My Peloton Stock Price Forecast Was Accurate: Now What?

Peloton Interactive (PTON) stock price is firing on all cylinders after the highly-embattled company published modest results and pivoted towards profitability instead of growth as it did in the past. It made an up-gap and rose to the important resistance point at $5, its highest swing since March 14. It has risen by over 71% from its lowest point this year.

Peloton’s turnaround continues

Peloton Interactive has gone through a rough patch in the past five years. Its stock initially surged to a record high of $170 in 2021 as demand for its hardware and software surged during the Covid lockdowns. At its peak, its market cap surged to over $53 billion.

The pandemic was a bittersweet for the company as its revenue surged to over $4 billion. However, the implication was that the company manufactured more bikes and treadmills expecting that demand would remain high forever. As a result, its inventory rose from $244 million in 2020 to over $1.1 billion in 2022.

To deal with that inventory, Peloton shifted gears and changed its strategy. Instead of selling its products just in-house, it added them in other mainstream shopping platforms like Amazon.

This transition has not had a major impact on the company as its annual revenue dropped from a peak of $4 billion in 2021 to $3.5 billion in 2022, $2.8 billion in 2023, and $2.7 billion in the last financial year.

It has also become a cash incinerator, with its net loss peaking at $2.8 billion in 2022. It then narrowed to $1.2 billion and $551 million in the next two financial years, respectively.

Latest earnings report

The main catalyst for the Peloton stock price surge was its recent financial results, which showed that the company made some modest progress, albeit from a low base.

The number of members dropped by 2% YoY to 6.4 million while the number of subscribers fell by 1% to 2.8 million. Ending paid app subscriptions fell by 26%.

While the company hailed the low churn, I believe that the user trends are not good since the company is not adding members as it did before. Also, I suspect that churn will increase over time because of the general trends in the fitness industry. Ideally, most people subscribe to fitness solutions and then give up along the way.

The results showed that its total revenue stood at $643 million in the last quarter, up slightly from the $642 million it made a year earlier. This revenue was mostly because of its subscriptions, which brought in over $431 million while its connected fitness products dropped by 4% to $212 million.

The subscription business had a gross margin of 68.2%, which is a good one since a company like Netflix has a margin of 43.84% while Spotify has 27.54%. The New York Times has a margin of 48% while Zoom Video has 76%.

The high gross margin figure means that Peloton Interactive has room to expand its profit margin in the future. Its net loss improved from $240 million to $30.4 million while the company’s free cash flow rose to $26 million.

Peloton expects that its paid subscriptions will move to 2.98 million while its annual revenue will be $2.7 billion and its adjusted EBITDA will be $3.5 million. Analysts see its revenue coming in at $2.61 billion.

Still, I believe that one quarter of improved metrics does not reflect the company’s bigger picture as its business continues to face challenges. Competition is still a big issue while its hardware sales have little room to grow in the future.

Therefore, I believe that we need some more quarters of growing revenues and memberships to justify the company’s stock surge.

Peloton stock price analysis

(Click on image to enlarge)

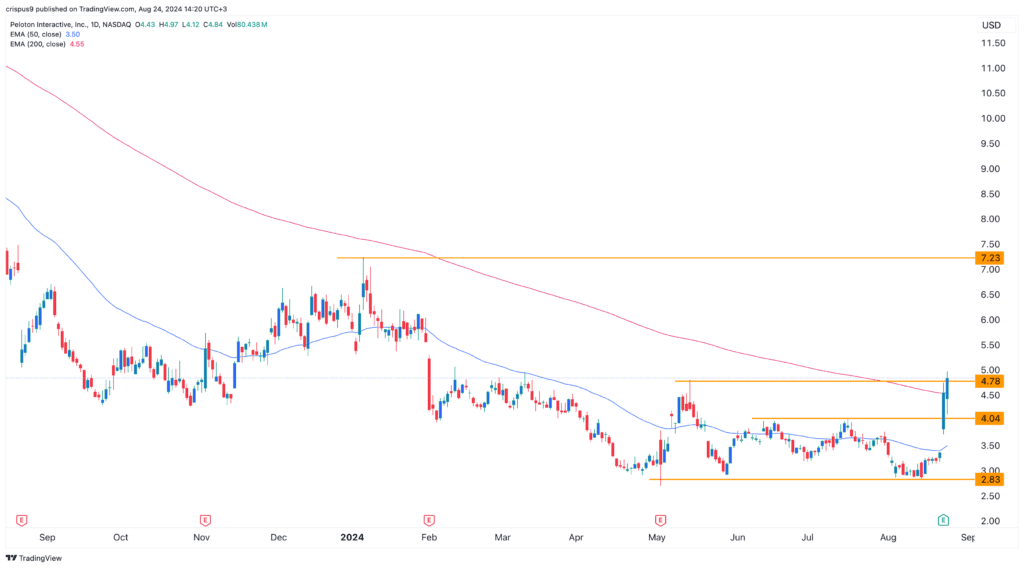

The daily chart shows why the PTON share price has surged in the past few days, as I predicted in July. Its jump happened after the company formed a double-bottom pattern at $2.83. It has now moved above the first neckline at $4 and the second one at $4.78, its highest point on May 14.

Peloton has also jumped above the 200-day Exponential Moving Average (EMA), meaning that bulls are in control. Therefore, in the short-term, Peloton could rise to the next pivotal resistance point at $7.23.

However, in the long-term, there is a risk that the Peloton share price will drop as investors wait for more clarity about its business recovery.

More By This Author:

Avoid Virgin Galactic Stock: Buy Rocket Lab Instead

Hedge Funds Turn Bearish On S&P 500 (SPY ETF); Double-top Forms

EIS ETF: Should You Buy During The Escalating Israel Conflict?

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more