Mid- And Small-Caps Lag Large-Caps From Oct ’22 Lows, But Neck And Neck From ’23 Lows

With the 4Q earnings season nearly over, large-caps were in the black last year, while mid- and small-caps were in the red. The latter two have underperformed the large-caps from Oct ’22 lows but are running neck and neck from last year’s lows. The mid-caps are at a crucial juncture technically, and a breakout can help broaden the rally, which otherwise is narrow.

The fourth-quarter earnings season is just about over. As of last Tuesday, 92 percent of S&P 500 companies had reported their results, with blended estimates at $51.52, which is up 2.3 percent from a year ago but much lower than the consensus estimates at $57.38 when the December quarter began.

The picture is much worse for the mid- and small-caps.

Blended estimates for S&P 400 companies were $34.84. When the fourth quarter began, the sell-side was expecting $43.95. From a year ago, 4Q earnings are down 15.1 percent.

Fourth-quarter earnings are also down for S&P 600 companies, which saw the blended estimates drop 13.2 percent from a year ago to $14.99. When the December quarter began, the consensus stood at $21.94.

As the estimates progressively got lowered through the quarter, so was the bar for these companies to jump over.

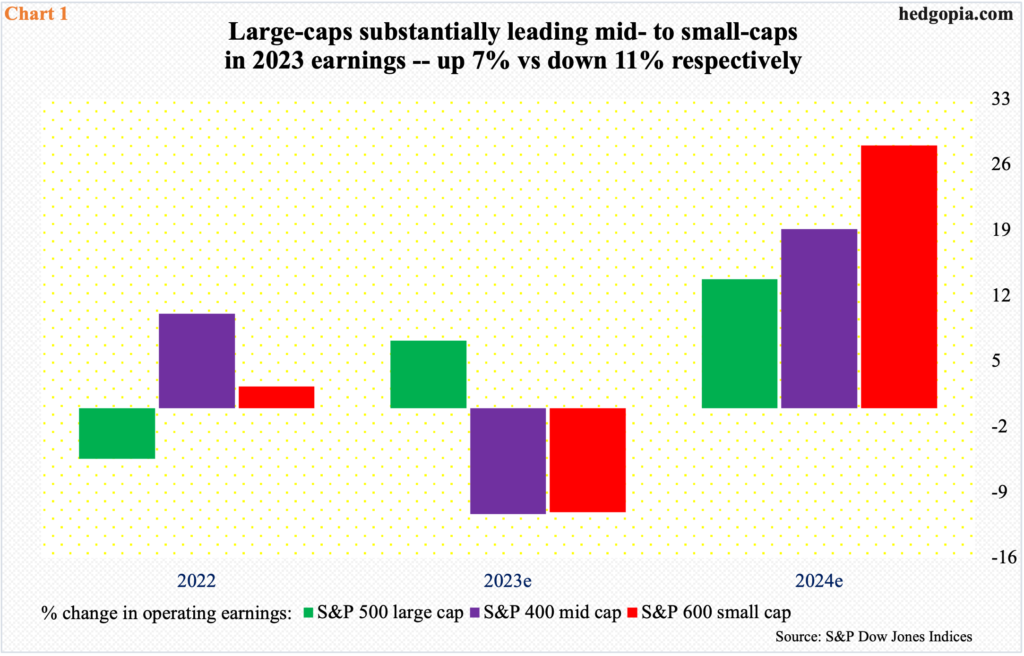

In the end, S&P 500 companies are on pace to earn $211.14 for the whole year, which will have registered growth of 7.2 percent. The mid- and small-caps are not so fortunate. The $150.20 in mid-cap earnings will be down 11.3 percent over 2022, while small-caps’ $67.50 will have dropped 11.1 percent (Chart 1).

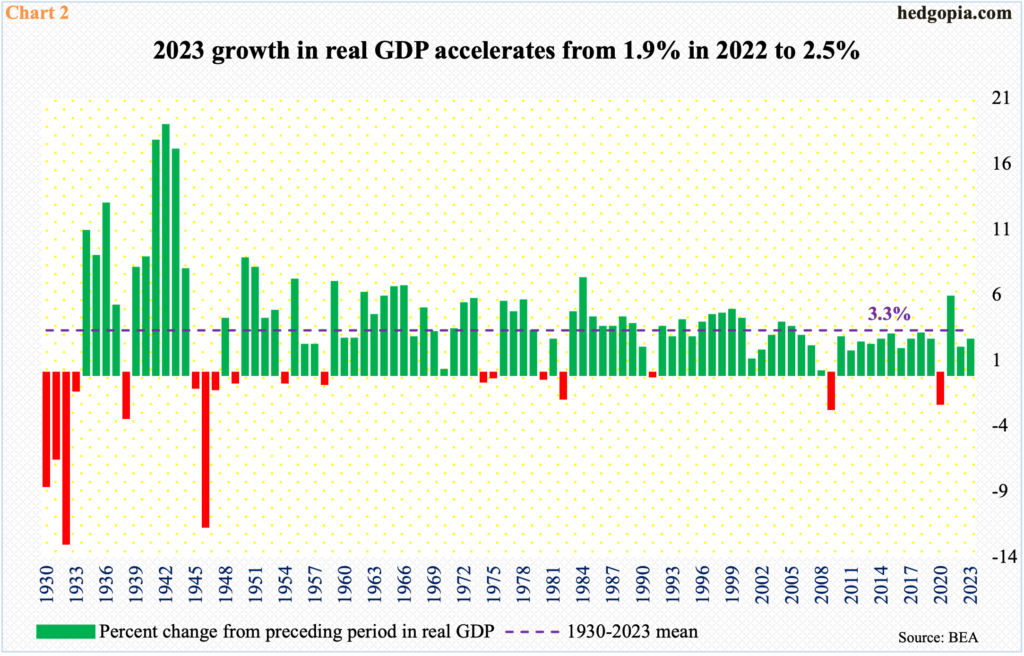

The irony in all this is that the mid- and small-caps are losing money in a year in which real GDP expanded 2.5 percent (Chart 2).

