Avoid Virgin Galactic Stock: Buy Rocket Lab Instead

The space industry is growing and nearing a pivotal era as companies like Virgin Galactic (SPCE), Blue Origin, and SpaceX start offering their services. A report by Morgan Stanley estimates that the industry is worth about $350 billion and that it will get to $1.8 trillion in 2035.

It is hard to get in, as evidenced by Virgin Galactic’s history, which began 20 years ago. As such, the existing companies, which are too far ahead in their development, are the ones set to prevail and dominate.

For investors, Virgin Galactic and Rocket Lab are two options to consider. This article looks at the two of them and explains why the latter is the better option.

Virgin Galactic could run out of cash

Virgin Galactic, backed by Richard Branson, is a company whose end goal is to make space travel mainstream.

To that end, the company has achieved many milestones, including certification and taking tourists to space.

Now, the management is working on two Delta space crafts, which will carry more passengers when they start commercialization in 2026.

Virgin Galactic has also completed building a final assembly plant in Arizona, which will be used for the Delta Class spaceships.

The company has hundreds of reservations – for a trip priced at over $450,000 – and it believes that its flights will be profitable within a short period.

The only risk, as I have written before, is that Virgin Galactic could run out of money, forcing a distress sale or bankruptcy. Besides, Virgin Orbit, its sister company, filed for bankruptcy last year.

On paper, things look good as the company has over $821 million in cash, equivalents, and marketable securities. It is also narrowing its losses, as it did in the last quarter when its net loss came in at $94 million.

However, Virgin Galactic will burn more cash between now and 2026 when its commercial flights are expected to start. The cash burn will also continue as the company moves to scale its operations.

Worse, the stock has crashed, giving it a market cap of $202 million while Richard Branson has ruled out giving it more cash. Therefore, it could struggle to stay afloat unless the management finds a way of raising cash, probably through convertible debt.

Rocket Lab is a better space stock

Like Virgin Galactic, Rocket Lab’s stock has not done well since its SPAC merger in 2021. It has crashed by over 67%, giving it a market cap of over $3.4 billion.

The two companies are significantly different from each other. SPCE focus is on space tourism while Rocket Lab offers end-to-end solutions, including launch services, spacecraft design, and spacecraft manufacturing.

It has also started making money. Data shows that its annual revenue has grown from over $48 million in 2019 to over $244 million in 2023.

This growth was seen its recent financial results as its total revenue came in at $106, or 43% of what it made in the whole of 2023. The revenue was also 15% higher than what it made in the previous quarter.

Additionally, the company’s backlog jumped to $1.06 billion, made up of commercial and government agencies like NASA and the Department of Defense (DoD).

The company hopes that its Q3 revenue will be between $100 million and $105 million, with its space systems generating between $79 million and $84 million. It also expects that its gross margins will improve to about 27%.

Therefore, Rocket Lab has room to grow its business as space launch demand rises and as the management shifts gears to focus on profitability.

Rocket Lab stock has strong technicals

(Click on image to enlarge)

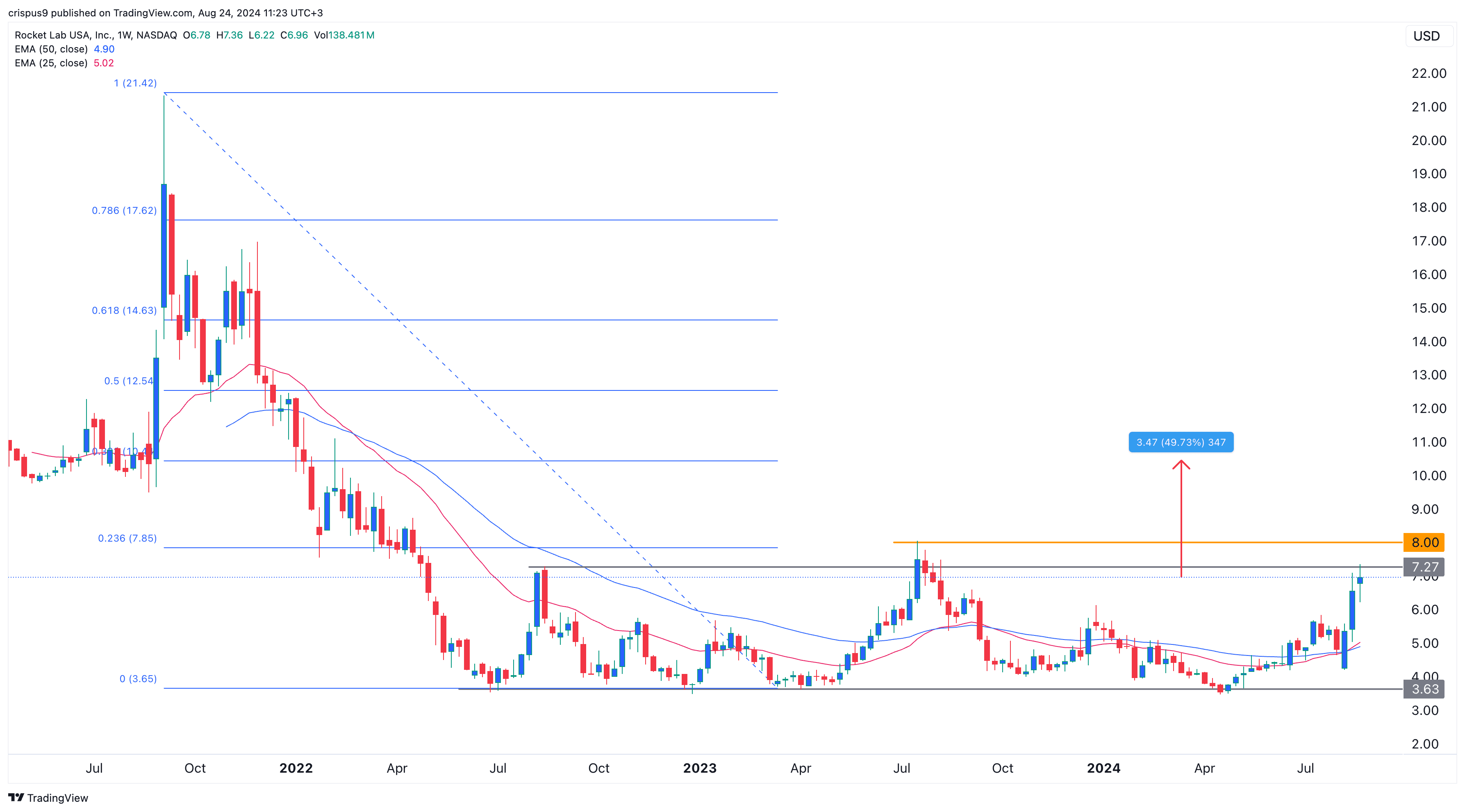

The other reason to invest in Rocket Lab is that it has some solid technicals. On the chart above, we see that it found a strong support at $3.63, where it failed to move below since July 2023. It has struggled to pass below that level at least six times since then.

Now, it has rallied and is approaching the 23.6% Fibonacci Retracement level. It has also jumped above the 50-week moving average and is approaching the resistance point at $8, the neckline of the multiple bottoms at $3.63.

Therefore, the path of the least resistance for the stock is bullish, with the initial target being at $8. A break above that point will open the possibility of it moving to the 38.2% retracement point at $10.42, which is about 50% above the current level.

More By This Author:

Hedge Funds Turn Bearish On S&P 500 (SPY ETF); Double-top FormsEIS ETF: Should You Buy During The Escalating Israel Conflict?

Charles Schwab Stock Price Is At Risk As Death Cross Nears

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more