 F/X rates), up from 29.5% in 2025, which includes approximately $275M of acquisition-related expenses. Our margin forecast also reflects content amortization growth of ~10% in 2026, with higher growth in the first half than the second half due to the timing of title launches.

As a result, we expect higher operating income growth in the second half of 2026 than in the first half. We still see plenty of room to increase our margins and our intent is to grow our operating margin each year, although the magnitude of margin expansion will vary year-to-year as we balance reinvesting in our business with improving profitability.

Summarizing the highlights from the guidance, the company sees higher operating income growth in H2 2026 vs H1; sees "plenty of room" to increase margin; the company intends to grow operating margin each year. NFLX sees about doubling of ad revenue in 2026 vs 2025.

Netflix is buying Warner Bros. to obtain one of the strongest film and TV libraries in the world, content it can mine for new material and help the company expand newer businesses like consumer products, experiences and video games. Last year’s programming budget delivered a marginal increase in viewership for Netflix, with overall engagement growing about 2% in the second half.

Yet even as growth in new users and viewing has slowed, Netflix has sustained double-digit sales growth by raising prices and introducing advertising. The company predicts ad sales will double this year from $1.5 billion in 2025.

And while investors were not delighted with some of the aspects,, the big hit to the stock after hours was news that Netflix would pause share buybacks to accumulate cash to help fund pending Warner Bros. acquisition.

This, together with the poor guidance, sent the stock tumbling 5%, and back to the lowest level since the April Liberation day.

More By This Author:

USA Rare Earth Soars, To Build Plant In France With Government Support

Gold And Silver Explosion: Something Big Is Happening

Futures, Global Markets Sink, Gold Soars On Trump Tariff Threat