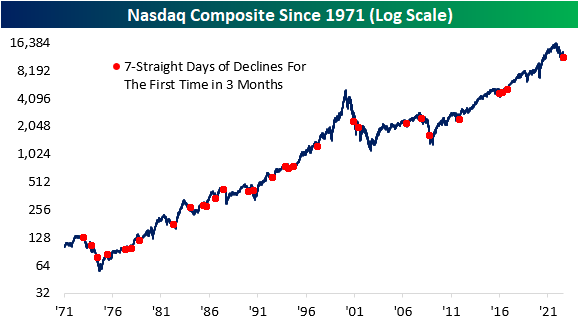

Nasdaq Declines For 7th Straight Day

Following Tuesday’s drop, the Nasdaq Composite has closed lower for seven consecutive days, a streak that has not occurred since November 2016. During this stretch, the index has declined roughly 9%, which is the largest decline over seven trading days for the index since mid-June of 2022. Even during the COVID crash and the continued sell-off during the first half of this year, the Nasdaq never declined for seven straight days. As apparent from the chart below, the frequency of these occurrences has declined substantially since the first 20 years of the index’s history.

As shown in the table below, the median performance following these occurrences does not differ greatly from all periods. Average performance is lower over the following month, three months, and six months, but the positivity rate six months out is identical to that of all periods. The median performance does not differ too greatly compared to all periods across each time frame we looked at. Although investors are likely feeling the pain of this sell-off, there is no evidence suggesting that the forward performance will diverge from the norm.

The chart below provides an alternative way to visualize the consistency of positive returns following seven straight declines for the Nasdaq. Apart from three months forward, the positivity rate for the index was within three percentage points of the norm for every time period we looked at.

More By This Author:

Dollar Index Inflating

Labor Day Holiday Hangover

2022: Not The Year For Optimism

Click here to learn more about Bespoke’s premium stock market research service.

See Disclaimer ...

more