Money And Smiles: The Debt Ceiling

The debt ceiling is a ridiculous political tool that is hurting the economy, the banks, and the stock market.

Dollars and Smiles

For a currency-creator, money is like smiles for an individual; neither can run out of either. Which is why the 'debt ceiling' is akin to economic self-harm. Imagine not allowing yourself to smile at your children or your friends because you have reached some arbitrary limit of smiles. Insane, right? Well, by not raising the debt ceiling, that is exactly what the US Congress is doing. Because of the debt ceiling, there can be no deficit spending when it comes to the Federal budget; all Federal spending must be "paid-for".

If the government spends (creates) more dollars than it taxes back (cancels), then it has an accounting deficit which represents the dollars that are left in the economy as a private sector surplus.

Government Deficits = Private Sector Surpluses

Since deficit spending is a net transfer of money to the private sector, a balanced budget prevents the private sector from increasing its wealth: a balanced budget means that all dollars delivered by government spending must be taxed back and destroyed. Since the government is the monopoly currency-creator (monetary-sovereign), it does not need and does not use tax dollars to pay for anything; it creates every dollar it spends and cancels every dollar it collects in taxes.

As Stephanie Kelton states:

...“finding the money” is never the challenge for governments that issue their own non-convertible—i.e. floating exchange rate—fiat currencies... Anything that is technically feasible is financially affordable.

Limiting the government "debt" started in 1917 during WWI. It could be argued that the debt ceiling made some sense while under the gold-standard monetary system, but under a fiat monetary system, it makes no sense at all--illustrated by the fact that the ceiling has been raised during every administration since Herbert Hoover.

Nobody in Washington seems to realize that the US budget is not like a household budget--the US government can choose to default, but can never be forced to default. The "national debt" is not "debt" as experienced by households and corporations (currency-users, not currency-creators). The "debt" is a vestigial left-over of the gold-standard system, which functions to drain reserves, control interest rates, support the dollar (by creating interest payments for those who already hold dollars), and is an accounting record of the government spending that has not been taxed back, i.e. dollars left in the economy. It is not borrowing; the government created the dollars in the first place.

It is becoming increasingly apparent that the entire GOP, and several democrats, are 'hell-bent' on not raising or eliminating the arbitrary debt-ceiling and forcing a government shutdown. This uncertainty has already started to aggravate and increase the severity of the seasonal pattern of weakness that is usual as we enter the government's new fiscal year.

Fund Flows

The economy and the stock market are driven by the fund-flows coming out of the Treasury and the credit creation of the banks.

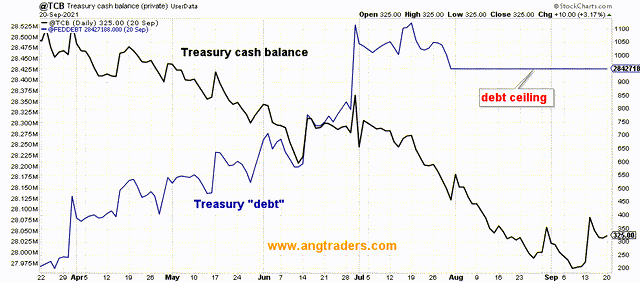

Up to this point, the Treasury has managed to continue deficit-spending--even though the (arbitrary) debt ceiling prevents it from selling Treasury securities--by drawing down its TCB (Treasury cash balance), and "shuffling" funds inside certain agency accounts (these will need to be replenished after the ceiling is raised). However, Yellen has repeatedly warned that the US Government will start defaulting on some of its obligations by mid-October. The chart below shows the drawdown of the TCB.

Source: ANG Traders and stockcharts.com

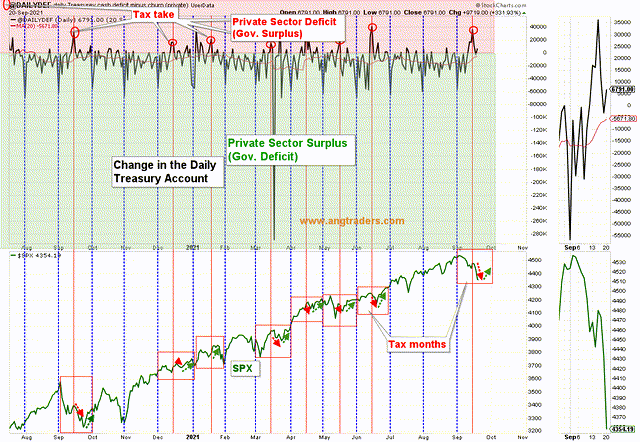

The stock market is supported by funds created by the daily Treasury deficit (transfer to the private sector). As we have been pointing out to our subscribers, the average daily net transfer to the private sector, since the debt ceiling was implemented at the start of August, has dropped from $18B/day to less than $6B/day. This, along with the September Tax collection (red oval below) has forced the stock market lower (chart below).

