MicroMarvel: ScanScource

Image Source: Unsplash

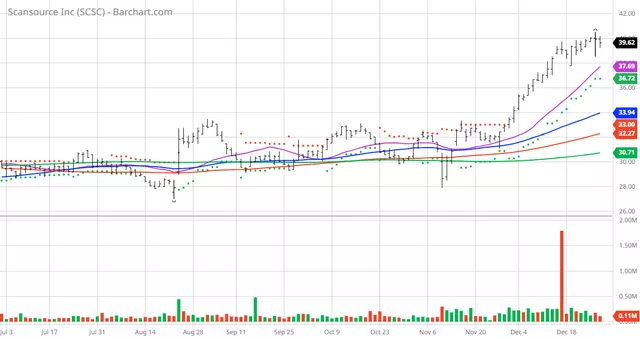

Today's MicroMarvel is the technology distributor ScanSource (SCSC). MicroMarvel is a series of articles highlighting undercovered stock with less than a billion dollars Market Capitalization. I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 11 /30 the stock gained 18.52%.

These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile so if you do decide to add them to your portfolio I highly recommend you use stop loses and limit orders.

SCSC Price vs Daily Moving Averages (Barchart)

ScanSource, Inc. distributes technology products and solutions in the United States, Canada, and internationally. It operates through two segments, Specialty Technology Solutions and Modern Communications & Cloud. The Specialty Technology Solutions segment provides a portfolio of solutions primarily for enterprise mobile computing, data capture, barcode printing, point of sale (POS), payments, networking, electronic physical security, cyber security, and other technologies. This segment offers data capture and POS solutions to automate the collection, processing, and communication of information for commercial and industrial applications, including retail sales, distribution, shipping, inventory control, materials handling, warehouse management, and health care applications. It also provides electronic physical security products, such as identification, access control, video surveillance, and intrusion-related devices; networking products comprising wireless and networking infrastructure products; other software as a service (SAAS) products; and engages in hardware rental activities. The Modern Communications & Cloud segment offers a portfolio of solutions primarily for communications technologies and services comprising voice, video conferencing, wireless, data networking, cybersecurity, cable, unified communications and collaboration, cloud, and technology services, as well as IP networks and other solutions for various vertical markets, such as education, healthcare, and government. The company serves manufacturing, warehouse and distribution, retail and e-commerce, hospitality, transportation and logistics, government, education and healthcare, and other industries. ScanSource, Inc. was incorporated in 1992 and is headquartered in Greenville, South Carolina.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 46.00+ Weighted Alpha

- 38.87% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 22.25% in the last month

- Relative Strength Index 74.11%

- Technical support level at $39.18

- Recently traded at $39.62 with 50 day moving average of $33.94

Fundamental Factors:

- Market Cap $995 million

- P/E 11.34

- Revenue expected to grow another 4.30% next year

- Earnings are estimated to increase an additional 13.70% next year and continue to compound at an annual rate of 14.00% for the next 5 years

Analysts and Investor Sentiment -- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 1 strong buy, 1 buy and 1 hold recommendations on the stock

- Analysts price target are between $35 and $42 with a consensus of $38.50 which is 3% below its recent price - confusing???

- The individual investors following the stock on Motley Fool voted 82 to 4 for the stock to beat the market with the most experienced investors voting 10 to0 for the same result

- Value Line gives the stock an above average rating of 2 with an 18 month price target of $40 to $65

- CFRA's MarketScope gives the stock a hold rating

- 1,540 investors monitor the stock on Seeking Alpha

Special Note: With all the professionals having strong buy and buy recommendations does it make sense that their price targets are below today's price??? This is a good reason why you should do your own research and think for yourself.

More By This Author:

Chart Of The Day: PTC - Great Software Play

MicroMarvel: MoneyLion

Chart Of The Day: Merchants Bancorp - Banking On Real Estate

Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are ...

more

Interesting, i had never heard of this company. Thanks.