MicroMarvel - ORIC Pharmaceutical - Fights Cancer

Image Source: Unsplash

MicroMarvel is a series of articles highlighting undercovered stocks with less than a billion dollars in Market Capitalization. These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile, so if you do decide to add them to your portfolio I highly recommend you use stop losses and limit orders.

- 100% technical buy signals

- 14 new highs and up 50.16% in the last month

- 187.43+ Weighted Alpha

Today's MicroMarvel is the biotechnology company ORIC Pharmaceuticals (ORIC). I found the stock by using Barchart's screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 1/17 the stock gained 35.88%.

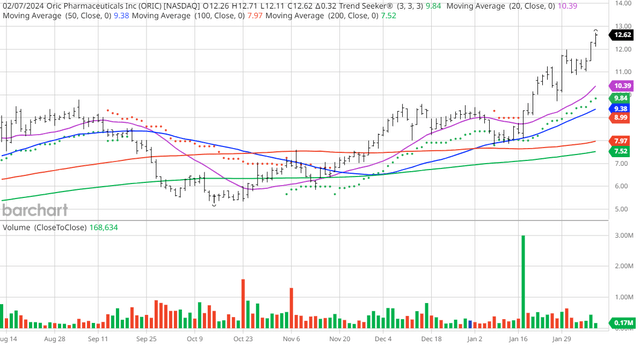

ORIC Price vs Daily Moving Averages (Barchart)

ORIC Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, discovers and develops therapies for the treatment of cancers in the United States. Its clinical stage product candidates include ORIC-533, an orally bioavailable small molecule inhibitor of CD73 being developed for resistance to chemotherapy- and immunotherapy-based treatment regimens; ORIC-944, an allosteric inhibitor of the polycomb repressive complex 2 for prostate cancer; and ORIC-114, a brain penetrant orally bioavailable irreversible inhibitor designed to selectively target epidermal growth factor receptor and human epidermal growth factor receptor 2 with high potency towards exon 20 insertion mutations. The company is also developing multiple discovery stage precision medicines targeting other cancer resistance mechanisms. ORIC Pharmaceuticals, Inc. has a license and collaboration agreement with Voronoi Inc.; a license agreement with Mirati Therapeutics, Inc.; and clinical development collaboration agreement with Pfizer Inc. The company was incorporated in 2014 and is headquartered in South San Francisco, California.

Barchart Technical Indicators:

- 100% technical buy signals

- 187.43+ Weighted Alpha

- 125.77% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 14 new highs and up 50.16% in the last month

- Relative Strength Index 71.71%

- Technical support level at $11.75

- Recently traded at $12.70 with a 50-day moving average of $9.35

Fundamental Factors:

- Market Cap $8.29 million

- Earnings are estimated to increase 11.60% this year

Analysts and Investor Sentiment -- I don't buy stocks just because everyone else is buying, but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 8 strong buy recommendations this month

- Their price targets are $12 to $27 with a consensus of $16.50 for a 33.00% gain

- Value Line rates the stock an above-average 2

- CFRAs MarketScope rates the stock a buy

- 1,610 investors monitor the stock on Seeking Alpha

More By This Author:

Chart Of The Day: Republic Service - There's Big Money In Trash

Fusion Pharmaceuticals - Already Discovered By Wall Street

Chart Of The Day: Chipolte Mexican Grill Is Sizzling

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

The ...

more