Micron: Spot Prices Up, More Important Contract Down

Micron (Nasdaq:MU) has been up big, due in part to a trade rift between Japan and South Korea. That trade rift helped spot prices appear to bottom. But that's spot pricing. Contract pricing keeps dropping which is what mainly affects Micron's earnings.

Here's Spot Pricing

I've spoken with Micron many times and they've consistently said that spot is a small part of their business. Contract is what matters.

But here's spot pricing.

You see that spot prices, above, bounced big time. That gave hope to Micron shares.

Look at what happened to Micron stock in that time.

I actually was hopeful this could potentially bottom the stock. The biggest driver to my EPS model is pricing. So pricing jumping should be great for earnings and so great for the stock.

But...

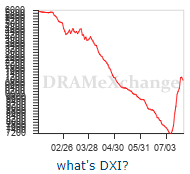

But Contract Pricing Continuing Down

While the spot market has been up contract pricing has continued to move lower. Usually they can move in lockstep, but most reports show that they've diverged.

The Japan-South Korea feud hasn't turned contract pricing. That tells us something worrisome with underlying supply and demand. Despite the apparent major risk or fear of an important supply disruption, memory customers haven't budged. That tells you demand is still below supply if contract prices keep dropping, unaffected by the supply risk.

Listen to what Trendforce/DRAMeXchange said,

"Although the Japan-South Korea incident over material exports at the beginning of July caused prices to bounce in the spot market, the scale of the spot market is too small to effectively clear the large inventory levels held by suppliers in 3Q looking forward. Furthermore, end demand was weak, and contract prices kept on falling in July."

The memory market still faces the same problem of too much inventory and demand that's too weak. The supply scare did not change the core issues.

They continued that supply disruptions are not expected to change the course of contract pricing.

"TrendForce points out that despite the ripples in the market formed as a result of the Japan-South Korea incident, contract prices mainly depend on the basic supply-demand dynamics, and since production capacity were not affected substantially, we don't see a significant force keeping prices up. Moreover, contract prices for mobile DRAM and server DRAM, which take up 70% in shipments, remained on a downtrend in 3Q."

It sounds like they expect prices to fall again in Q3 10%-20%.

So while the stock is up on spot pricing the fundamentals have not changed on the much more important contract pricing side.

Huawei and China

We saw last week that the US backed off allowing US companies to do business with Huawei again.

But as of last quarter Micron was still expecting to ship to Huawei. Here's what they said on the last earnings call,

"Through this review, we determined that we could lawfully resume shipping a subset of current products because they are not subject to Export Administration Regulations and Entity List restrictions. We have started shipping some orders of those products to Huawei in the last two weeks."

This amount is at risk. Huawei is a 10%-plus customer.

China (Page 78 in the 10K) makes up more than 50% of Micron's business.

We see that the trade war is, if anything, heating up. President Trump's reversing against allowing Huawei sales was the latest US blow. After that, China responded by apparently allowing their currency to drop. They then soon reversed but I saw that as a shot across the bow. China also hinted that they plan to wait for 2020 to see if there's an easier president to deal with then.

I don't think this trade deal is getting resolved so soon.

Bit Growth

Micron expects bit growth to bounce back in the second half. But cloud customers elsewhere have shown that they may not grow much more than we saw in Q2.

Plus added trade tensions also can hinder growth.

Conclusion

Spot pricing jumping was a hope but pricing keeps dropping on the contract side. That's what affects Micron's business and tells you what's going on with underlying supply and demand. It's still negatively balanced. China is of course another clear and present risk. I want to be on the sidelines here.

Related article: Arista's Capex Comments Matter For Micron And Tech

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Ready to Nail Tech Earnings? Start your more

Would be helpful if the author could respond to some of these reader questions.

Yes, it would! Quite a shame.

Good article that highlights some strong facts.

I only registered here to warn you that I read this article on Seeking Alpha also, the general consensus on that site is this author does not know what he's talking about.

I'd politely request that you take that attitude back to Seeking Alpha where it belongs. I thought this article was useful, but even if you disagree, no need to be rude. We prefer a higher level of discussion here. It's fine to disagree or give constructive criticsm. But your comment is disparaging and meaningless.

The author claims that July spot prices didn’t impact contract negotiations. His evidence is to post a chart of June contract prices. Obviously spot prices will influence future pricing, not the past.

Interesting read and well written. You've clearly done your research. What percentage of Micron's business is actually in China?