Models That Are Predicting A Headwind For The Stock Market

We have developed a stable of proprietary models that track the S&P500 (SPX) with a high correlation. In this piece, we demonstrate four of these models.

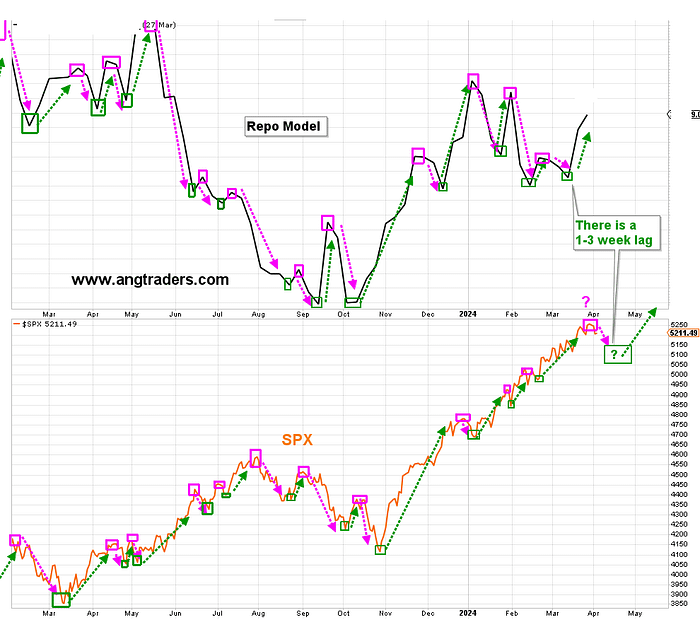

The Repo Model has a positive correlation with the SPX on a 1–3 week time lag. The model made a local low (green box) a couple of weeks ago which means the SPX should make its local low in the next couple of weeks (chart below).

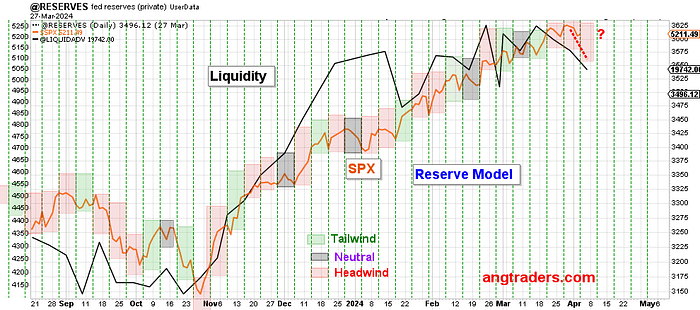

The chart below, shows two models: the Liquidity Model, and the Reserve Model. Both models show weakness going into the second week of April.

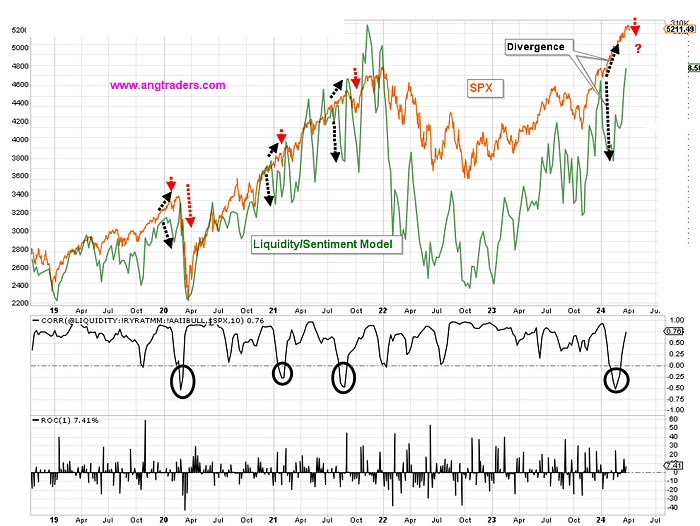

Our newest model is the Liquidity/Sentiment Model. It shows a strong positive correlation of 0.75, and the last three times that the correlation flipped negative (black-ovals) and the SPX diverged from the model, a pullback in the SPX followed a month of two later. January had a divergence, and the model is currently over-extended which implies that the SPX is close to a local-high (chart below).

More By This Author:

Look For The Money Source

If You Like The Dotcom Bull Market, You Are Going To Love The Next Few Years.

Like Amputating Your Toes To Fit Your Shoes

Join us at angtraders.com during the month of April and get 20% off!