My Dirty Dozen Undervalued Dividend Growth Stocks

Introduction

Relative to historical norms the overall stock market as measured by the S&P 500 is overvalued with the current blended P/E ratio of 19.2. Historically, the S&P 500 would be considered fairly-valued when its P/E ratio was between 15 to 16. Therefore, some could argue that the market is not terribly overvalued, but instead fully valued or simply highly valued at this time. Regardless, it is a historical fact that today’s stock market valuation is not low.

As it relates to best-of-breed dividend growth stocks, the valuations are even more extended than the overall stock market. Chronically low interest rates have increased the demand, and therefore, the valuations of high-quality dividend growth stocks. With this said, I am fully aware that there are those who would consider this introduction as merely stating the obvious. However, I have a very specific, and in my view, important reason for providing the above summary.

As I have stated numerous times in the past, I believe in a market of stocks in contrast to a stock market. However, I also find myself in the minority. Most people that I come across seem to be concerned about what the market might or might not do in the near future. As a result, they tend to lump all stocks into the same basket. Personally, I evaluate each stock I own or that I am interested in individually based on their own fundamental merits.

Consequently, I am constantly searching for attractive value regardless of general market levels. Therefore, with this article I will be covering 12 dividend growth stocks that I consider undervalued despite the general high level of the overall stock market currently. After all, this is what value investors do.

Principles of Value Investing: How and When It Works

The idea that value investing and long-term investing go hand-in-hand is critically important to understand. Value investors are not market timers. Instead, value investors are interested in long-term results generated at the lowest risk possible and with as much certainty as possible. In this regard, value investors clearly understand that forecasting short-term movements in a stock’s price is an exercise in futility, and therefore, an exercise in uncertainty.

Additionally, value investors also understand that fundamentals are what generates true value in a business. Long-term investors position themselves as stakeholders in fine businesses, and as such, concern themselves more with how the business they own is performing than they do how a fickle stock market might be treating it in the short run. Value investors also understand that short-term price volatility is the side effect of liquidity. In the short run, buy and/or sell decisions are often based on emotional responses and not deep analysis.

This is the real meaning of Ben Graham’s famous metaphor: “The father of value investing, Benjamin Graham, explained this concept by saying that in the short run, the market is like a voting machine–tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine–assessing the substance of a company.” To my way of thinking, Ben Graham’s message is quite clear. In the long run it’s the underlying performance of the business that matters most, and not the investing public’s too often fickle opinions in the short run.

This important principle about value investing is also summed up by many popular clichés offered up by Ben Graham’s most famous student Warren Buffett. Statements such as “you can’t buy what’s popular and expect to do well” or “be greedy when others are fearful and fearful when others are greedy” support the value investor’s goal of exploiting other people’s folly. However, it’s important to understand that this exploitation takes place over the years – not days or weeks. Consequently, one of the true hallmarks of a successful value investor is the willingness and the patience to take a long-term view. Furthermore, this is most easily accomplished when you focus on fundamentals over price volatility.

12 Undervalued, Above-Average Yielding, Dividend Growth Stocks

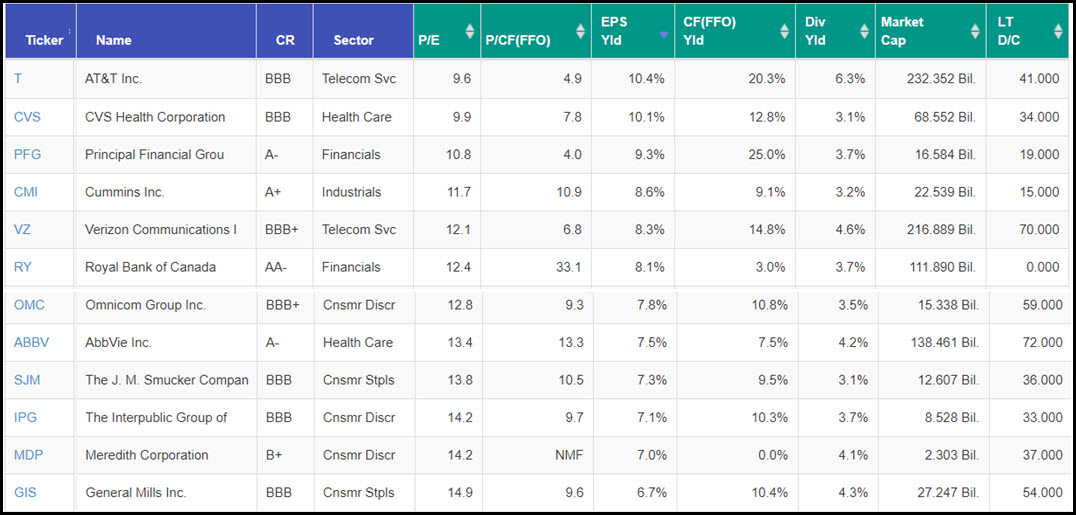

The following portfolio review lists 12 above-average yielding and currently undervalued dividend growth stocks listed in order of highest earnings yield to lowest. The concept of the earnings yield is critically important, and in my personal experience often overlooked or ignored by investors. This most commonly occurs when investors get attracted to a stock that has great short-term performance. Caution is often thrown out the window because like moths to a light, investors get caught up in chasing short-term performance with little or no regard to excessive valuation and the risk it brings.

Earnings yield is a simple calculation that is the inverse of the P/E ratio. To calculate earnings yield you divide a company’s earnings by its current price. A simple way to think about earnings yield is to relate it to your being the sole owner of the business and therefore entitled to all of the company’s profits. The question you must ask, and answer, is whether the yield that all of the company’s profits offer you compensates you adequately for the risk of investing in an equity (business). My personal threshold is a minimum earnings yield of 6 ½ to 7%. A quick review of the earnings yield column in the following table shows that each of the companies in my “dirty dozen dividend growth stocks” offer earnings yields greater than my minimum threshold.

In the following FAST Graphs analyze out loud video I will provide a clear illustration of how each of these research candidates appear currently undervalued based on fundamental strengths. However, since I will be covering 12 companies, I will only be hitting the high spots of valuation. My general purpose is to provide attractive options that the reader might want to research more comprehensively on their own.

Summary and Conclusions

The key takeaway that I hope the reader experiences from this article is the importance of taking a long-term view as a value investor. The crucial understanding to being able to accomplish this is the acknowledgment and recognition that fundamental results take time to manifest. Companies report their operating results quarterly, and it takes several quarters – and even years – for a company to grow earnings and cash flow enough to generate sufficient increases in shareholder value. This is not an overnight occurrence.

In this same vein, if each of the company’s highlighted in the video achieve operating results within a reasonable range of what is being forecast, the long-term returns and dividend growth would be exceptional. Moreover, over the longer run the stock prices of the stocks will inevitably move back into alignment with the increases in intrinsic value that these businesses are generating. Remember, in the long run the market is a weighing machine.

Disclosure: Long ABBV, CMI, CVS, GIS, MDP, PFG, RY, SJM, T, VZ

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a ...

more

What about $BKEP?