Futures, Global Markets Sink, Gold Soars On Trump Tariff Threat

Image Source: Unsplash

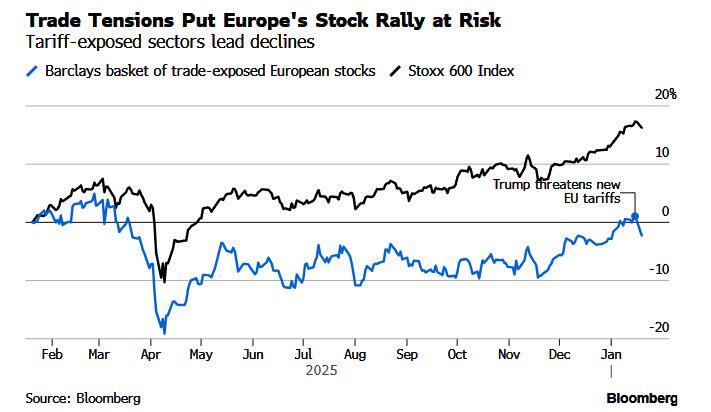

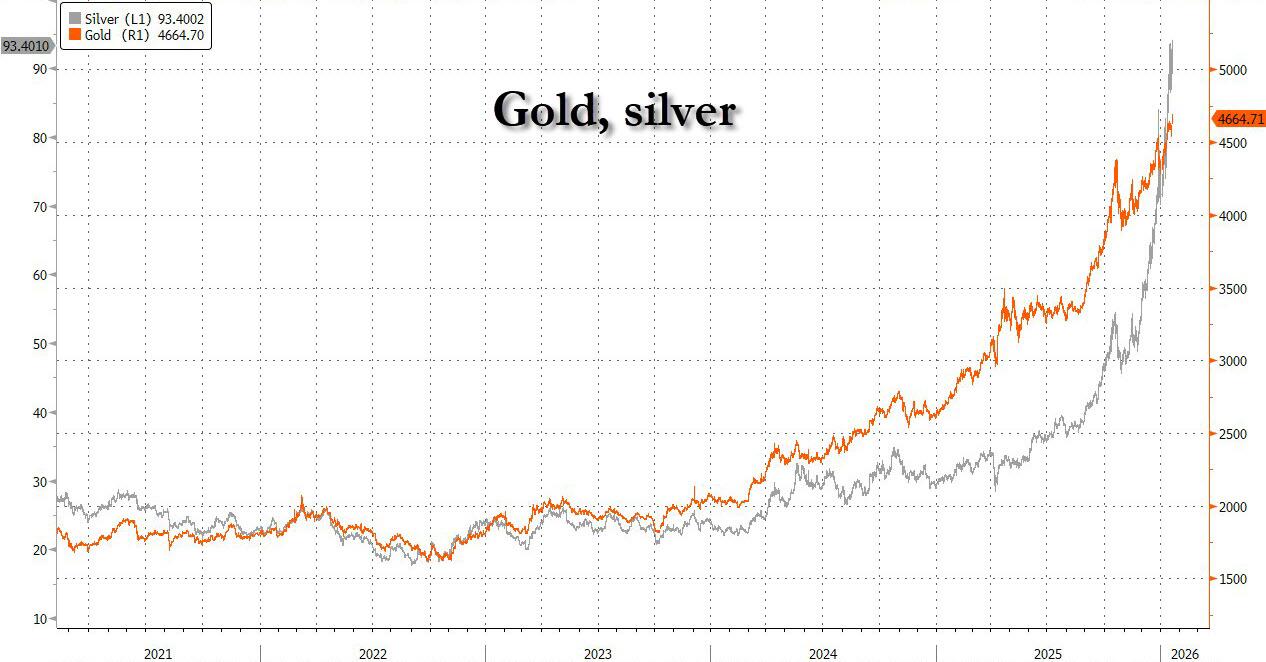

Stocks sold off, and gold hit a new record as trade tensions between the US and Europe erupted over Trump’s push to take control of Greenland (which we learn today is due to Norway's snub of Trump for the Nobel peace prize). While US cash markets are closed for the MLK holiday, S&P futures dropped 1.1% and Nasdaq futures tumbled 1.4%, while Europe's Stoxx 600 was on track for its worst day in two months led by luxury stocks and German automakers as BMW dropped 3%. The dollar retreated 0.2%, while the Swiss franc outperformed. Gold topped $4,670 an ounce. US markets are shut today for a public holiday.

In corporate news Nvidia (NVDA) supplier Micron Technology (MU) said an ongoing memory chip shortage has accelerated over the past quarter and reiterated that the crunch will last beyond this year due to a surge in demand for high-end semiconductors required for AI infrastructure.