Source: ANG Traders and stockcharts.com

If the 'insane' debt ceiling is not raised in time, the Treasury deficit-spending will end altogether and the stock market will pay a price (the uncertainty has already caused damage).

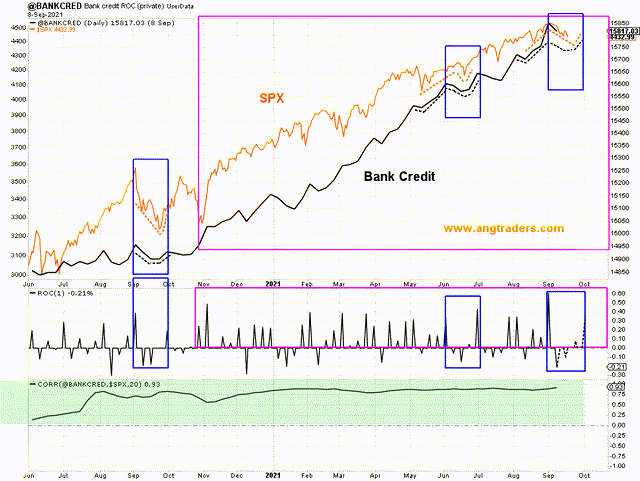

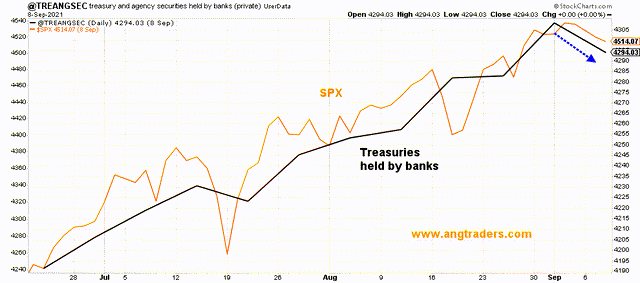

In addition to the reduction in Treasury net-transfers, the other source of money, bank credit creation, has also decreased and is expected to follow a similar pattern as September of last year and this past June (blue rectangles). The pattern implies that bank credit and the SPX will be lower over the next week, but increase the week after (chart below).

Source: ANG Traders and stockcharts.com

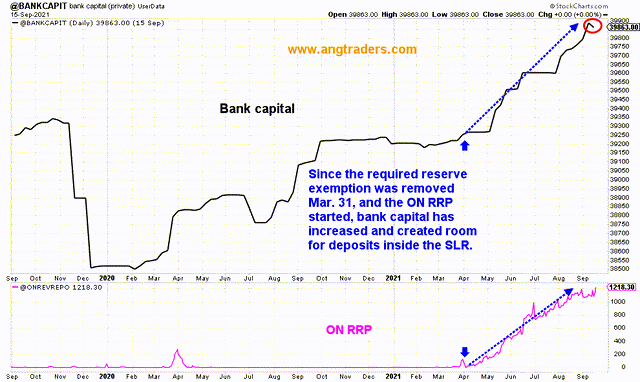

Banks need to maintain their lending ratios (SLR) that include their own bank capital and reserves on deposit. With reserves rising, and the termination of the required reserves exemption back in March, the banks would have had their ability to lend severely constrained if it hadn't been for the Fed's overnight reverse repurchase operations (ON RRP) which started in April. This reserve-drain operation has allowed the banks to continue lending (credit-money creation) and to continue adding funds to the economy (and the stock market). The chart below shows how bank capital has grown since April but dropped in the latest week for the first time since February (red oval).

Source: ANG Traders and stockcharts.com

With the debt ceiling in place, the banks are having difficulty maintaining their optimum level of Treasury holdings which is resulting in lower credit-creation and slower fund flow to the stock market (chart below).

Source: ANG Traders and stockcharts.com

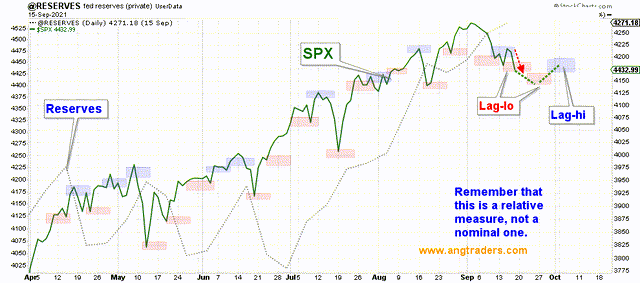

This agrees with our proprietary reserve study which is predicting lower prices again this week (chart below).

Source: ANG Traders and stockcharts.com

The debt ceiling is a major confounding factor in the fund flows that are required for the stock market to continue rising. If the ceiling is not raised or eliminated in the next two weeks, parts of the government will have to be closed down and the rough patch in the stock market will continue. Investors should not be surprised if weakness in stocks lasts well into October.