MicroMarvel: Crawford Co. Thrives In Bad Weather

MicroMarvel is a series of articles highlighting undercovered stock with less than a billion dollars Market Capitalization. These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile so if you do decide to add them to your portfolio I highly recommend you use stop losses and limit orders.

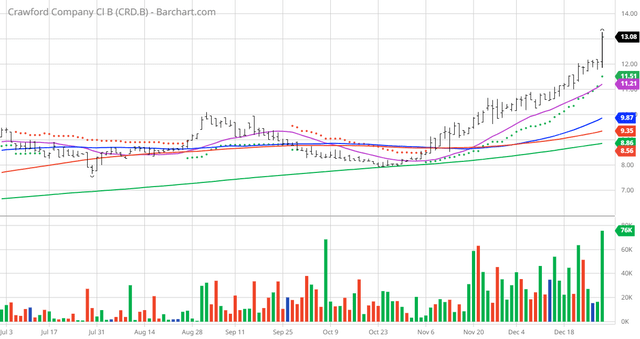

Today's MicroMarvel is the insurance service company Crawford & Company (CRD.B). I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 11 /7 the stock gained 47.30%.

CRD.B Price vs Daily Moving Averages (Barchart)

Crawford & Company provides claims management and outsourcing solutions for carriers, brokers, and corporations in the United States, the United Kingdom, Europe, Canada, Australia, Asia, and Latin America. The company operates through four segments: North America Loss Adjusting, International Operations, Broadspire, and Platform Solutions. The North America Loss Adjusting segment provides claims management services to insurance companies and self-insured entities risk including property, public liability, automobile, and marine insurances. The International Operations segment provides claims management and adjusting services to insurance carriers and self-insured entities; and field investigation and the evaluation and resolution of property and casualty insurance claims. The Broadspire segment offers claims management services, including workers' compensation, liability, property, accident & health, and disability claims management; accident & health claims programs; disability and leave management services, as well as legal services, risk management information, and consultative analytical services. This segment also provides medical management services; administration services; medical bill review services; and physician review services, as well as claims and risk management services and technology solutions; desktop claim adjusting and evaluation of claims; initial loss reporting services for claimants; loss mitigation services, such as medical bill review, medical case management and vocational rehabilitation; and risk management information services. The Platform Solutions segment offers insurance through service lines, such as Contractor Connection and Networks, including losses caused by natural disasters, such as fires, hailstorms, hurricanes, earthquakes, floods, as well as man-made disasters, such as oil spills, and chemical releases. The company was founded in 1941 and is headquartered in Atlanta, Georgia.

Barchart Technical Indicators:

- 100% technical buy signals

- 154.20+ Weighted Alpha

- 148.67% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 28.87% in the last month

- Relative Strength Index 80.83%

- Technical support level at $12.20

- Recently traded at $13.08 with 50 day moving average of $9.87

Fundamental Factors:

- Market Cap $639 million

- P/E 10.88

- Dividend yield 1.99%

- Revenue expected to grow 8.80% this year and another 6.80% next year

- Earnings are estimated to increase 52.90% this year, an additional 17.80% next year and continue to compound at an annual rate of 10.00% for the next 5 years

Analysts and Investor Sentiment -- I don't buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 1 strong buy and 2 buy recommendations on the stock

- Analysts price target are between $11 and $14 with a consensus of $11 which is 16% below its recent price - confusing???

- Value Line gives the stock its highest rating of 1 with a 3-5 year price target of $12-$20

- CFRA's MarketScope gives the stock a strong buy rating

- 1,360 investors monitor the stock on Seeking Alpha

Special Note: With all the professionals having strong buy and buy recommendations does it make sense that their price targets are below today's price??? This is a good reason why you should do your own research and think for yourself.

More By This Author:

Chart Of The Day: Verra Mobility Provides Smart Mobility Technology Solutions

MicroMarvel: ScanScource

Chart Of The Day: PTC - Great Software Play

Disclosure: At one time over 30 years ago I was an officer and employee of Crawford but presently have no ties with the Company

Analyst's Disclosure: I/we have no stock, option or ...

more