Interestingly, in 2022, when the economy grew 1.9 percent, the large-caps saw their earnings decrease 5.4 percent, even as the mid- and small-caps saw theirs increase 10.1 percent and 2.3 percent, in that order (Chart 1).

Not surprisingly, the sell-side has high expectations for 2024, as large-, mid- and small-cap earnings are expected to surge 13.8 percent, 19.1 percent and 28.1 percent respectively. Customarily, these analysts start out the year with a lot of optimism and bring out the scissors as the year goes on.

For 2023, for instance, S&P 500 companies in April 2022 were expected to ring up $250.12. Similarly, in May 2022, S&P 400 companies were penciled in to bring home $207.54, while S&P 600 estimates in June 2022 were $111.23!

If anything, this year’s estimates should be taken with a grain of salt.

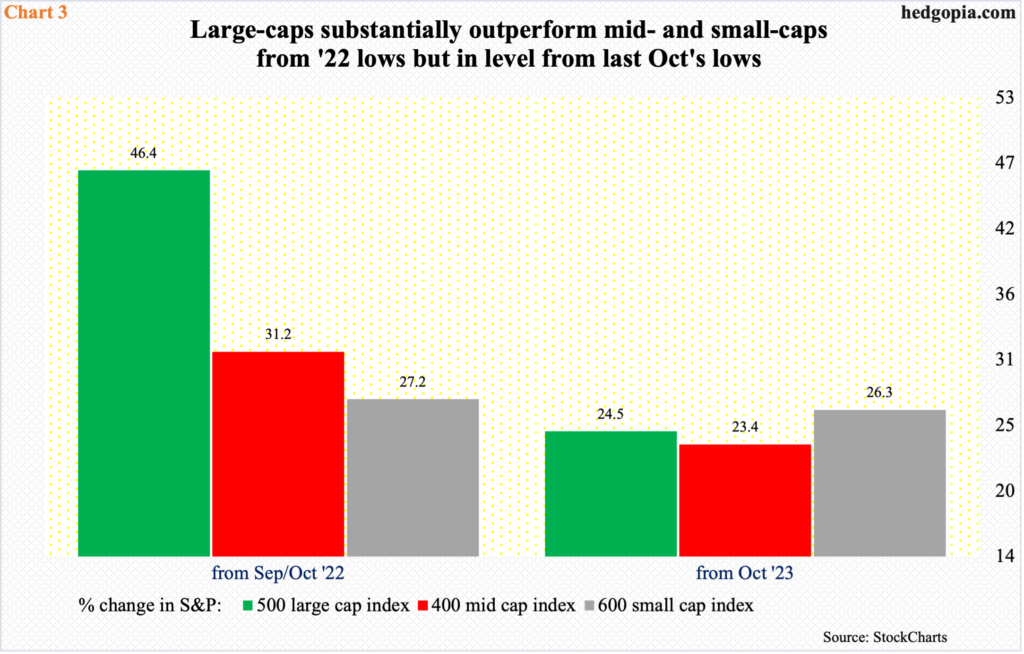

Earnings mediocrity last year in part explains why the mid- and small-caps have underperformed the large-caps from the lows of 2022.

Back then, the S&P 500 bottomed at 3492 in October. Last Friday, the large cap index tagged 5111 – for a rally of 46.4 percent over 16 short months. In 2022, both the mid- and small-caps bottomed in September – respectively at 2186 and 1058. Last Friday, the mid-caps tagged 2867, while the small-caps reached 1345 late December. From the September 2022 lows, the mid- and small caps rallied 31.2 percent and 27.2 percent, in that order (Chart 3).

While the mid- and small-caps underperformed their large-cap cousins, they are however running neck and neck from the lows of last year. From last October, the large-, mid- and small-caps are respectively up 24.5 percent, 23.4 percent and 26.3 percent.

One constant knock against the rally the last several months has been that it is too narrow – which is true. Indeed, the generals – just a handful and all tech, by the way – are leading by a mile and the soldiers are falling behind. The mid- and small-cap performance since last October is a sign they are trying to catch up.

The S&P 400 mid cap index, as a matter of fact, is staring right into a great opportunity. We shall see if the bulls can deliver.

Both the S&P 400 and 600 peaked in November 2021, as did the Nasdaq 100. The S&P 500 did not peak until January the following year.

The S&P 400 tagged 2926 back then and retreated, leaving behind a long upper wick on the monthly candle. It subsequently reached 2187 in June 2022 and rallied; that low was once again tested come September with a low of 2186. Last October, the index reached a higher low of 2322. Since that low, it rallied in November and December and is up 4.6 percent February-to-date, with a down January. (Incidentally, the S&P 600 has performed similarly, with three up months and a down January, but the S&P 500 is up in all four.)

Last Friday’s close of 2858 brings the S&P 600 mid cap index within less than 60 points of the November 2021 high (Chart 4). A breakout – should one occur – will carry importance, as this can help broaden participation in the otherwise-concentrated rally.

More By This Author:

CoT Report As Crystal Ball: Peeking Into Future Thru Futures, Hedge Fund BuyingMarch Dot Plot Can Surprise Markets

Sifting The CoT Report - How Hedge Funds, Noncommercials Are Positioned

This blog is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any security or ...

more