Moderna Is Melting - Why I Am Buying This Dip

Maddie Meyer/Getty Images News

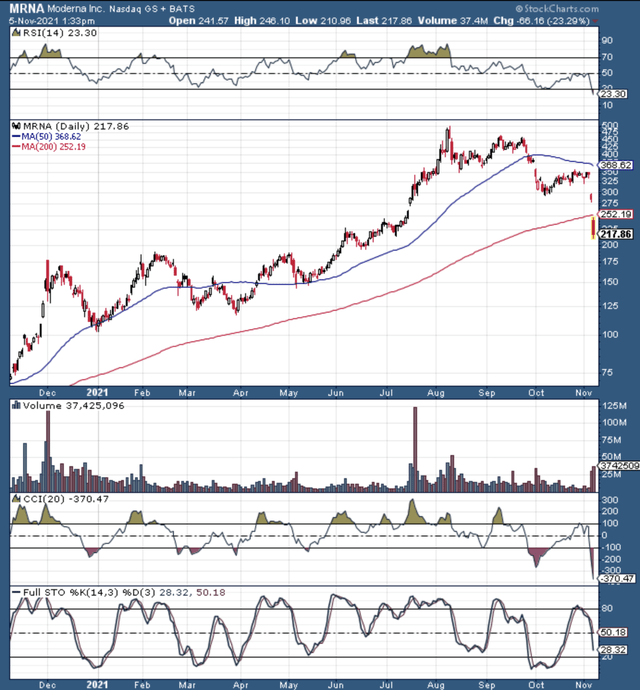

Shares of Moderna (MRNA) are getting crushed after the company's weaker than anticipated earnings release and the Pfizer (PFE) pill announcement. The stock was down by 18% yesterday, followed by another 25% decline today. Now, shares are off by more than 50% from the company's all-time high of around $500. At $180 - 200, Moderna becomes a strong buy again, in my view. I am a buyer of this dip as shares are likely heading into this support area. The company arguably has the best COVID-19 vaccine on the market, and the company has enormous revenue and income-generating potential in its pipeline. Moreover, the company's COVID-19 vaccine should continue to bring in substantial profits in future years. Moderna will likely become increasingly more profitable as the company moves forward, and the company's share price should move substantially higher from here.

Moderna: Falling Off A Cliff

Source: stockcharts.com - Moderna, falling off a cliff right now after missing earnings and Pfizer's COVID-19 pill announcement. In the $200 range, the stock looks increasingly attractive and is a strong buy, in my view.

Moderna: Huge Potential Ahead

It seems like there are more and more restrictions for the unvaccinated these days. People who refuse to get the COVID-19 shot face increasing restrictions at jobs, restaurants, sporting events, entertainment venues, travel, and so on. Moreover, this phenomenon is transitioning into increased isolation for the unvaccinated. No one wants to feel like they are being targeted, and most people certainly don't want their way of life to be affected in a negative sense.

Some Examples of Restrictions:

- If you want to catch a Celtics or a Bruins game at the TD Garden in Boston, you need to provide proof of vaccination or a recent negative COVID-19 test. It's not just the Celtics, as about half of NBA teams now have similar requirements.

- So, you want to go to a restaurant in San Francisco? Please provide your COVID-19 vaccine certificate. It's not just restaurants, because if you're going to do just about anything indoors in San Francisco (bars, significant indoor events, fitness centers, etc.), you need to show proof of vaccination. Naturally, it's not just San Francisco, as Los Angeles and other major U.S. cities are instituting various restrictions.

- President Biden's administration announced that all businesses employing 100 or more people must require vaccinations or submit their employees to regular COVID-19 testing. Large companies like Facebook/Meta Platforms (FB), Alphabet (GOOG), (GOOGL), and others already have similar policies in place.

These are just several examples, but I think you see where this is heading. Whether many people like it or not, we are heading towards a primarily vaccinated society. This dynamic is not a U.S. phenomenon, as we see a similar activity developing in Europe, Asia, and across other areas in the world. Also, I want to emphasize a point here. While being a part of a "vaccinated society" is nothing new for most people, COVID-19 is a recent phenomenon, as revaccinations could be required perpetually for most people. This new dynamic creates a sustainable and continuous revenue/income generating market for Moderna.

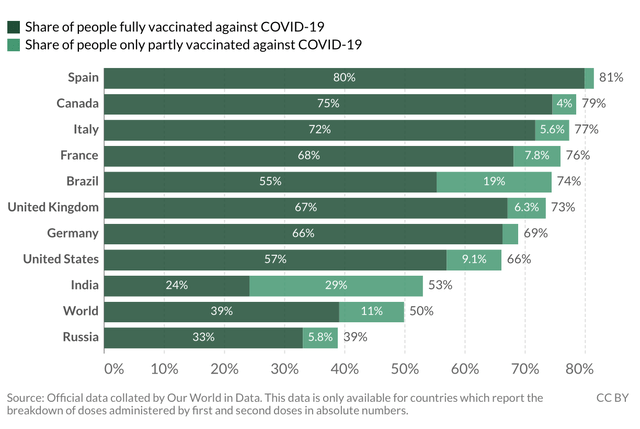

Here are some statistics:

Share of people vaccinated against COVID-19 as of Nov 3rd, 2021

Source: CNBC.com

We see that many countries now have relatively high vaccination rates. With the numerous restrictions and COVID-19 guidelines in many countries, high vaccination rates will likely persist. Now, of course, not all people are being vaccinated with the Moderna vaccine. Other major vaccine makers like Pfizer, BioNTech (BNTX), Johnson & Johnson (JNJ), and AstraZeneca (AZN) are present in the market.