- Apple Inc. (AAPL) retook the top spot in China after iPhone shipments jumped 28% during the holiday quarter despite a worsening shortage of vital memory chips, according to Counterpoint Research.

- Tesla (TSLA) Chief Executive Officer Elon Musk said the electric carmaker will resume work on the Dojo3 project after making progress on the design of its AI5 chip.

- Bayer AG’s (BAYZF) shares surged after the US Supreme Court said it would hear the company’s appeal in a Roundup case that could undercut thousands of lawsuits tied to the weedkiller.

Stocks around the world were knocked lower by Trump’s threat to impose levies on countries opposing his bid to assert authority over Greenland, which risks reigniting the tariff-fueled volatility that rattled markets in the early months of his second term. The selloff deepened as Monday’s session wore on after European officials signaled they were unlikely to back down and were considering retaliation.

“Markets are sensitive to the dynamic developments regarding new tariffs as a basis for negotiating security issues,” said Guillermo Hernandez Sampere, head of trading at MPPM. “Rising uncertainty, as seen last year, will weigh on all markets.”

The standoff is coming at a time when risk appetite has been supported by resilient corporate earnings and sustained investment in artificial intelligence. The outlook will hinge in part on the European Union’s response, with the bloc in talks to impose tariffs on €93 billion of US goods.

“The key element to watch in the coming days is whether the message translates into formal measures or remains purely rhetorical, which would make a clear difference in the market reaction,” said Francisco Simón, European head of strategy at Santander Asset Management.

The tensions are also adding to the significance of a pending US Supreme Court ruling on some of Trump’s earlier tariffs, with a decision possible as soon as Tuesday.

“It is not about whether the US can roughly maintain its tariff levels,” wrote Krishna Guha, head of central bank strategy at Evercore ISI. It is “rather about whether Trump has to use regular order to impose tariffs, reducing uncertainty and his ability to weaponize tariffs for geopolitical purposes.”

Trump’s threats raise the possibility of European governments trimming their holdings of US assets, supporting the euro, according to George Saravelos, Deutsche Bank’s global head of FX research. As we reported last night, Europe is the US’s largest lender with its countries owning $8 trillion of US bonds and equities, almost twice as much as the rest of the world combined.

“The key thing to watch will be whether the EU decides to activate its anti-coercion instrument,” Saravelos said. “It is a weaponization of capital, rather than trade flows, that would by far be the most disruptive to markets.”

While Trump’s threats have reignited the ‘Sell America’ trade, some traders expect the swings to be short-lived.

“My working assumption is that an ‘off-ramp’ from these threats will soon be found,” said Michael Brown, senior research strategist at Pepperstone. “With the fundamental bull case for risk still a resilient one, and providing that any European retaliation remains largely rhetorical, I would view equity dips as buying opportunities.”

In Europe, the Stoxx 600 is down 1.3%, on track for its worst day in two months. Autos & parts, luxury and tech are seeing a brunt of the selling pressure. There is no US cash trading today, however, futures are notably weaker with the S&P 500 and Nasdaq contracts down 1.1% and 1.5%, respectively. Here are the biggest movers Monday:

- D’Ieteren shares gain as much as 9.2% after the auto distributor announced that its Belron unit had successfully repriced a loan, while the Financial Times reported that Belron was in talks on a stock market listing

- Bayer shares rise as much as 8.4% after the US Supreme Court agreed to hear the German company’s appeal taking aim at thousands of lawsuits targeting Roundup weedkiller for causing cancer

- Ageas shares rise as much as 3.3%, the most since June, after the Belgian health insurance firm boosted its net operating profit guidance for the full year, beating the average analyst estimate

- ASM International shares rise as much as 2.5%, bucking a decline in Europe’s tech sector, after the chip equipment firm reported preliminary orders well ahead of consensus estimates, while seeing a “healthy increase” in 1Q revenue versus 4Q

- Europe’s tariff-exposed sectors — including autos, drinks and shipping — are trading lower on Monday, after President Donald Trump announced on Saturday a new 10% levy on eight countries opposed to his plans to seize Greenland

- LVMH drops as much as 4.8%, and is among the weakest members of the Stoxx 600 consumer products and services index on Monday, as Morgan Stanley downgrades to equal-weight

- Adidas shares fall as much as 4.8% to the lowest level since November, after Bank of America forecast the sportwear retailer’s fourth-quarter sales to undershoot market expectations

- Banca Generali shares declined as much as 5.2% in Milan trading, the most since Aug. 21, after Kepler Cheuvreux analysts cut the recommendation on the stock to hold from buy, ahead of the 2025 results

