Japanese Yen Forecast Improves Amid Narrowing Yield Differentials

Image Source: Pixabay

The narrowing interest rate differentials between Japan and the rest of the world have been a key theme in the improving Japanese yen forecast in the last couple of weeks. The main USD/JPY pair dropped to fresh five-week lows on Tuesday, before bouncing back to trade in the green at the time of writing, while yen pairs such as the CAD/JPY, which have been falling even more sharply because of Trump’s plans to impose tariffs on Canada’s exports to the US, remained in the red. The yen has also shown relative strength against other commodity dollars as well. Pairs such as the AUD/JPY and NZD/JPY remained on the backfoot.

Bank of Japan rate hike expectations lift Japanese yen

The Bank of Japan’s rate decision on Friday is this week’s key event on the economic calendar this week. But with a 25 basis point rate hike almost fully priced in, could this recent USD/JPY dip offer a buy-the-dip opportunity, or will we see a more decisive bullish trend emerge for the yen?

As US-Japan yield spreads hit five-week lows, USD/JPY followed. However, with inflation risks heightened by potential large-scale tariffs, the recent yield compression may be nearing its limit, you would think. Thus, for the USD/JPY to drop more markedly, we will need to see a hawkish rate hike from the BoJ this week, or a significant deterioration in US data.

Rates markets are currently pricing in two full 25bp hikes by the end of 2025, with the first one arriving this week. Thus, if the BoJ opts for a smaller hike or no hike at all, that could trigger significant downside for the yen.

Tariff speculation undermine CAD and ComDolls

Yesterday, there was initial optimism surrounding trade policy before Trump’s inauguration speech. But later this was overshadowed by news that the Trump Administration is likely to implement 25% tariffs on imports from Canada and Mexico starting in February. So, tariffs are still on the horizon, though not as soon as Trump had made it out to be case.

We initially saw a big relief rally in the likes of the Canadian dollar, Mexican peso, and the euro yesterday as Trump, when addressing tariffs, did not specify a timeline. In fact, he referred to himself as a "peacemaker and a unifier," which suggests he may avoid actions that could cause significant tensions with other nations through sweeping tariffs. However, this should not have been mistaken as a softening of his stance, because later, he said his government would impose 25% tariffs on imports from both sides of its borders.

Trump intends to overhaul the trade system in order to “tariff and tax foreign countries to enrich our citizens” through the creation of an "external revenue service." His goals to reform international trade policies clearly prioritize American industries and aim to reduce trade deficits. By imposing tariffs on imports, revenue would be redirected toward domestic economic growth and infrastructure development.

Yen pair to watch: CAD/JPY

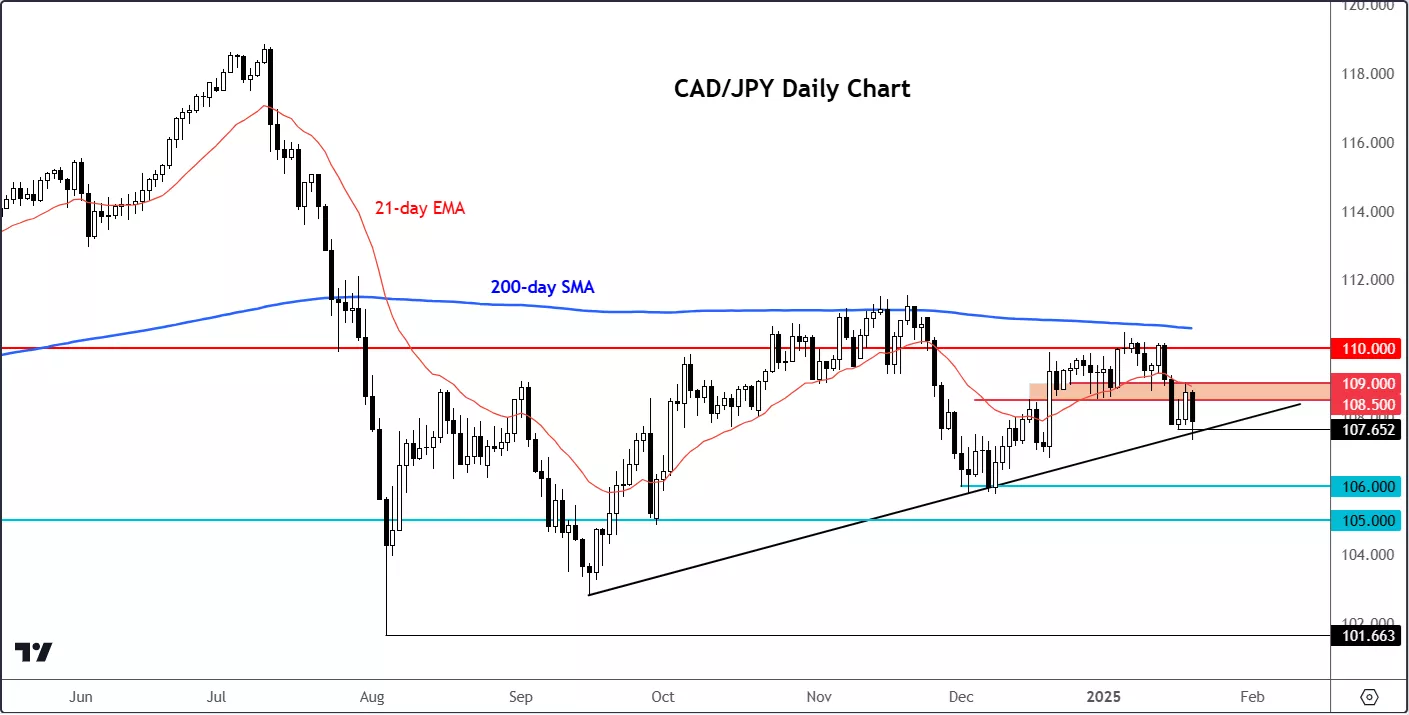

We have already seen repeated multi-year highs in the USD/CAD pair in recent months, and the Loonie hit a new high of just above 1.4500 overnight following Trump’s February 1 tariff threat, and despite its sizeable drop the prior day. Now with the USD/JPY moving into consolidation mode, the ongoing weakness in the CAD means the CAD/JPY pair could be poised for a breakdown.

(Click on image to enlarge)

The CAD/JPY has tried to break below its bullish trend line, but so far, the bears haven’t been quite successful. However, as the yield spread between Japan and the rest of the world narrows, while risks of tariffs for Canada’s exports grow, we could see the CAD/JPY break lower and potentially head down to the next support levels situated at 106.00 and then 105.00.

USD/JPY technical analysis: Key levels to watch

With the US dollar still remaining largely supported against other currencies, the USD/JPY currency pair may not be the best yen cross for those who are bullish on the Japanese currency. Still, given the narrowing yield spreads, I do think the upside is fairly limited for the UJ from here.

(Click on image to enlarge)

USD/JPY’s dip overnight was brought around the minor horizontal support at 155.00. However, if rates resume lower and we go below this level, then you have a short-term uptrend that was established from September, around 144.00, to keep an eye on, followed by the 200-day moving average around 152.80 area.

For traders who are bullish the USD/JPY, they will now want to see rates breaking key short-term resistance around 156.00-156.75 area. A decisive break here would signal bullish sentiment, potentially opening the door for follow-up technical buying towards 160.00. But this is not my base case scenario.

More By This Author:

Could EUR/USD Drop To Parity?Gold’s Resilience Faces A Key Test Amid Rising Yields

EUR/USD: Bearish Pressure Deepens As Tariff Concerns Resurface