Nasdaq 100: Tech Stocks In Focus After Trump-Fueled Rally

Image Source: Pixabay

While US futures were trading in the negative in early London trade, European stock averages were all in the black, suggesting that sentiment remains upbeat. Technology stocks have been riding a wave of enthusiasm around artificial intelligence and robust earnings reports from corporate giants. The S&P 500 has outshone its peers, fuelled by President Trump’s announcement of a $500 billion investment in AI infrastructure, sending the index to a new all-time high yesterday. The Stargate project, a collaboration with OpenAI, Oracle, and Softbank, has captured investor imagination, focusing attention on growth and productivity gains. For now, valuation and debt concerns have been put to the backburner.

Tech rally propels Nasdaq amid AI optimism

Trump’s decision to boost AI spending lifted megacap tech stocks midweek, even as his protectionist trade rhetoric continues to cast a shadow on some sectors of the global markets. While he has refrained from imposing universal tariffs, the threat of levies on Europe and China still lingers, tempering some of the market’s optimism. However, judging by how the markets have behaved this week, we could see new all-time highs in the Nasdaq soon, despite these concerns.

So, US index futures may have dipped into the red but the familiar “buy-the-dip” mentality could push markets higher by the close. Investors are sifting through Trump’s comments on potential tariffs targeting Mexico, Canada, Europe, and China. His remarks on Europe’s trade surplus with the US and the possibility of a 10% tariff on Chinese goods have stoked concerns, though this figure remains far below the 60% he touted during his campaign.

For now, markets are focused on the balance between growth initiatives, like AI investments, and the looming risks of protectionist policies. Trump’s measured approach to tariffs has provided some breathing room.

What’s on the Radar Today?

Today, traders will keep an eye on weekly US jobless claims data and President Trump’s address at the World Economic Forum in Davos. Fourth-quarter earnings from General Electric, American Airlines, and Texas Instruments are also expected to draw attention.

With the US economic calendar otherwise quiet, markets will likely remain fixated on Trump’s protectionist plans and any hints of inflationary pressures, particularly as the Federal Reserve gears up for next week’s policy meeting, where rates are expected to hold steady.

It is also worth keeping an eye on Oracle and Netflix stock, which were among the top stock gainers following their strong results.

Yesterday saw a standout performance from Netflix, whose shares surged after the streaming giant smashed Q4 expectations. With 19 million new subscribers pushing the total past 300 million, Netflix reported EPS of $4.27 on $10.25 billion in revenue, beating forecasts of $4.20 on $10.11 billion. Strong content, improved product offerings, and seasonal demand drove the impressive growth.

Oracle also enjoyed a strong day, buoyed by its inclusion in Trump’s ambitious AI investment plan. Shares climbed further, adding to a week of robust gains for the software giant.

While both stocks fell from their highs, dip-buyers could step in to keep the momentum going for these stocks.

Technical analysis and trade ideas on Nasdaq 100

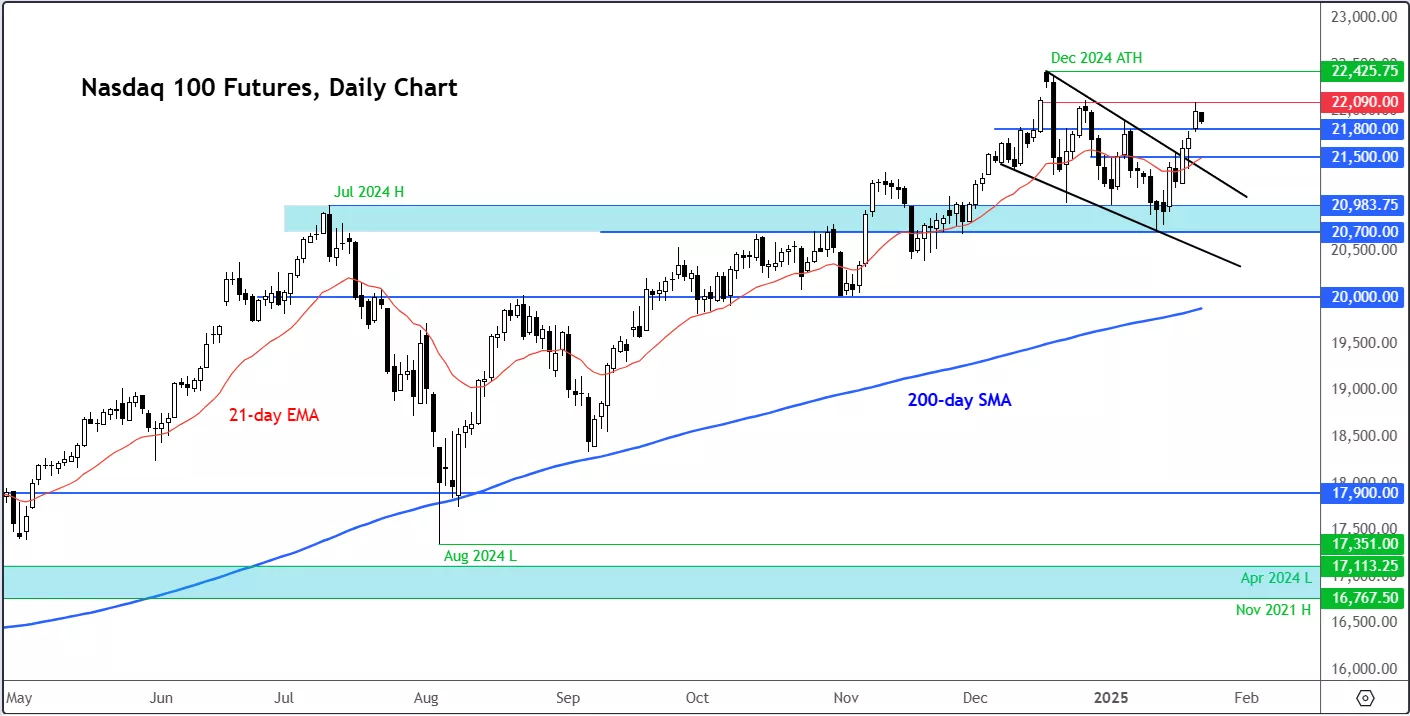

From a purely technical point of view, the trend remains bullish on the Nasdaq, as you can see on this daily futures chart.

(Click on image to enlarge)

Following Trump's inauguration speech, the index broke out of a falling wedge continuation pattern to the upside. It rose above the 21 day exponential moving average and broke a few resistance levels, including 21,500 and more recently 21,800.

While the futures point to a weaker start to today's session, the dip can be bought given that the trend is quite strong. And so those broken resistance levels at 21,800 and 21,500 are the key support levels to watch for a potential buy-the-dip trade.

In terms of resistance levels to watch, 22,090 is an interesting level, marking the high from yesterday. It was also a high from the last week of December. A potential break above that area could pave the way for the December's all time high at 22,425, which is the main bullish target for the falling wedge breakout traders.

At this stage, I wouldn't entertain the idea of shorting this index until and unless we see a bearish reversal formation.

More By This Author:

Japanese Yen Forecast Improves Amid Narrowing Yield Differentials

Could EUR/USD Drop To Parity?

Gold’s Resilience Faces A Key Test Amid Rising Yields