MicroStrategy Approches The Support As Correction Nears Completion

Image Source: Pixabay

MicroStrategy (MSTR), now rebranded as Strategy Inc., was originally a business-intelligence (BI) software company but has transformed into a hybrid software and Bitcoin-holding firm. While it still offers analytics and enterprise software, its core identity now centers on being the world’s largest Bitcoin Treasury Company. Most of its value and investor attention come from its massive Bitcoin holdings rather than its software business, making it effectively a Bitcoin-leveraged company with a software arm.

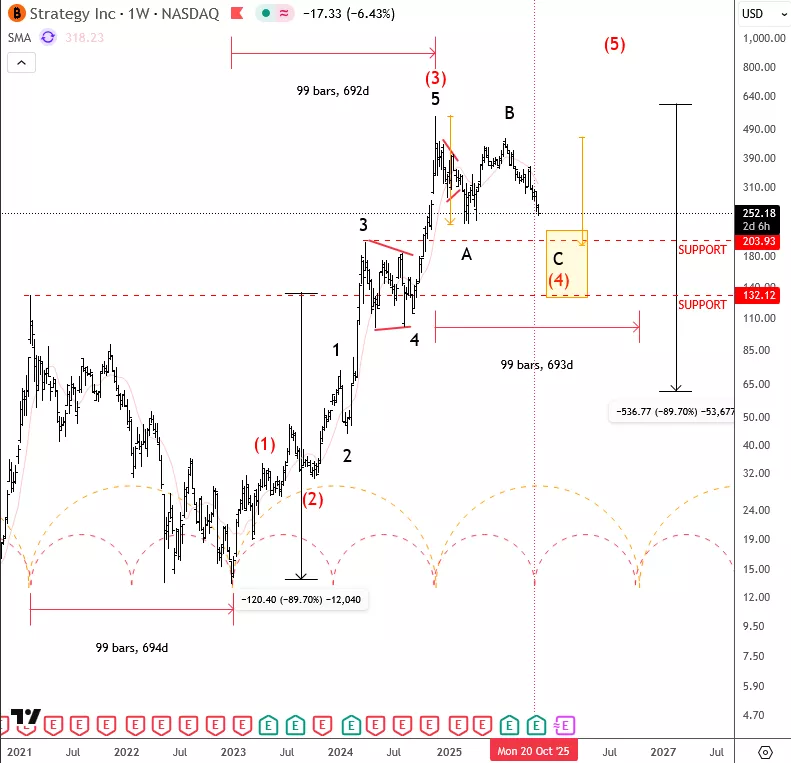

MicroStrategy has seen a strong uptrend since the December 2022 lows, but over the last year, the market has been in a retracement phase. It appears that this could be another A-B-C setback within a higher-degree wave four, where subwave C could potentially retest the 200 area, or even extend toward the deeper 132 support. That level also aligns with the February 2021 high, making it an important zone to watch.

MSTR Weekly Chart

Cycle-wise, it looks like we’re currently in the middle of a full cycle, suggesting that the correction could be moving into the second half of this retracement and may come to an end within the next few months. Ideally, we could then see a new turn higher in 2026, continuing the broader bullish trend.

Highlights:

Trend: Corrective pullback in wave four

Support: 200 / 132

Cycle View: Mid-cycle; possible new uptrend in 2026

Note: Structure fits within a broader five-wave bullish sequence, with a strong long-term trend intact

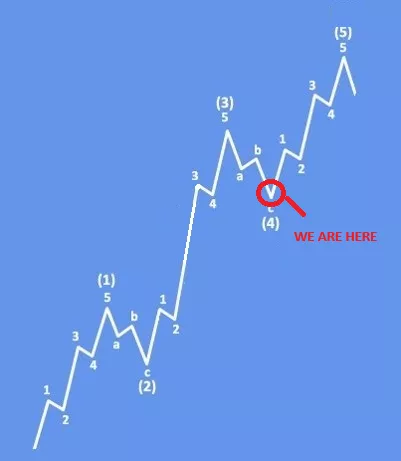

The Elliott Wave Principle is a core method in technical analysis used to identify recurring patterns in market movements. One of its key formations is the bullish impulsive wave, which reflects how price action typically unfolds in the direction of the prevailing trend during an uptrend. A bullish impulsive wave consists of five waves labeled 1, 2, 3, 4, and 5 — with waves 1, 3, and 5 advancing in the direction of the main trend, and waves 2 and 4 acting as corrective phases. In the case of MicroStrategy, the basic impulsive bullish pattern suggests that the stock could be completing a wave 4 correction, potentially preparing for a bullish continuation toward wave 5. This scenario would align with renewed market strength and could confirm further upside momentum once wave 4 support holds.

More By This Author:

Microsoft Is Trading In Wave 4 Correction

Gold Can Stay In Consolidation As USDCNH Recovers And Fed "Signals" A Pause

Ebay Slows Down For A Higher Degree Correction After Earnings