However, mRNA technology-based vaccines are amongst the best vaccine options, and Moderna has the edge over Pfizer/BioNTech. Studies suggest that more antibodies are observed for longer in individuals with the Moderna vaccine over Pfizer. There is also an indication of fewer breakthrough infections amongst Moderna recipients relative to the Pfizer vaccine. Probably the most significant advantage is Moderna's storage needs.

The company's vaccine can be stored at -20 Celsius, while Pfizer's needs to be colder than Antarctica at -70 Celsius. This temperature difference alone provides Moderna with a massive logistics advantage over Pfizer/BioNTech. It will be much more difficult and costly to successfully deliver the Pfizer vaccine to many areas around the globe than Moderna's vaccine.

Therefore, Moderna has the vaccine advantage, as the company has the best product in the global marketplace today. Moderna's vaccine has exceptionally high efficacy, is considered highly safe, and doesn't face the same logistic challenges as its mRNA counterpart Pfizer offers.

The Earnings Miss

Moderna missed on revenues and EPS. The company also guided lower for the full year.

- EPS came in at $7.70 vs. the $9.05 expected.

- Revenues came in at $5 billion vs. the $6.2 expected.

- The company now expects COVID-19 vaccine sales of $15-18 billion this year, down from prior estimates of $20 billion.

- Moderna also lowered its expected dose delivery from 800-1000 million to 700-800 million this year.

- The company projects sales of $17-22 billion next year.

The Takeaway

Analysts and expectations got ahead of themselves. However, that does not make Moderna a lousy investment. First, we must realize that Moderna is still a very young company.

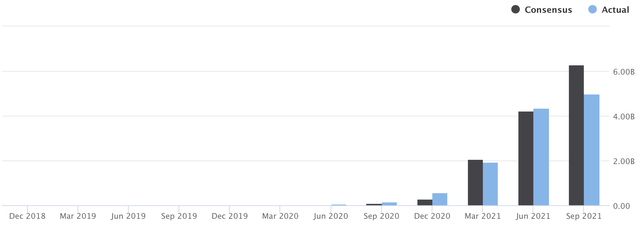

Quarterly Revenues/Surprises

Source: seekingalpha.com

Moderna has been a public company for fewer than three years. The firm used to generate about $10-20 million per quarter, and now the company is doing $5 billion. There are going to be some issues when you are scaling at this pace. The company confirmed that some doses scheduled for 2021 delivery were shifted to 2022 due to production issues. Moderna is also facing transitory issues due to increased supply chain complexity. Moderna supplied vaccines to just a few big countries at the beginning of the year, but the company is increasingly making deliveries to many countries worldwide.

It is not easy to pinpoint precisely where revenues and earnings will be at this early point in Moderna's development cycle. However, it is crucial that Moderna is improving its supply chain and is gaining market share in numerous countries around the globe. This expansion process should enable Moderna to cement its presence as a dominant COVID-19 vaccine provider on a global scale.

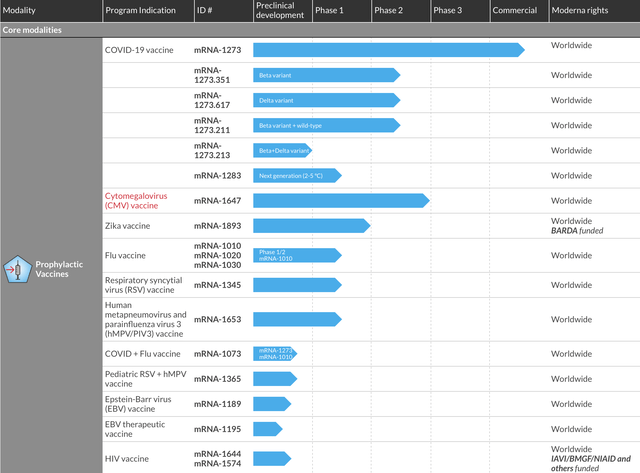

Much More Than a COVID-19 Vaccine Maker

Although the COVID-19 vaccine should be Moderna's prominent near-term blockbuster revenue and income generator, Moderna is much more than just a one-trick pony. The company possibly has the most advanced technology in the mRNA field, and it should continue to lead in this highly lucrative space in future years.

Moderna's Rich Pipeline

Source: modernatx.com

Moderna is a young company that is highly capable. Many of the company's efforts have been focused on the COVID-19 space, but the company has numerous projects in the development and clinical trial phases. We know about Moderna's primary COVID-19 vaccine, but the company also has several variant-specific vaccines in clinical trial phases.