Asian stocks erased an early decline, as gains in South Korea and Taiwan defied broader market concerns over the latest tariff threats from Trump’s administration. The MSCI Asia Pacific Index fluctuated in a narrow range, after capping its best week since early October. Benchmarks declined in Japan, Hong Kong, Singapore and India, amid global risk-off trading after Trump announced new levies on goods from European countries that have rallied to support Greenland. The tech-heavy markets of South Korea and Taiwan shrugged off the regional selloff, extending rallies driven in large part by investor optimism over artificial intelligence demand. TSMC and SK Hynix rose, even after US Commerce Secretary Howard Lutnick said Friday that Korean and Taiwanese companies that aren’t investing in the US may face up to 100% tariffs.

In rates, bunds are a touch higher, coinciding with a decline in European natural gas futures, which are trimming last week’s rally. UST and gilt futures are slightly weaker. The yield on 30-year Japanese debt climbed 11 basis points to 3.58%, while rates on 10- and 20-year notes rose to their highest levels since 1999.

In FX, the dollar is softer versus most peers with the Bloomberg Dollar Index down 0.1%. The euro has been resilient in the face of the trade conflict, but the Swedish krona and Norwegian krone are both weaker. The Swiss franc tops G-10 currencies while the yen has seen little follow-through from Japanese PM Takaichi’s widely-expected decision to call an election for Feb. 8.

In commodities, the latest tariff flight-to-quality triggered further record highs for spot gold and silver, up 1.5% and 3.5% respectively. Bitcoin is down by 2.5%.

Top Overnight News

- US President Trump hit 8 European countries with a 10% tariff, effective February 1st, over Greenland. The 8 countries include Denmark, Norway, Sweden, France, Germany, Finland, the Netherlands and the UK. The tariff will be increased to 25% on June 1st, unless a deal is reached for the purchase of Greenland.

- Pentagon readies 1,500 troops for potential Minnesota deployment: RTRS

- Trump Invited Putin to Join Gaza ‘Board of Peace,’ Kremlin Says: BBG

- The EU is preparing €93bln of tariffs on the US or restrict American companies' from the European market, in retaliation to the latest threat by US President Trump as European leaders meet for an emergency meeting on Thursday: FT

- French President Macron plans to urge the EU to use the Anti Coercion Instrument to retaliate against US President Trump's new 10% tariff on European countries: FT

- Germany Says Trump Reached Red Line With Greenland Threat: BBG

- Denmark Officials Skip WEF Over Trump’s Greenland Threats: BBG

- Trump's Greenland threat puts Europe Inc back in tariff crosshairs: RTRS

- Canada Weighs Sending Troops to Greenland Despite Tariff Threat: BBG

- At least 39 dead in Spain after two high speed trains collide: RTRS

- The EU is proposing to phase out Chinese-made equipment from critical infrastructure in a move to revamp its security and tech policy: FT

- Cook case could lead to 'cause' protections for Fed, or a roadmap for dismissals: RTRS

- Qatar Wealth Fund CEO Signals Nuanced Approach to AI Investments: BBG

- Hohn Breaks Citadel’s Record With $18.9 Billion Trading Profit: BBG

- Jane Street India’s Trading Gains Soared 494% Before Curbs: BBG

- Japan PM Takaichi to call Feb 8 snap election on spending, tax cuts and defence: RTRS

- Jeremy Grantham Says AI Is Indeed a Classic Market Bubble: BBG

- Guatemalan prison hostages freed, president declares state of siege: RTRS

- Trump Says Mamdani Facing ‘Big Test’ From NYSE’s Texas Trading Outpost: BBG

Trade/Tariffs

- Trump links Greenland threat to Nobel Peace Prize snub, EU eyes trade retaliation: Reuters

- The US is seeking a rare-earth deal with Brazil as Washington is looking for alternative sources away from China, the FT reports citing sources.

- The EU is proposing to phase out Chinese-made equipment from critical infrastructure in a move to revamp its security and tech policy, the FT reports.

- South Korea's Trade Ministry said South Korea and China are to hold a new round of free-trade negotiations on services and investment.

- US President Trump, on Carney in China, said it's OK for him to get a deal with China and if he can get a deal with China, he should do that.

- Brazilian President Lula said he wants to build new partnerships with Mexico, Canada, Vietnam, Japan, and China.

More By This Author:

Macy's Closing Two Fulfillment Centers, Laying Off 1,000 WorkersUS Eyes Private Security Contractors To Protect Oil Assets In Venezuela

$500 Billion... U.S.-Taiwan Agree Huge Chip Trade Deal