Moderna has a CMV vaccine in phase two, a Zika virus vaccine in phase one, mRNA flu vaccines in phase one, and more. The company also has an HIV vaccine in early development, and that's not all. Moderna has personalized cancer vaccines "PCVs" in phase two trials, and Immuno oncology research moves forward.

To put it plainly, the company is working on a lot right now. Due to its booming COVID-19 vaccine business, Moderna now has the substantial cash flow required to realize success in its other projects. Being a leader in mRNA technology combined with significant profits from its COVID-19 program should enable Moderna to bring numerous other vaccines and treatments to market in future years.

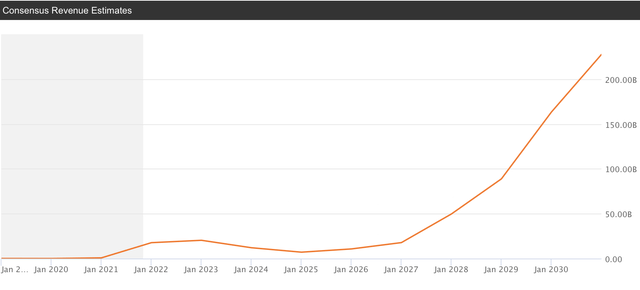

Moderna: Revenue Estimates

Source: seekingalpha.com

Moderna should achieve close to $18 billion in revenues this year and hit above $20 billion next year. The good news is that Moderna should see record revenues and EPS in H1 2022. However, we will likely see a period of transitory revenue and EPS decline at Moderna. The company will likely see a temporary decline in sales as new vaccine makers like Novavax (NVAX) and others bring new COVID-19 shots to market. Nevertheless, due to Moderna's numerous projects, advanced technology, and advantageous market position, the company should return to substantial revenue growth in future years.

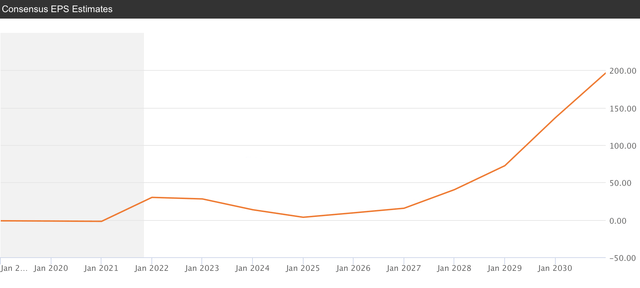

EPS Estimates

Source: seekingalpha.com

We see a similar image in EPS projection estimates. Moderna should see transitory peak earnings around here, but the company's EPS will likely increase substantially after a period of transitory decline. Given the likely earnings dynamic, Moderna's P/E ratio will likely fluctuate in the coming years before declining into 2025 and beyond.

Here is what Moderna's financials could be in future years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenues $Bs | 21.2 | 17.5 | 13 | 18.2 | 25 | 37 | 48 | 65 | 81 |

| Revenue growth | 4.5% | -17% | -26% | 40% | 38% | 48% | 30% | 35% | 25% |

| EPS | $28 | $15 | $9.5 | $17 | $25 | $39 | $58 | $85 | $120 |

| Forward P/E ratio | 23 | 42 | 35 | 36 | 31 | 28 | 26 | 23 | 20 |

| Price $ | $350 | $400 | $600 | $900 | 1200 | 1600 | 2200 | 2800 | 3300 |

Source: Author's material

While these estimates may look optimistic, they are pretty tame relative to some of the more bullish expectations from Moderna on Wall St. I have Moderna's revenues coming in slightly above $80 billion in 2030, yet some analysts anticipate $200 billion or more by this time. Nevertheless, I think it is better to remain conservative than to be overly bullish right now. Also, I believe that Moderna's stock can increase by over 10x through 2030 from its depressed state right now. The stock is trading at just seven times 2021's consensus EPS figures, and the company is going to increase YoY revenues by over 2,000% this year. We have an atypical valuation scenario with Moderna. However, the valuation begins to make more sense when we consider that the company will go through a transitory earnings and revenue decline in 2023-2024 but should still come out well ahead in future years.

Risks To Consider

Despite my bullish outlook and high stock price expectations, market participants should consider that Moderna is an elevated risk investment. Various factors could derail Moderna from its trajectory. It's possible that the company may not produce more blockbuster vaccines or other treatments. It is also possible that increased competition from other vaccine makers will dwindle Moderna's COVID-19 vaccines revenues. The company could run into trial difficulties, or the coronavirus could transform into a highly manageable disease sooner than we think. The bottom line is that it is possible Moderna's stock can decline from here and may never significantly recover again. These factors are all potential, and Moderna should be approached with increased caution when considering the company for a long-term investment.

Disclosure: I/we have a beneficial long position in the shares of MRNA, GOOG, FB either through stock ownership, options, or other derivatives.

Disclaimer: This article expresses solely my ...

more